Anglo-American's Share Price Soars on BHP Buyout Talks

BHP's proposed acquisition of Anglo…

Oil Takes a Breather as Geopolitical Risk Eases

WTI crude hangs above $80…

WTI Prices Jump As Cushing Crude Draw Worries Oil Market

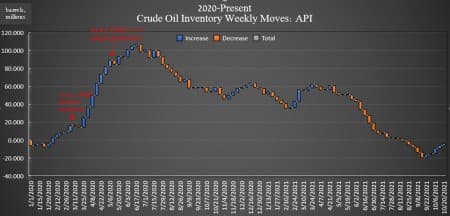

The American Petroleum Institute (API) on Tuesday reported its fifth straight week of crude oil inventory builds. This week, the API estimated the inventory build for crude oil to be 2.318 million barrels. But a persistent draw in Cushing inventory is causing a bit of a stir.

U.S. crude inventories are still 61 million barrels below where they were at the beginning of the year.

Analyst expectations for the week were for a build of 1.650-million barrels for the week.

In the previous week, the API reported a surprise build in oil inventories of 3.294-million barrels, compared to the 2.233-million-barrel build that analysts had predicted.

Oil prices were trading up on Tuesday in the runup to the data release, with WTI reaching near $84.50 and Brent trading around $86.35 per barrel. Both WTI and Brent were up .97% and .42%, respectively, at 2:00 p.m. EST.

Despite the inventory builds of the last few weeks, oil inventories in the United States are still down for the year, to the tune of 61 million barrels so far this year, according to API data, and 4 million barrels since the start of 2020.

U.S. oil production for the week ending October 15—the last week for which the Energy Information Administration has provided data—slid 100,000 bpd to 11.3 million bpd, and is still 1.8 million bpd below the all-time high of 13.1 million bpd reached right before the pandemic took hold in the United States.

The API reported a build in gasoline inventories of 530,000 barrels for the week ending October 22—compared to the previous week's 3.5-million-barrel draw.

Distillate stocks saw an increase in inventories of 986,000 barrels for the week, compared to last week's 3-million-barrel decrease.

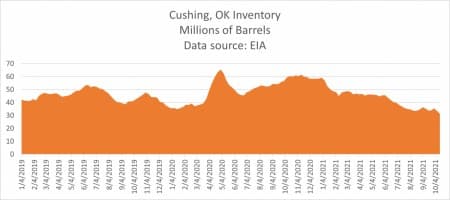

Cushing inventories, which have been a hot topic over the last few weeks, have drawn down roughly 30 million barrels so far this year leading up to this week’s data, drawing some panic in the market about how much inventory has been shed so far.

ADVERTISEMENT

And this week, the API reported yet another draw. Cushing, capable of storing 76 million barrels of crude oil serving as working storage, now has less than 30 million barrels. For this week, API data shows a draw of 3.734 million barrels, on top of last week's 2.5-million-barrel decrease.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Aramco CEO: Underinvestment In Oil Is A ‘’Huge Concern’’

- A Cold Winter Could Double Natural Gas Prices And Send Oil To $100

- Money Managers Are Throwing Their Weight Behind The Oil Price Rally

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B