- Gold consolidates weekly losses during two-day uptrend, eases from daily high of late.

- US dollar differs from firmer Treasury yields, helps gold buyers amid market’s indecision, central bank moves.

- US GDP, ECB and US stimulus updates are the key for fresh impulse.

- Gold Price Forecast: Bulls trying to recover the 1,800 mark

Update: Gold built on the previous day's rebound from the vicinity of weekly lows and edged higher through the Asian session on Thursday. The momentum pushed the XAU/USD back above the $1,800 mark, though a combination of factors might keep a lid on any meaningful upside. A generally positive tone around the equity markets could act as a headwind for the safe-haven precious metal. Apart from this, a solid rebound in the US Treasury bond yields, along with expectations for an early policy tightening by major central bank might further collaborate to cap gains for the non-yielding yellow metal.

Moreover, investors seem to have moved on the sidelines ahead of Thursday's key event risk – the highly-anticipated European Central Bank meeting. The ECB is expected to leave its monetary policy settings unchanged, though the outlook – amid worries about rising inflationary pressures – should infuse some volatility in the markets. Beyond this, traders will focus on the release of the Advance US Q3 GDP report. The data will play a key role in driving the USD demand and influence dollar-denominated commodities, including gold.

Previous update: Gold (XAU/USD) flirts with the $1,800 threshold, keeps the previous day’s rebound amid softer USD during early Thursday.

The yellow metal recovered the previous day from the weekly bottom as the US dollar faded the bounce off a one-month low, tracking the US Treasury yields. The latest run-up in the gold prices, however, could be linked to the market’s fears of an end to the easy money policies introduced during the pandemic. It’s worth noting that the hopes of US stimulus and Sino-American tussles are extra catalysts that helped the gold buyers at the latest.

The US 10-year Treasury yields consolidate the heaviest daily fall since mid-August, recently picking up bids to 1.55%, up 2.6 basis points (bps). The reason could be linked to the expectations that the US Federal Reserve (Fed) and the European Central Bank (ECB) will track their global counterparts and tighten the strings of monetary policies. The market consensus takes clues from the firmer inflation expectations and recently firmer data from the developed economies, as well as receding fears of the coronavirus.

On Wednesday, the Bank of Canada (BOC) announced the end of bond purchases and the UK also cuts bond issuance. Further, Australia’s strong prints of the RBA Trimmed Mean CPI also push the Reserve Bank of Australia (RBA) towards a rate hike.

Talking about the data, a lower-than-expected US Good Trade Balance and improvement in Durable Goods Orders probed the US dollar bulls ahead of the key Q3 GDP, indirectly helping gold buyers.

Elsewhere, the White House’s (WH) push for faster progress over the budget talks ahead of the December deadline for the debt ceiling extension keeps the gold buyers hopeful. The news joins the Democratic Party members’ scheduling of an additional meeting for President Joe Biden to sort out some last issues with expectations of a deal on the much-awaited stimulus.

Furthermore, the US-China tussles regain momentum, recently over telecom and Taiwan whereas the Evergrande fears aren’t off the table, which in turn underpin the gold’s safe-haven demand.

Against this backdrop, the US stock futures ignore the firmer Treasury yields and the US Dollar Index (DXY) stays on the back foot ahead of the key data/events.

Looking forward, firmer-than-expected preliminary prints of the US Q3 GDP will help the Fed hawks and weigh on the market sentiment, helping the US dollar to regain upside momentum. However, the ECB’s likely hawkish performance may challenge the greenback and help the gold buyers to keep the reins.

Read: US Third Quarter GDP Preview: A most uncertain estimate

Technical analysis

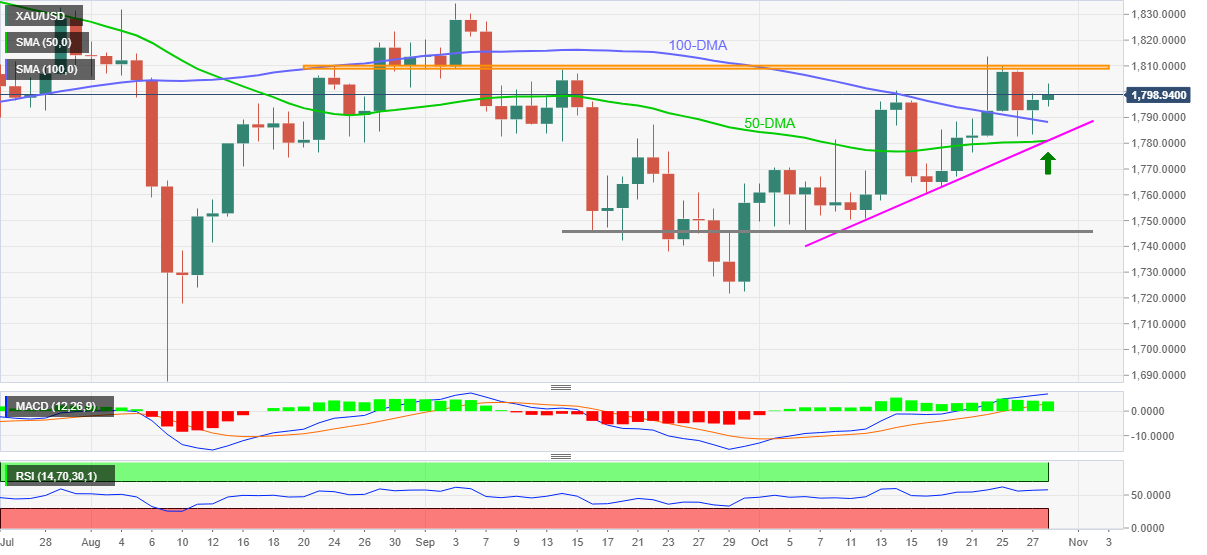

Gold’s failure to cross a two-month-old horizontal hurdle doesn’t allow sellers to sneak in as a convergence of 50-DMA and a fortnight-long rising trend line restricts short-term downside.

Hence, bullish MACD and firmer RSI line, not overbought, keeps gold buyers hopeful to cross the key resistance area surrounding $1,810-11 until staying beyond $1,780 support confluence.

During the quote’s upside past $1,811, the double tops marked in July and September close to $1,834 will be crucial to watch.

On the contrary, a sustained downside below $1,780 may aim for the latest swing low around $1,760 before directing gold sellers to the horizontal line comprising multiple levels marked since September 16, near $1,745.

To sum up, gold remains in a bullish consolidation phase but has tough barriers to the north.

Gold: Daily chart

Trend: Further upside expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.