LONDON — Former Unilever CEO Paul Polman has blasted some large banks for putting more money into polluting industries than into renewable energy.

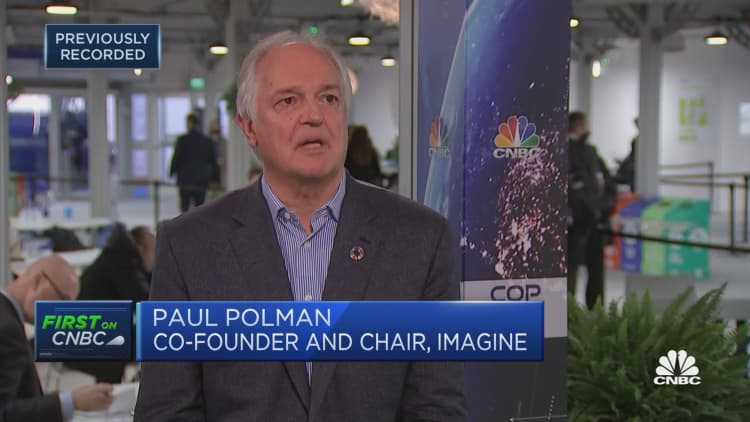

Speaking to CNBC's Steve Sedgwick at climate summit COP26 in Glasgow Tuesday, Polman said: "We still see some of the major banks doing more fossil fuel financing, coal financing than green energy and that's a big no-no."

Sixty of the largest banks collectively put $3.8 trillion into fossil fuel companies between 2016 and 2020, according to a group of climate organizations named Banking on Climate Chaos 2021.

Polman acknowledged that some of the large banks are moving toward backing projects that help the transition toward zero emissions but said this was financially, not ethically, driven.

"People are starting to realize that implementing the Sustainable Development Goals — which cost $3 to $5 trillion a year — is significantly less than dealing with these horrendous consequences of inaction. And the financial market is actually the first one to understand that. I don't think they are moving on moral grounds, I want to be honest there, but they are moving on economic grounds," he stated.

Polman added that the oil and gas industry needs to be helped to move toward greener alternatives. "The … high emitting industries that need to transform, we need to help them. I don't think it serves anything to chastise them … it just doesn't work. You need to be looking at the challenges that they have, also to reflect a lot of stranding of their assets which are now in the value of these companies and help them in that transition."

The term "stranded assets" refers to fossil-fuel related assets such as coal and oil reserves that are no longer able to make financial returns as the economy moves toward greener energy. Mark Carney, the U.N.'s special envoy on climate action and finance, said financial markets need to be revamped so that financial decisions can take climate change into account.

Carney is chairing a coalition of financial firms named the U.N.'s Glasgow Financial Alliance for Net Zero, which is aiming to speed up a transition to cleaner energy. Collectively, the banks manage more than $90 trillion of assets.

"You now see with the Glasgow pledge that Mark Carney is leading is that we have nearly $100 trillion, which is half the world's money, saying I want to be net zero in 2050. Can we translate that to 2030 targets which are absolutely key? Can we translate that now into key actions?" Polman stated.

Polman's comments come as some of the large banks have pledged to spend more on financing carbon reduction. Bank of America President Brian Moynihan said Tuesday that the firm will spend $1 trillion toward reaching net-zero emissions by 2050. "To get there, we will provide $150 billion in financing through 2030 over $1 trillion, to the effort," he said at COP26.

BofA is part of a task force called the Sustainable Markets Initiative, which has launched a guide for financial services firms to help their clients reach net-zero emissions. Other members include JPMorgan, Barclays and Credit Suisse.

- CNBC's Sam Meredith and Catherine Clifford contributed to this report.