Smaller US Soybean Crop Jolted Market While Corn Was As Expected

Market Analysis

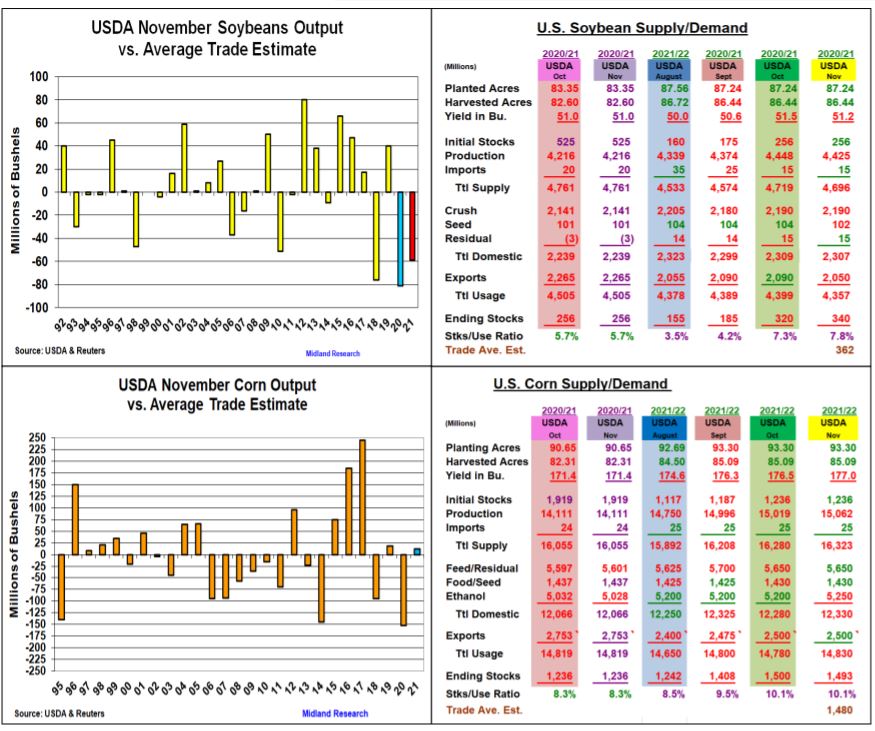

The USDA surprised the trade when they dropped US soybean yield verse the general expectations of a higher November output while corn’s latest DC production forecast was near the trade’s average estimate. With the trade anticipating an increase in the US bean yield and cut in the current export outlook, the USDA’s modest increase in 2021/22 ending stocks prompted a strong short covering rally after last week’s weakness. Corn (CORN) also rebounded when this month’s 2021/22 ending stocks weren’t increase while a slight tightening of wheat’s world stocks provided support to this bread grain.

Soybeans 0.3 bu drop in yield vs expectations of a 0.4 bu US rise doesn’t seem like much, but this 59 million swing from the trade’s forecast is 3rd largest miss since 1992. It also is the 3rd year over the last four for a substantial negative change. Reductions in IN (-3), OH (-2) and IA (-1 Bu) yields were behind Nov’s smaller crop. As most expected, the USDA shaved exports, but the 40 million cut was lower than many forecasts resulting in just a 20 million rise is beans’ stocks to 340 million.

Corn’s 2021 US output did rise 43 million bu to 15.062 billion bu with the US yield advancing 0.5 bu to 177.0. Interestingly, some dramatic yield shifts occurred across the Midwest. In the east, IL(-3) & IN (-5 bu) yields were sliced while yields in MN (+8), SD (+4) & NE (+1 bu) boosted the western output. This month’s US crop was just 12 million bu higher than trade. As expected, ethanol’s dramatic output jump and energy’s strong price outlook prompted a 50 million bu increase in this demand. The USDA left corn’s exports & feed unchanged resulting in 2021/22’s carryover slipping 7 million bu to 1.493 billion.

Wheat didn’t have a US production update this month, but the USDA did make some US balance sheet adjustments. The World Board sliced 10 million from imports, but they also dropped exports by 15 million because of recent slow foreign sales. After their 2022 baseline forecast of a 2.3 million acre increase in US wheat plantings, they also upped seed use by 4 million bu. keeping their stocks 583 million bu. This month’s tightening of world stocks to 275.8 mmt, the lowest in 5.

What’s Ahead:

Tight world wheat supplies and the closing of US barge system above St. Louis in early December prompting strong sourcing of US corn and beans remain supportive to prices. La Nina’s impact on S. America and dryness in the Black Sea & SW US could provide support.

Use post-harvest strength to up 2021/22 sales to 45-50% at $12.48-12.60 in beans (SOYB), $5.70-5.80 in corn & $8.00-8.20 in KC wheat (WEAT).

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more