Cryptocurrencies continue to live up to their high-risk profiles as bitcoin, ether and other top cryptocurrencies retreat from recent highs.

After hitting a new high of $68,990.90 last week, bitcoin has retreated more than 5% since Monday and fell below $59,000 briefly, reported the Wall Street Journal. Ether has fallen on its fifth day in a row to $4,260, down over 10% from its recent record highs.

As a speculative asset class, Martha Reyes, head of research at Bequant, believes that the recent high prices combined with current market conditions might have contributed to current sell-offs.

“A lot of people view crypto as a risk-on investment,” she said. “People will be looking to raise cash, and they will raise cash where they’ve maybe had the most profits.”

Concerns around inflation have many investors seeking refuge in safe-haven assets such as gold and the U.S. dollar. The increasing strength of the dollar is a reflection on investors counting on the Fed raising interest rates next year, according to Capital Economics researchers; these researchers anticipate the dollar’s value to continue to appreciate through next year as higher rates would bring in capital flows to the U.S. as outside investors look to find higher yields.

Fed policy tightening would spell bad news for crypto markets and other high-risk asset classes as they would most likely be the heaviest affected, according to Joel Kruger, Currency Strategist at LMAX Group. In addition, the passage of the $1 trillion infrastructure bill weighs heavily on the minds of crypto participants as it includes a section that requires stringent tax reporting information on any digital transaction above $10,000.

Diversifying Crypto Exposure with Bitwise

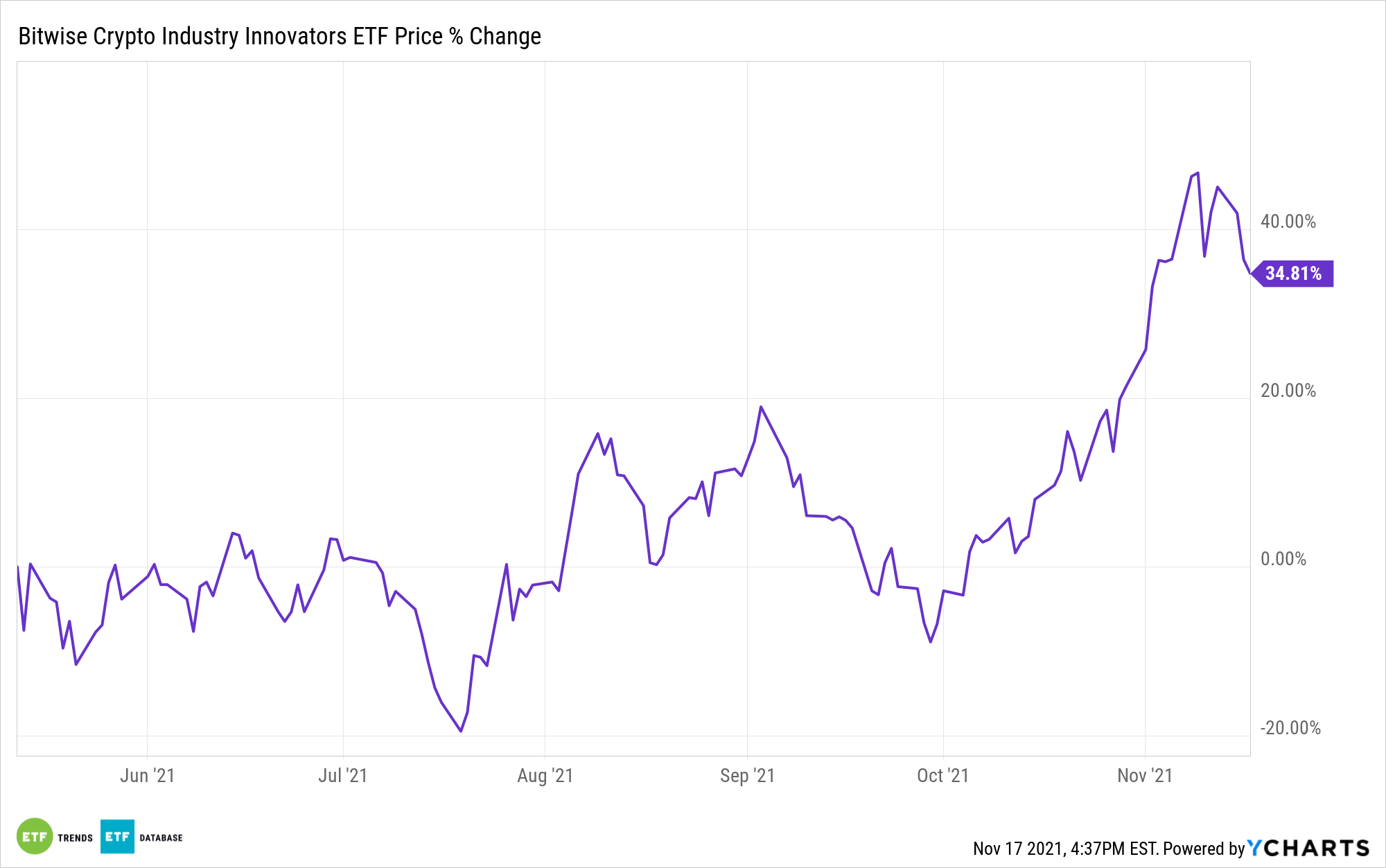

With cryptocurrencies sliding, investors looking to still invest within the industry should consider funds that carry a diversity of crypto and blockchain-related assets that might perform better even when cryptocurrencies are underperforming. The Bitwise Crypto Industry Innovators ETF (BITQ) offers investors exposure to the crypto revolution without investing directly in crypto assets.

BITQ tracks the Bitwise Crypto Innovators 30 Index, an index with at least 85% allocation into companies that are cryptocurrency exchanges carrying bitcoin and other cryptocurrencies, crypto miners, mining equipment companies, and service providers. The remaining 15% is allocated to large-cap support companies, with at least one major part of their businesses dedicated to crypto.

BITQ carries crypto companies such as Coinbase Global Inc (COIN) at 10.52%, Hut 8 Mining (HUT CN) at 5.04%, and Hive Blockchain Tech (HIVE CN) at 4.34%. Crypto mining companies and crypto exchanges often can have inverse momentum to that of cryptocurrencies; diversifying across the industry can help hedge against some of the most extreme movements made by cryptocurrencies.

The fund has an expense ratio of 0.85% and net assets of $140.9 million.

For more news, information, and strategy, visit the Crypto Channel.