It’s been a largely positive earnings season, particularly for tech companies. Nvidia yesterday posted numbers that beat expectations for earnings and sales as its stock rose 5% on Wednesday and buoyed the Nasdaq higher, reports CNBC.

In addition to higher-than-anticipated earnings, the chip maker also raised its expectations for the fourth quarter, anticipating $7.4 billion in revenue. The increasing demand for graphic processers by companies that are hosting cloud services and other technology that employs artificial intelligence has created a boom for Nvidia.

Data center sales were at $2.9 billion in the third quarter, reflecting a 55% growth year-over-year as “hyperscale customers,” or companies such as Microsoft, Google, and Amazon that provide cloud services, increased their demand for GPUs.

Gaming was also up and is the main driver for Nvidia; sales were $3.2 billion in gaming in a gain of 42% year-over-year. This comes amidst supply chain issues that have restrained sales for Nvidia due to limited supply of popular graphic processors such as GeForce. The company has recently split its graphic processing cards into those that are dedicated to cryptocurrency mining and those that are designed for gaming, which include software that prevents crypto mining.

Nvidia continues to harness the work-from-home market with its professional visualization product line, which grew 144% annually. This segment of Nvidia’s products caters mostly to professionals with high-end graphic needs and is flourishing as companies continue to supply laptops to employees working outside of the office.

The company reported $100 million in dividend payments in the third quarter, and its stock is up more than 124% year-to-date.

Capturing the Momentum of Nvidia Tech With QQQA

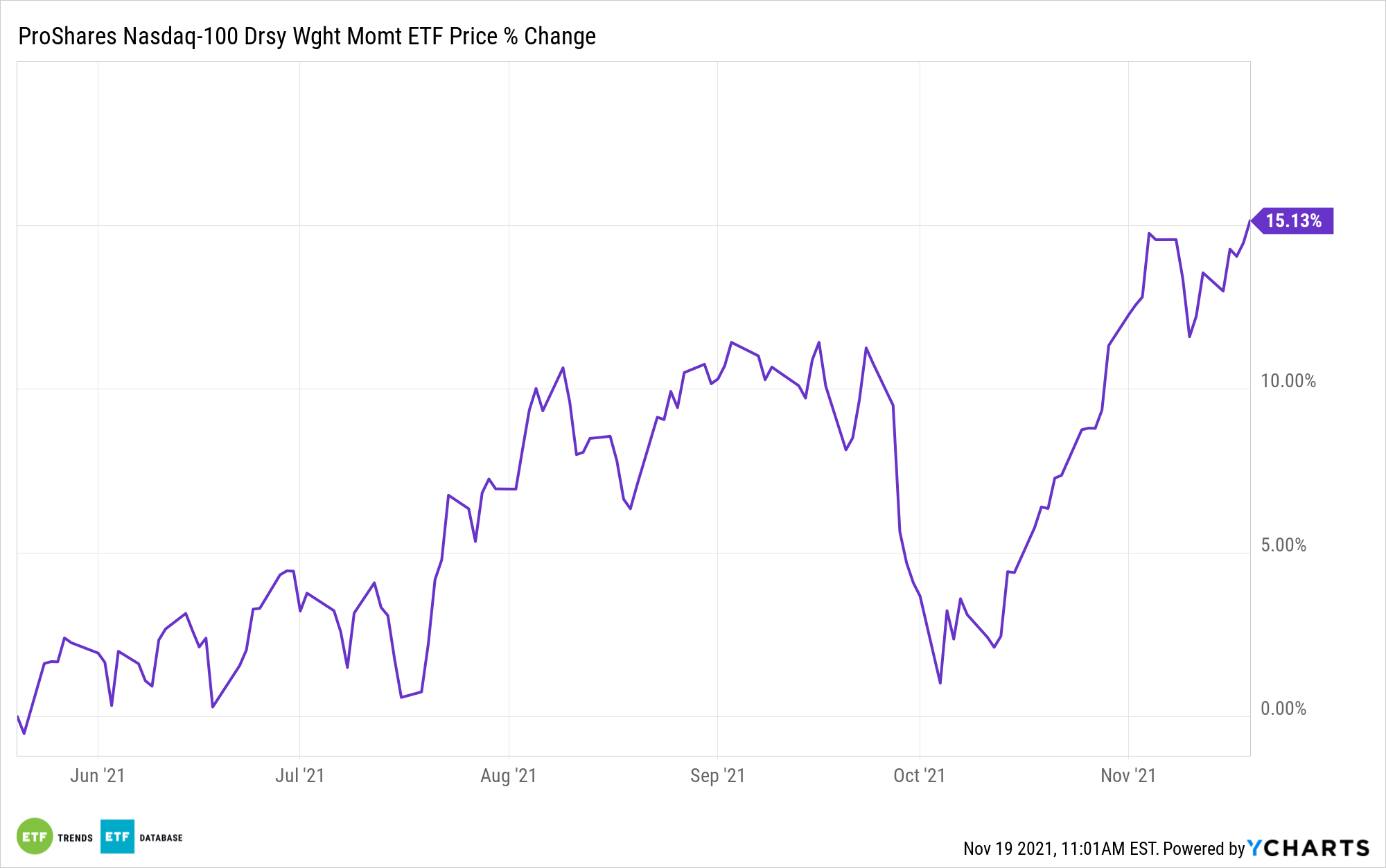

The ProShares Nasdaq-100 Dorsey Wright Momentum ETF (QQQA) is a smart beta ETF that, despite only holding 21 securities, is more diversified than the broader Nasdaq-100, according to Todd Rosenbluth, head of ETF and mutual fund research for CFRA.

The Nasdaq-100 Index tracks the largest domestic and international non-financial mega-cap growth stocks of the tech-heavy Nasdaq. It serves as the benchmark for the Invesco QQQ Trust (QQQ), one of the most widely traded ETFs in the world.

QQQA, meanwhile, utilizes a momentum strategy to select top performers within the Nasdaq-100 Index.

To build the portfolio, Dorsey Wright, a leader in momentum investing, uses a “relative strength” signal to select the top 21 companies within the Nasdaq-100 based on their highest price momentum at the time of rebalance.

Unlike the cap-weighted QQQ, QQQA is equal-weighted. Collectively, after its rebalance, the fund now has a 40.44% allocation to information technology, a 23.68% allocation to healthcare, and an 18.22% allocation to consumer discretionary.

Nvidia (NVDA) is currently the top holding in QQQA at 6.47%.

QQQA has an expense ratio of 0.58% and carries 21 holdings.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.