- US inflation surged to its highest in three decades, Fed officials becoming concerned.

- A new coronavirus variant that may evade immune response spurred risk-aversion.

- EUR/USD is correcting oversold conditions, additional gains are still unclear.

Risk aversion took over financial markets at the end of the week, and against the general belief, the greenback edged lower. Earlier in the week, the American dollar reached fresh 2021 highs vs the shared currency, with EUR/USD bottoming on Wednesday at 1.1185. Throughout the first half of the week, market participants were worried about stubbornly high inflation, pricing in the possible countermeasures – reducing QE and hiking rates – central banks may need to take.

Uncertainty stands behind risk-off

Concerns were backed by macroeconomic reports, as the preliminary estimates of November Markit PMIs indicated that, in the EU, the upturn was accompanied by a marked increase in inflationary pressures during the month, with costs and selling prices rising at record rates. At the same time, the US reported the Personal Consumption Expenditures Price Index’s core reading soared to 4.1% YoY, the highest in three decades. Core PCE inflation is the Federal Reserve’s preferred measure when it comes to taking monetary policy decisions.

Nevertheless, policymakers have been utterly cautious, although the Minutes of the Fed’s November meeting released Wednesday showed many participants were of the view that elevated prices could become more persistent and that the central bank should be prepared to taper further if needed.

On the other hand, the European Central Bank Monetary Policy Accounts showed that the ECB is in no rush to change its monetary policy. The document reiterated that net purchases under the Pandemic Emergency Purchase Programme (PEPP) could be expected to come to an end by March 2022 and that monetary policy decisions need to be data-driven.

Central bankers seem to be chasing inflation, and market participants fear the economic downturn resulting from policymakers doing too little, too late.

Unexpected downturn in the pandemic development

The US celebrated Thanksgiving on Thursday, keeping all of its markets closed, which in turn kept major pairs within familiar levels and the greenback near its multi-month highs. The market’s sentiment took a turn to the worst late on Thursday, on news indicating that a new coronavirus variant found in South Africa has a spike protein that is 'dramatically different' to the one which vaccines are based on, raising fears it could evade the immune response, according to Reuters.

The EUR/USD pair surged to 1.1294 on Friday and aims to close the week a handful of pips below that high. The news came as Europe struggles to contain a new wave of infection, and while several countries announced restrictive measures to contain the spread. As a result, Wall Street futures plummeted, with the DJIA shedding over 800 points ahead of the opening, amid fears of a steeper slowdown in economic recovery. On the other hand, US Treasury yields plunged with that on the 10-year note hitting 1.50% after flirting with 1.70% mid-week.

Uncertainty related to central banks’ inaction and how the pandemic will continue affecting economies are likely to keep markets in risk-off mode next week, as both are likely to take their toll on economic progress for years to come.

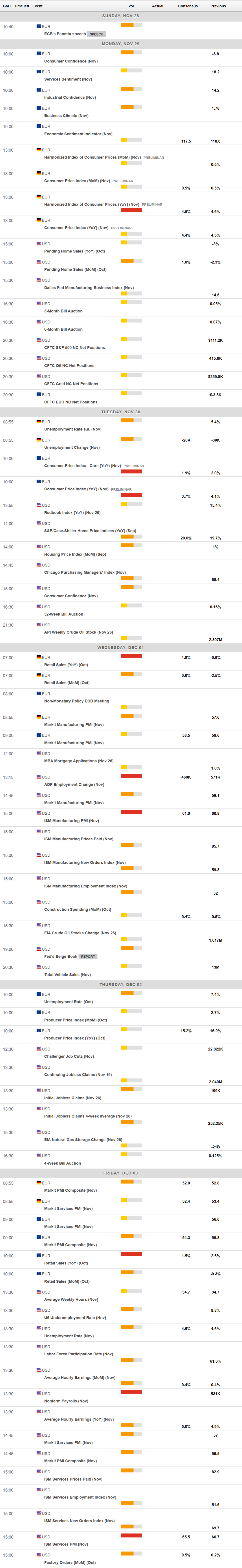

The first week of December will bring updates on European inflation, as the EU will publish the preliminary estimate of November inflation figures with the Core Consumer Price Index foreseen at 1.9% YoY from 2% in the previous month. Germany will report October Retail Sales, while Markit will release the final readings of its November PMIs for the Union.

In the US, the focus will be on the official November ISM PMIs and employment figures, as the country will publish the November Nonfarm Payroll report on Friday. The US added 531K new jobs in October, and a similar figure should hint at more action from the Federal Reserve.

EUR/USD technical outlook

The EUR/USD pair has trimmed its weekly losses, trading just ahead of the 1.1300 level. The weekly chart shows that the pair has completed a double top figure, falling roughly 550 pips after breaking the neckline at 1.1703. The ongoing pullback could continue up to the latter, should the pair recover above the 1.1470 price zone.

At this point, the weekly chart indicates that the pair may well resume its decline. It currently remains below the 23.6% retracement of the October/November slump at 1.1305. At the same time, EUR/USD is developing below all of its moving averages, with the 20 SMA accelerating south and poised to cross below the longer ones. Technical indicators have bounced just modestly from oversold readings without anticipating further recoveries ahead.

In the daily chart, a firmly bearish 20 SMA stands at around 1.1420, a possible bullish target for the upcoming days, en route to the mentioned 1.1470, a solid long-term static resistance level. Technical indicators are correcting oversold conditions but are still far below their midlines, falling short of confirming an interim bottom.

The immediate support level is the 1.1200 figure, followed by the 1.1160 price zone, where the pair bottomed in June 2020. A break below the latter should open the door for a test of the 1.1000 psychological threshold.

EUR/USD sentiment poll

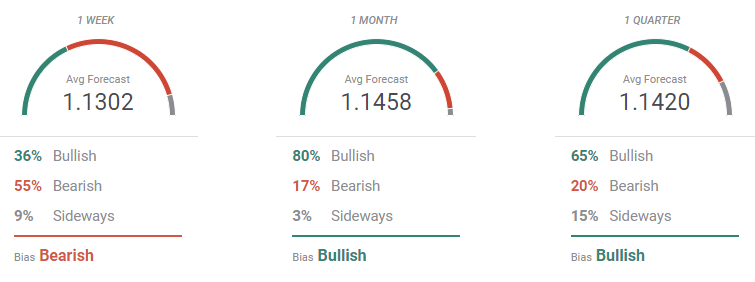

the FXStreet Forecast Poll suggest that EUR/USD could edge lower in the near-term, as 55% of the polled experts are betting for lower targets. However, bulls take over of the monthly view, as over 80% of participants look for higher highs, with the pair seen on average at 1.1458. Bulls retain control in the quarterly perspective, with the pair seen holding above the 1.1400 threshold.

The Overview chart shows that the shorter moving average has partially lost its bearish strength, but still heads lower as most targets accumulate below the current level. The same chart shows that as time goes by, the accumulation of possible targets moves higher, with chances of recovery up to the 1.17/1.18 region. Nevertheless, the longer moving averages maintain their bearish slopes.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.