Most analysts aren’t ready to turn their back against Roku (ROKU) yet, even after shares lost over half of their value from peak to trough.

While there have been downgrades, one can’t help but notice that many analysts still maintained their Buy ratings. The maker of digital media players still has a lot to love in the way of growth prospects.

For that reason, I remain bullish on Roku stock going into 2022, especially given the threat of the Omnicron COVID-19 variant that could cause video-streaming pure-plays to heat up again. (See Analysts’ Top Stocks on TipRanks)

Roku Drop Appears Overdone

The double-top technical pattern is now clear in the rear-view mirror. Looking ahead, the road is hazy, with top-line growth slowing down in the latest quarter (Q3). Slowing growth has been a concern for quite some time and the third quarter showed that such fears were warranted. However, it is worth noting that the trends were not on Roku’s side this time around.

Moreover, given such a vicious implosion in the stock, it’s arguable that the addition of 1.3 million accounts (down from 3 million added a year ago) is not all bad, given the reversal of trend, which could reverse again depending on the potential impact of the Omicron variant.

It’s hard to gauge what effect Omicron will have on the demand for video-streaming hardware. Still, secular tailwinds are at Roku’s back. The only question is whether the company can remain competitive, as rivals like Amazon (AMZN) or Google (GOOG) look to edge it out.

Such big-league competitive threats pose a serious risk to Roku, given minimal switching costs (Amazon tends to aggressively mark down its hardware during Prime Day or Black Friday sales events).

Still, Roku has the ability to improve upon its value proposition for its strong network of users. By gravitating away from commoditized player sales and funnelling more investment into original content for the Roku Channel, it can form a moat around its users, even if rivals beckon in its customers with the latest and greatest hardware at rock-bottom prices.

Roku’s 2-Year Content Development Plan

Last week, the Wall Street Journal reported that Roku plans to develop over 50 original shows over the next two years. The company has already won over 150 million users. Now, it needs to add value to keep its growth alive as it looks to double down on ad-friendly shows.

Undoubtedly, Roku content remains an exclusive offering and a compelling reason to buy a Roku hub over competing products.

As Roku becomes more Netflix (NFLX)-like in nature, I think analysts are right to be sticking by their Buy ratings. Should pandemic tailwinds make a return, Roku stock may be timelier than it appears after its pullback.

Wall Street’s Take

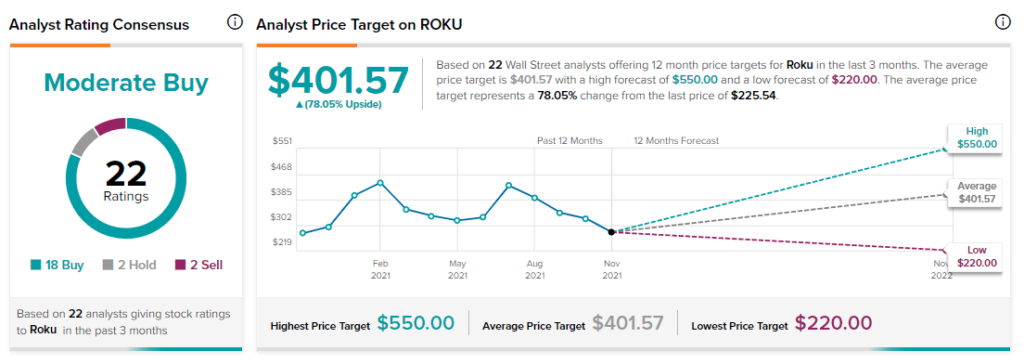

According to TipRanks’ analyst rating consensus, ROKU stock comes in as a Moderate Buy. Out of 22 analyst ratings, there are 18 Buy recommendations, two Hold recommendations, two Sell recommendations.

The average Roku price target is $401.57. Analyst price targets range from a low of $220 per share to a high of $550 per share.

Bottom Line

At 12.7 times sales, Roku stock isn’t what you’d consider a value stock. Still, the company has many levers it can pull to re-accelerate its growth, one of them being an aggressive investment in exclusive ad-driven content.

Disclosure: Joey Frenette owned shares of Amazon at the time of publication.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >