Volatility returned into the cryptocurrency market on Dec. 3 amid worrying concerns on the ”omicron” variant. Bitcoin price slid to lows of $51,640 after the SEC officially disapproved asset manager WisdomTree’s spot Bitcoin (BTC) exchange-traded fund (ETF) after deferring on a decision several times this year.

Amid the market selloff, Bitcoin dipped from $57,640, shedding nearly $6,000 or 10% in a remarkably similar pattern to that of the Black Friday/Thanksgiving dump. Despite the pressure exerted on many crypto assets, selected Altcoins, Terra (LUNA, +8.85%), Polygon (MATIC, +6.27%), Cosmos (ATOM, 17.24%), GXChain (GXC, +85.44%) managed to sustain gains as the rest of the market traded in the red.

Terra’s LUNA cryptocurrency is up 63.32% on a 7-day basis, making it bigger than Dogecoin, Shiba Inu, or Avalanche. Terra is set to mark the 7th straight day in green rallying to record highs, thanks to a combination of falling supply of tokens, and a series of changes in how the coin is used in its payment network.

Layer 2 blockchain project Polygon’s MATIC token is up in the last 3 days after crypto exchange-traded product (ETP) issuer 21Shares announced listing a product linked to its performance on Euronext exchanges in Paris and Amsterdam.

Also trading in the green is Cosmos (ATOM), which was up 15.64% at $30.50 at press time. GHXChain, a fundamental blockchain for the global data economy is up 62.66% in the last 24 hours.

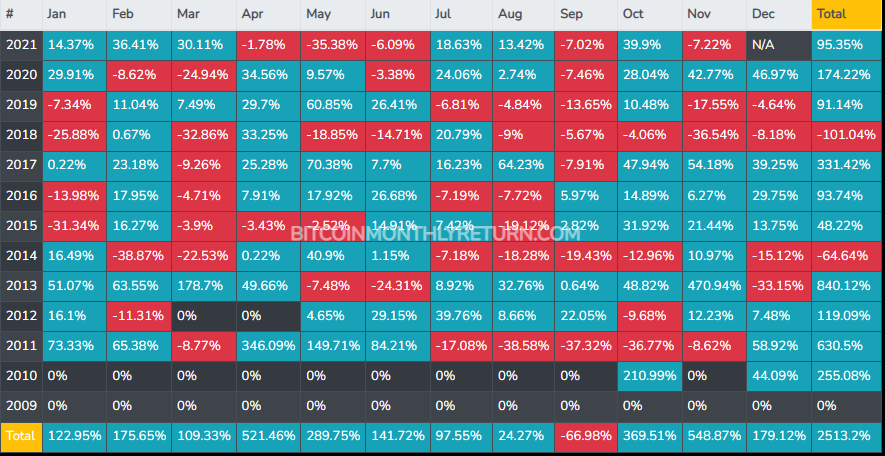

Looking at Bitcoin’s December price action since 2010, the lead asset has posted positive returns in all the years, except for 2013 and 2014, then 2018 and 2019. Bitcoin had a negative correction in 2018 when it crashed from $19,783 at the end of 2017 to $3,742 at the end of 2018.

Courtesy: Bitcoin Monthly Returns

Courtesy: Bitcoin Monthly ReturnsOn the contrary, if 2021 turns out to be a year similar to 2017 or 2020, a moderate to significant run-up could materialize in December, adding on to the year’s 95.35% gain. In this scenario, Bitcoin may end the year at probably $145,000 or around $100,000 as the case may be.

A scenario like 2018 is unlikely to materialize, given that Bitcoin has gained significantly year-to-date, and it would take a correction of nearly 95% to take it into the red zone. Even if Bitcoin declines further, it could still end the year with modest gains.

Stock to flow analyst, PlanB maintains that his $135,000 December floor stands despite the miss in November, saying ”S2F model unaffected and on track to $100K”. While analysts are bullish on the cryptocurrency, some don’t foresee a rally to six figures in the short term.

Matthew Dibb, chief operating officer and co-founder of Stack Funds, said the chance of Bitcoin rallying to $100,000 is getting slimmer by the day as the macro-economic environment doesn’t appear price supportive, especially with Federal Reserve Chairman Jerome Powell’s recent hawkish turn.

Image Credit: Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.