Under The Spotlight - The TJX Companies

The TJX Companies is the leading off-price retailer of apparel and home fashions in the U.S. and worldwide. As of Oct. 30, 2021, the company operated a total of 4,684 stores in the United States, Canada, the United Kingdom, Ireland, Germany, Poland, Austria, the Netherlands and Australia and five e-commerce sites. These include 1,285 T.J. Maxx, 1148 Marshalls, 850 HomeGoods, 55 Sierra and 39 Homesense stores in the United States.

Image: David Marshall

Strong Brand Loyalty

TJX traces its roots back to 1976 when Ben Cammarata, general merchandising manager of Marshalls, was recruited to develop and lead the launch of a new off-price chain selling family apparel and home fashions. Under Ben’s leadership, T.J. Maxx was born, with its first two stores opening in Massachusetts during 1977. TJX has continued to grow steadily over the years, opening stores in new markets, countries and continents.

TJX is also launching new chains and acquiring other retailers to bring its popular off-price model to an even wider network of customers. In 1990, TJX acquired a five-store chain called Winners, which has grown into a winner by becoming Canada’s leading offprice retailer. In 1992, HomeGoods was introduced to expand TJX’s presence in the booming home fashions market.

In 1994 T.J. Maxx was launched in Britain, introducing the off-price concept to the United Kingdom. In 1995, TJX acquired Marshalls, which doubled the company’s size. The company’s newest divisions include HomeSense and Sierra. In 2013, TJX launched its e-commerce site and now operates 4,684 stores in nine countries.

TJX delivers a rapidly changing assortment of quality brand name merchandise at prices 20%-60% less than department and specialty store regular prices. TJX can offer these savings because of its opportunistic buying strategies.

As the largest offprice retailer, TJX has tremendous buying power and solid relationships with more than 21,000 merchandise vendors in 100 countries. This retail recipe engenders strong brand loyalty from consumers of all ages.

Strong Third Quarter

TJX reported revenues for the third quarter rang up a 24% gain to $12.5 billion as overall open-only comparable store sales increased 14%, driven by a 34% comparable store sales gain at HomeGoods. This is the third consecutive quarter that comp store sales increased mid-teens or better. Operating profit jumped 37% to $1.4 billion with net income and EPS each up 18% to $1.0 billion and $.84, respectively. These results were well above management’s plan thanks to robust sales trends throughout the quarter.

The home businesses across all divisions continued their “phenomenal” performance while the apparel business rebounded from the pandemic with comp store sales increasing by mid-single digits.

Substantial Share Buyback

Fiscal year-to-date, the company generated $1.9 billion of operating cash flow and ended the quarter with $6.8 billion of cash. During the first nine months of the fiscal year, TJX paid $942 million in dividends and repurchased 16.3 million of its shares for $1.1 billion at an average price of about $67.48 per share. TJX expanded its share repurchase program by $500 million and now expects to repurchase $1.75 billion to $2.0 billion of its stock this fiscal year.

Despite global supply challenges, TJX is well-positioned for the important holiday selling season with sales very strong' with comp store sales up mid-teens as the company starts its fourth quarter. The company is in an excellent inventory position with most of the product needed for the holiday season either on hand or scheduled to arrive at its stores and online in time for the holidays.

Shelves should be stocked full throughout the holiday season which TJX plans to advertise in their “Endless Selection and Low Prices All Season Long” campaign, including its first TV marketing campaign in Europe. TJX’s great values resonate well with its consumers around the world especially during inflationary times.

Gaining Market Share

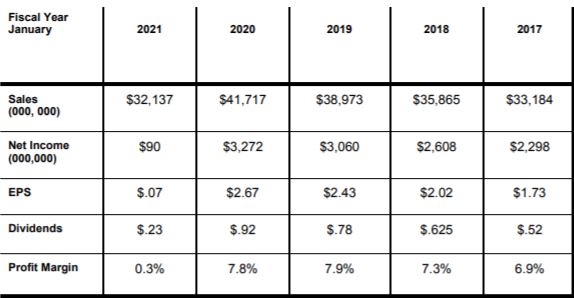

Management is very confident in continuing to gain market share, improving its profitability and reaching its strategic vision of becoming a $60 billion sales firm. Long-term investors shopping for a bargain should consider The TJX Companies, a well-managed high-quality business which is gaining market share with strong brand loyalty, outstanding cash flows and substantial share repurchases. Buy.

Disclaimer: Copying, reproduction or quotation is strictly prohibited without written permission. Information presented here was obtained from sources believed to be reliable but accuracy and ...

more