Top 10 Themes For 2022

In its comprehensive take of the top 10 themes for 2022, Deutsche Bank's Luke Templeman asks if covid is the only theme that matters? He correctly responds that "that is not the right question. In fact, covid is now not so much a theme as it is the backdrop against which most things are evolving in economics, finance, and corporates."

So what themes matter in 2022?

As part of Deutsche Bank's look ahead analysis, Templeman, director of the bank's thematic research group, addresses the big macro topics – the risk of the global economy overheating given stimulus measures and the change in attitude of central banks towards employment goals. Then there is how tight labor markets may further boost inflation. A flow on is higher bond yields and the end of free money that has propped up markets since the financial crisis. As he notes, while "stock markets may not crash, they could witness the return of fundamental investing." It certainly would be welcomed... even if it comes with the S&P several hundred/thousand point lower.

Some more observations from Tempelman's summary:

Corporates, in 2022, will struggle with new issues – in addition to labor shortages. For two decades, returns have been generated by rising profit margins and cheap debt. Now both those things are looking to reverse in 2022. Competition regulators are flexing their muscle and, to compensate, managers will have to rediscover their operational mojo. That means generating more sales from existing assets.

Does any corporate theme matter in a shortage economy? A good question with a contrarian answer. Basically, we see an inventory glut in 2022. Manufacturers are going full tilt, while retailers are beginning to over-order.

Then there is ESG, which for better or worse has been turbo-charged by covid. The momentum is fully behind ESG bonds, particularly sustainability-linked bonds: "Investors love the story, customers love the story, and corporates are piling on board."

Away from the spotlight, several other themes could have serious repercussions in 2022, according to Deutsche Bank. One is that central bank digital currencies will take a massive step forward with some countries planning to go live in 2022. Meanwhile, the DB strategist argues that most people underestimate how the growing militarization of space will ratchet up geo-political tensions. Between anti-satellite missiles and growing budgets for military space divisions, the worrying thing is that the benefits of space supremacy are now so great that there are reasons why countries may push back against any new treaty.

* * *

We split DB's "Top 10 Themes" into two posts, each covering 5 of the biggest themes the bank believes will define the coming year. Part 1 will cover 1) An overheating economy; 2) Covid optimism; 3) A hypersonic labor market and inflation; 4) Corporate focus on asset efficiency; 5). Inventory glut. The second part, which we will publish tomorrow will turn to 1) Antitrust (or competition) renaissance; 2. The end of free money in stock markets; 3) Space: a worrying geopolitical frontier; 4) Central Bank Digital Currencies: Growing into reality; 5) ESG bonds go mainstream.

So without further ado, here is theme #1 for 2022...

1. An overheating economy, by Jim Reid

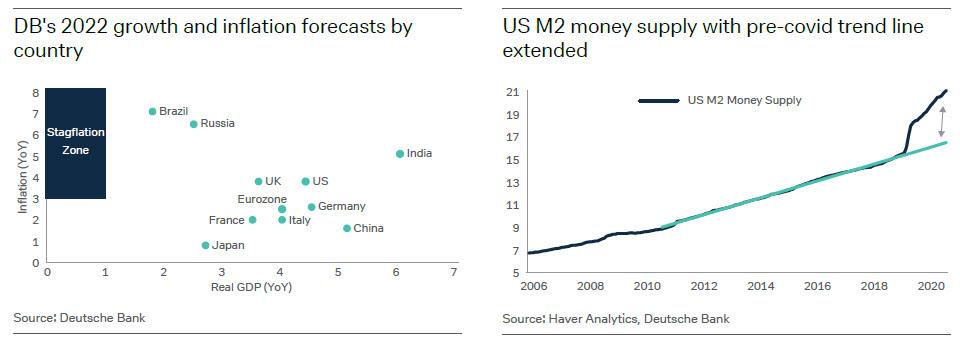

While some commentators worry about stagflation in 2022, it is far more likely that the US economy will encounter overheating risks. Of course, many economies are still recovering from covid with the current winter wave plus Omicron providing obvious risks. However, unless the new variant completely rewrites the path of the pandemic, next year should be a better year on the pandemic front. Meanwhile, the huge stimulus that remains in the system, alongside easy policy conditions, will continue to ensure both inflation and growth stay high.

The result is likely to be a “growthflationary” environment in 2022. In turn, the Fed will likely become more aggressive in 2022 in order to curb inflation. This will tighten financial conditions for a period while investors become used to the new regime. Growth should survive this in 2022 as policy and financial conditions will likely stabilize at still accommodative levels as the adjustment takes place. However, should the economy overheat, and the pace of tightening outweigh the historically easy level of financial conditions, the cycle’s end could be brought into sharper focus with a recession in 2023 or 2024 increasingly debated.

Indeed the starting point is that the spot real federal funds rate is now more negative than it has been at any time since the 1950s. Money supply has exploded in a way it did not after the financial crisis when the world was deleveraging and thus offsetting extreme monetary policy. A lack of deleveraging in this cycle and helicopter money has left a monetary overhang this time round that will continue to encourage high growth and inflation. Potential political gridlock after the mid-terms will not change the legacy fiscal stimulus still working its way through the system in 2022.

Overheating risks have been amplified by the recent change in the Fed’s attitude towards maximum employment. Maybe history will suggest that the Fed was unfortunate in its timing to move to average inflation targeting just as helicopter money finally arrived that removed the necessity for the policy change. It is arguably fighting the battle of the last cycle. By waiting to see actual gains in employment rather than respond to the clear labor market tightness, albeit exaggerated by the pandemic, it has arguably fallen too far behind the curve.

One of the biggest differences between this cycle and the last is the US output and employment gap. After the financial crisis both took eight years to close. That was the slowest recovery in history so with hindsight it is quite easy to see why we did not see inflation. In this cycle the gaps will close over the next quarter which will be one of the quickest recoveries in history. So the US economy will be bumping against its inflationary speed limit in 2022 with huge stimulus still working through the system.

(Click on image to enlarge)

Some argue that stagflation is a bigger threat than overheating. The reality is that most economies are still a long way from it. If DB’s growth forecasts prove correct, then most of the G7 economies will still generate economic growth of at least three percent next year. This is some way above trend and inconsistent with ‘stagflationary’ dynamics.

We can therefore expect robust growth and elevated inflation. This makes the overheating of the global economy a key risk in 2022. Consider that in 2021, investors went from not pricing in a hike until 2024 to expecting as many as three next year. The risk lies in central banks, led by the US, being forced enact yet more.

* * *

2. Covid optimism. – Henry Allen

The covid outlook for the northern hemisphere winter is deeply concerning. Numerous countries are moving into fresh lockdowns, and the arrival of the Omicron variant has led to new travel restrictions and another bout of financial market turmoil. Nevertheless, there are credible reasons to be optimistic about how the pandemic may evolve in 2022. Critically, improved medicines will hopefully become mainstream. At the same time, an expected increase in the availability of several covid vaccines means that those populations without access should finally receive it. And as the world begins to manage covid, it is likely that benefits will be found in some neglected areas of society upon which the pandemic has thrown a light.

The biggest game-changer of 2022 will likely be antiviral pills. These promise to diminish hospitalizations and fatalities and already there are two encouraging candidates. Trials of the Merck pill suggest it cuts the risk of hospitalization and death by 30 per cent. Meanwhile, the Pfizer pill appears to reduce hospitalization and deaths among high-risk adults by 89 percent. Both have applied to US regulators for authorization and Merck’s pill has already been approved in the UK.

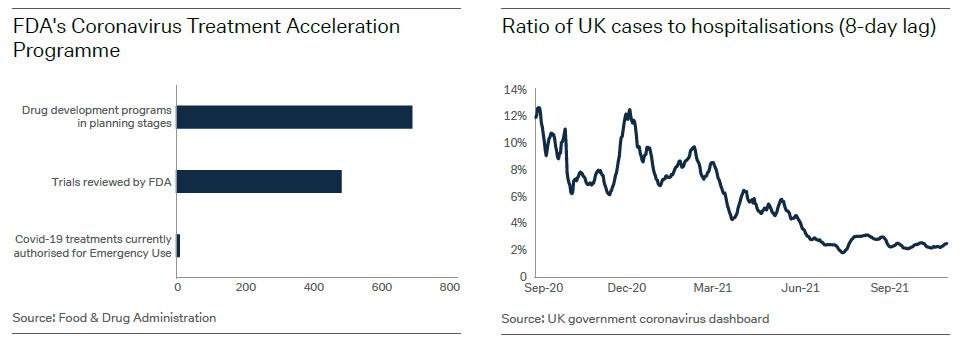

Apart from pills, treatments are broadening. For example, the US Coronavirus Treatment Acceleration Program is supporting a range of therapies in development, such as antiviral pills, neutralizing antibodies, and also immunomodulators that reduce the immune reaction to the virus and prevent it going into harmful overdrive.

(Click on image to enlarge)

Vaccine manufacturing will also accelerate in 2022. The production of the Pfizer vaccine is expected to increase by a third to 4bn doses. Moderna will also increase supply. A chunk of this inventory is likely to be distributed in the developing world where vaccine access has, so far, been poor. Moreover, the extension of the vaccine to younger age groups will push developed countries closer to herd immunity. The US has already authorized the Pfizer vaccine for children aged 5-11. Other countries are following suit.

Taking a step back, the tragedy of covid has forced societies to reckon with difficult issues that have been neglected for too long. As they begin to manage the virus more effectively, this offers hope that areas such as tackling educational inequalities or greater support for mental health are given greater attention.

The pandemic has also helped us become more inventive in how we can prevent such crises in the future. The importance of a quick reaction has been fully accepted. Indeed, leaders at a recent G20 summit pledged to enhance early detection and warning systems, as well as shorten the development cycle for vaccines and therapeutics. On a smaller scale, buildings and schools are starting to plan better ventilation systems.

Of course, new variants still pose a risk, and the arrival of the new Omicron variant has demonstrated this once again. Yet over the medium term, history shows that many viruses can become less dangerous over time, which was what happened with the H1N1 virus that was responsible for the Spanish Flu in 1918. And with the advantages of modern medicine and the array of treatments in the development pipeline, we can be confident that eventually, humanity will move past this virus too.

* * *

3. A hypersonic labor market and inflation, Olga Cotaga

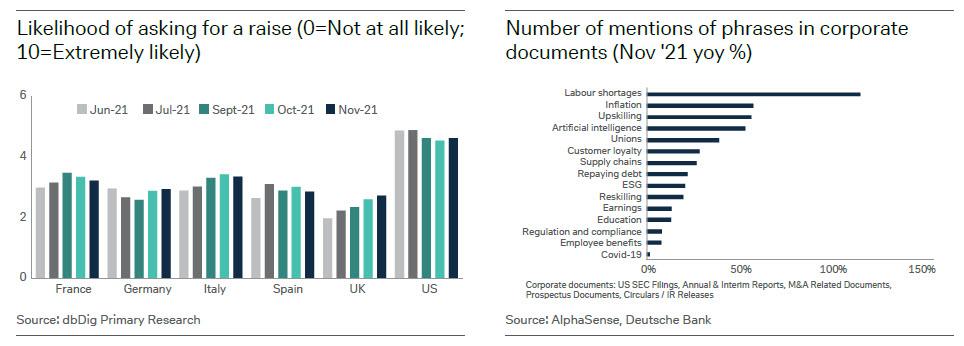

Just as hypersonic missiles are stirring geopolitical tensions, the hypersonic recovery of the labor market is stirring inflationary concerns. That will likely be exacerbated in 2022 as workers that are upskilling themselves leave their current roles in search of a better job.

The big difference in this labor market recovery is its breath-taking speed. After a normal recession, it usually takes between four to seven years for the labor market to recover. This time, it is recuperating much faster. The US unemployment rate has now returned to 4.2 percent, not far from the 3.5 percent seen just before covid. In France and Spain labor force participation is already higher than prior to covid.

Whilst it is a relief that people are back in work, the speed of the recovery does contain some hidden dangers. This is because history shows the unemployment rate tends to decrease for the length of an economic cycle. Given this economic cycle has only just begun, and cycles in recent decades have been lasting longer, that implies the labor market may continue to tighten for years. Exacerbating this tightness is the fact that not everyone has returned to work. Indeed, in the US, more than 4m people left their job since covid and have not come back. More than half of those have retired early.

An outlook for an unusually tight labor market is a perfect recipe for wage-driven price growth. Our economists have previously commented that excluding the stagflation period of the late-1970s and early- 1980s there is a decent correlation (41 percent) between unemployment and inflation, although the correlation has weakened over time.

Amplifying the issue is that covid has inspired people to upskill and find a better-suited and better-paid job. Indeed, more than two-thirds of workers globally are willing to retrain for new jobs.1 Meanwhile, a third of people who have ever registered on a ‘Massive Open Online Course’ platform joined in 2020.2 A global survey of nearly 6,000 people found that 40 percent are at least somewhat likely to leave their current jobs.

(Click on image to enlarge)

The issue is dominating the corporate discussion, as seen in the chart above, and pushing companies to be more proactive. Alphabet, Amazon, IBM, Walmart, and many other large companies are introducing training programs. Some now pay for higher education. Corporates are also spending more on wages and salaries because of labor shortages.

While avoiding mass unemployment was one of the great successes of covid-policy, there is a catch. After all, hypersonic missiles would not be as much of a threat if they traveled at slower speeds (they would just be missiles). If we are at the start of a new economic cycle that lasts as long as the others of the last four decades, wage inflation will likely continue.

* * *

4. Corporate focus on asset efficiency, Luke Templeman

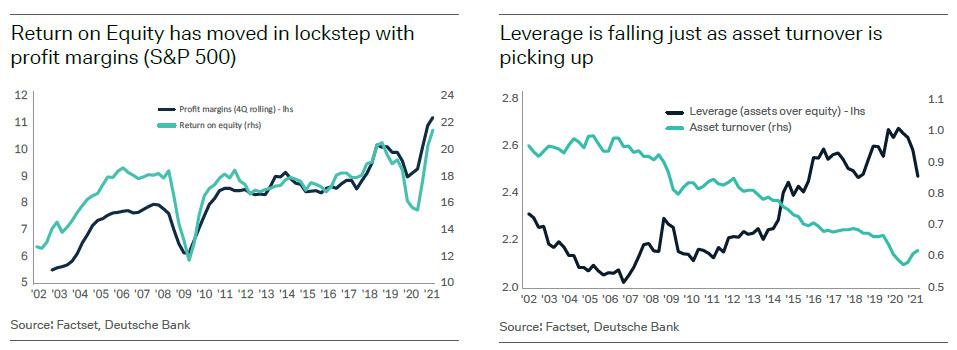

Investors have not needed to care about bloated companies until now. After all, for the last decade or so, corporate returns were juiced by rising profit margins and super-cheap debt. Companies grew through acquisitions and ignored their asset efficiency. Indeed the median S&P 500 company earned $1 in sales for every $1 it held in assets in the early 2000s. It now earns just 60 cents.

In 2022, the focus on asset efficiency is set to return as the two other sources of returns on equity – profit margins and leverage – are coming under significant pressure.

Profit margins will be squeezed as workers increasingly demand higher wages and benefits. The trend towards this began in earnest in 2021; in 2022 it will likely continue as worker shortages persist (see our theme A hypersonic labor market and inflation). Also pressuring margins will be policies that aim to arrest the decline in corporate competition. Indeed, President Biden, and leaders in other developed countries, have lamented how the decline of corporate competition has helped firms over workers.

Leverage, too, appears set to drop in 2022. Possible interest rate rises will make debt more expensive and, if some level of higher inflation proves permanent, companies can expect higher debt costs in the medium term. Already, companies have been curtailing their leverage. Since it hit a multi-decade peak in mid-last year, leverage in the median S&P 500 company has dropped eight percent and now sits at 2016 levels.

(Click on image to enlarge)

There are initial signs that asset efficiency is hitting managers’ radar. Over the last three quarters, the asset turnover ratio of S&P 500 companies has risen quicker than at any time since the financial crisis. This is good news. If asset turnover returns to pre-financial crisis levels, returns on equity would theoretically increase by two-thirds.

Some high-profile companies are already slimming down. Johnson & Johnson, General Electric, and Toshiba have all recently announced plans to split their firms. That comes as our analysis shows that stock market returns of asset-light companies have outperformed asset-heavy companies over the last decade. Private equity will have a field day – they love acquiring unloved spin-offs.

From an investor’s point of view, if companies do not slim down, they will have to make their existing assets work harder. This will not be easy. It requires someone skilled in turnaround management and the type of structural change that not only consumes a lot of management attention but also creates ructions amongst staff.

Just as 2022 will likely usher in the return of investor focus on asset efficiency, it will separate companies into three groups: those that are already asset efficient, those that ignore the issue, and those that are inefficient but addressing the problem. The latter group may provide investors with the most value. And as they do, they will likely penalize those companies that continue to meander along with a bloated balance sheet.

* * *

5. Inventory glut, Olga Cotaga

In 2022, we are going to have a lot of stuff. Everywhere. Supply chain disruptions, coupled with an imperfect market, are likely to lead retailers and manufactures to being stuck with abundant inventories. A slower than expected release of pent-up demand, as well as a focus on experiences over goods, will likely exacerbate the glut. Marie Kondo would not approve.

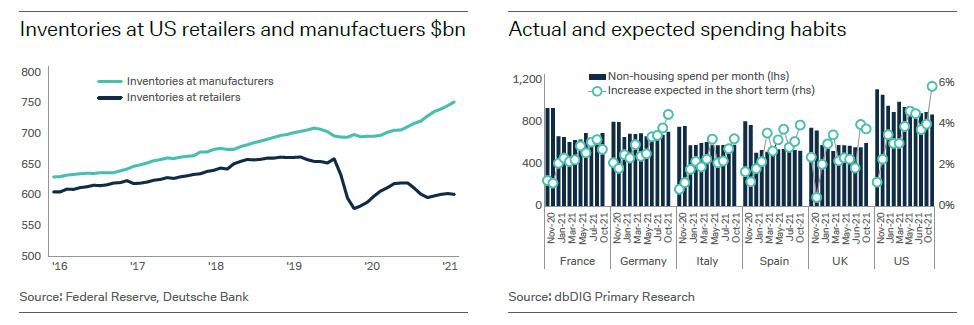

An inventory glut will follow the fact that retailers do not want to be caught off guard with a lack of product as they have been last year and this. Although their inventories are currently low (partly due to the auto shortage), there are signs that retailers are over-ordering ahead of the busy holiday period. All the while, manufacturers are already producing and holding far more inventory than they did before covid.

(Click on image to enlarge)

This means 2022 is set for the “bullwhip” effect – where retailers and manufacturers respond to each other by under- and then over-ordering. Shortages are followed by gluts and then shortages until equilibrium is finally established.

Third-quarter earnings results showed the highest number of S&P 500 companies discussing “supply chains” in a decade.

Exacerbating the problem are concerns that customer demand does not recover as quickly as corporates think. Our latest presentation on pent-up demand, shows that people expect their spending to rise. But each month so far, those expectations have failed to materialize. Specifically, Americans have been spending less but expect to spend more. This is why expectations of a release of pent-up demand may not materialize. That will leave a glut of inventory either in warehouses or on the shop floor.

One important factor behind demand not materializing is people’s appetite for savings. The US still has the highest level of covid savings of large economies, at about $1.2tn, but Europeans have arguably saved more. Savings of about six percent of 2019 GDP are slightly higher than in the US. On top of that, more Europeans think their savings will increase in the next 12 months, compared with the beginning of last year.

Equally as important for inventories is the fact that, so far, people have shown a preference for experiences over goods. Indeed, the upwards trajectory in spending since the beginning of 2021 has been the sharpest in the out-of-home entertainment, such as restaurant meals, theater, or cinema. This has little to do with inventories.

The swings in the availability of goods will continue back and forth until an equilibrium is eventually established. In other words, the “bullwhip” effect is likely to continue to dominate the supply chains in 2022 and lead to a surplus of inventories. In that case, Marie Kondo's organizational techniques may prove useful.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more