Mastercard (NYSE: MA) provides transaction processing and other payment-related products and services in the United States and internationally.

Although a very high-quality company, we are currently neutral on the stock.

Competitive Advantage

There are a couple of ways to quantify a company’s competitive advantage using only its income statement. The first method involves calculating the earnings power value (EPV).

Earnings power value is measured as adjusted EBIT after tax, divided by the weighted average cost of capital, and reproduction value can be measured using total asset value. If earnings power value is higher than reproduction value, then a company is considered to have a competitive advantage.

The calculation is as follows:

EPV = EPV adjusted earnings / WACC

$124.085 billion = $8.686 billion / 0.07

Since Mastercard has a total asset value of $35.4 billion, we can say that it does have a competitive advantage. In other words, assuming no growth for Mastercard, it would require $35.4 billion of assets to generate $124.1 billion in value over time.

The second method of quantifying a competitive advantage is by looking at a company’s gross margins because it represents the premium that consumers are willing to pay over the cost of a product or service.

An expanding gross margin indicates that a sustainable competitive advantage is present. If an existing company has no edge, then new entrants would gradually take away market share, leading to decreasing gross margins as pricing wars ensue to remain competitive.

Taking a look at Mastercard, we can see that gross margins have remained at 100% in the past several years. As a result, its gross margins indicate that a competitive advantage is present in this regard as well.

Profitability

Most investors judge a company based on earnings per share. This is especially true for institutional investors who tend to overreact to the slightest earnings miss. However, these are only paper profits, and they can potentially be misleading. As a result, we prefer to focus on free cash flow.

In the last 12 months, Mastercard has recorded $8.2 billion in free cash flow, making it profitable by our definition.

This allows the company to return money to shareholders through both dividends and buybacks, although the yield on both is currently about 2% combined. More importantly, its free cash flow has been trending up in recent years.

To us, this means that the company’s free cash flows are reasonably predictable.

Risks

To measure Mastercard’s risk, we will first check to see if financial leverage is an issue. We do this by comparing its debt-to-free cash flow.

Currently, this number stands at 1.7x. In addition, when looking at historical trends, we can see that the debt-to-free cash flow ratio has been trending up.

Overall, we don’t believe that debt is currently a material risk for the company because its interest coverage ratio is 19x (calculated as free cash flow divided by interest expenses).

However, there are other risks associated with Mastercard. According to Tipranks’ Risk Analysis, the company disclosed 32 risks in its most recent earnings report. The highest amount of risk came from the Legal and Regulatory category.

The total number of risks has remained relatively flat over time, as shown in the picture below.

Valuation

To value Mastercard, we will use the H-Model, which is similar to a three-stage DCF model. The H-Model assumes that growth will decelerate linearly over a specified period of time. We believe this is a reasonable assumption, as companies gradually slow down as they mature.

The formula is as follows:

Stock Value = [CF(1+tg)]/(r-tg) + [CFH(hg-tg)]/(r-tg)

Where:

CF = cash flow per share

tg = terminal growth rate

hg = high growth rate

r = discount rate

H = half-life of the forecast period

For Mastercard, we used the following assumptions:

CF = $8.29

tg = 2.016%

hg = 25.5%

r = 6.556%

H = Five years (we are assuming it will take 10 years to reach terminal growth)

As a result, we estimate that the fair value of Mastercard is approximately $400.69 under current market conditions.

Wall Street’s Take

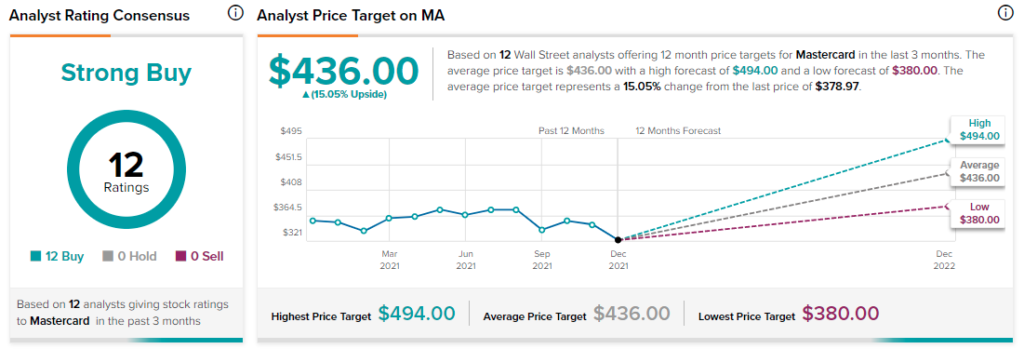

Turning to Wall Street, Mastercard has a Strong Buy consensus rating, based on 12 Buys assigned in the past three months. The average Mastercard price target of $436 implies 15.1% upside potential.

Final Thoughts

Mastercard is a great company that has a strong competitive advantage and gross margins. In addition, it is undervalued under current market conditions.

Nonetheless, we remain neutral on the stock because its undervalued status is mostly the result of low-interest rates, which has led to low discount rates.

Thus, the upside potential does not really provide a sufficient margin of safety if rates continue to rise as they are expected to.

Download the TipRanks mobile app now

Disclosure: At the time of publication, StockBros did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >