Ford Is A Great Large Cap

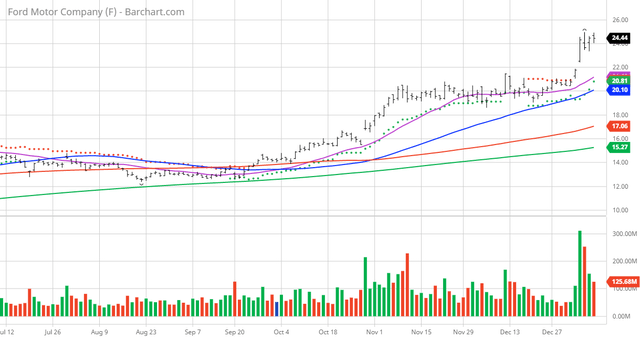

The Barchart Chart of the Day belongs to the automotive company Ford (F). I found the stock by using Barchart to sort the S&P 100 Index stocks first by the highest Weighted Alpha and Barchart technical buy signals, then used the Flipchart feature to review the charts for consistent price appreciation.

Since the Trend Spotter signaled a buy on Jan. 3, the stock gained 12.30%.

The basics: Ford Motor Company designs, manufactures, markets, and services a range of Ford trucks, cars, sport utility vehicles, electrified vehicles, and Lincoln luxury vehicles worldwide. It operates through three segments: Automotive, Mobility, and Ford Credit. The company was founded in 1903 and is based in Dearborn, Michigan.

The Automotive segment sells Ford and Lincoln vehicles, service parts, and accessories through distributors and dealers, as well as through dealerships to commercial fleet customers, daily rental car companies, and governments.

The Mobility segment designs and builds mobility services; and provides self-driving systems development services.

The Ford Credit segment primarily engages in vehicle-related financing and leasing activities to and through automotive dealers. It provides retail installment sale contracts for new and used vehicles; and direct financing leases for new vehicles to retail and commercial customers, such as leasing companies, government entities, daily rental companies, and fleet customers. This segment also offers wholesale loans to dealers to finance the purchase of vehicle inventory; and loans to dealers to finance working capital and enhance dealership facilities, purchase dealership real estate, and other dealer vehicle programs.

Ford Motor Company has a strategic collaboration with ARB Corporation Limited to develop a suite of aftermarket products for the new Ford Bronco.

Please note that the Barchart Opinion indicators are updated live and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you would see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals

- 163.19+ Weighted Alpha

- 170.14% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 5 new highs and up 22.62% in the last month

- Relative Strength Index 77.88%

- Technical support level at 23.67

- Recently traded at 24.44 with a 50 day moving average of 20.10

Fundamental Factors:

- Market Cap $97.75 billion

- P/E 12.65

- Dividend yield 1.69%

- Revenue expected to grow 9.50% this year and another 14.60% next year

- Earnings estimated to increase 363.40% this year, an additional 4.70% next year and continue to compound at an annual rate of 77.67% for the next 5 years

Analysts and Investor sentiment -- I don't buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock its hard to make money swimming against the tide:

-

- Wall Street analysts issued 6 strong buy, 6 buy and 6 hold and 4 under perform opinions on the stock

- The individual investors following the stock on Motley Fool voted 9,973 to 2,422 for the stock to beat the market with the more experienced investors voting 1,338 to 371 for the same result

- 455,060 investors are monitoring the stock on Seeking Alpha

- Seeking Alpha gives a Quant Rating of 4.99 out of 5 with the following components:

Factor Grades

| Now | 3M ago | 6M ago | |

|---|---|---|---|

| Valuation | C- | B | A- |

| Growth | B+ | B | A |

| Profitability | A+ | A+ | A+ |

| Momentum | A+ | A- | A- |

| Revisions | A+ | B- | C- |

Conclusion: Ford (F) is currently having very positive upward price momentum driven by favorable Revenue and Earnings projections. The stock has great evaluations by both professional and individual investors with a very, very large following. This might be a good addition to you portfolio if you practice proper diversification and rick management techniques.

The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis.

Disclaimer: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are ...

more