EUR/USD Price Pauses At 1.1480 Ahead Of ECB, US Retails Data

Bullish sentiment surrounding the single currency is healthy on Friday, pushing the EUR/USD price to new 2-month highs around 1.1480.

For the fourth year in a row, the EUR/USD is rebounding and is approaching the key barrier around 1.1500.

The sharp improvement in the risk mix continues to be supported by the quick sell-off of the dollar, with the US dollar index (DXY) falling to its lowest level since November 2021, which was in the 94.60 zone.

Photo by Ibrahim Boran on Unsplash

Before Thursday, the dollar’s decline accelerated following the release of December inflation data (Wednesday), while US yields appeared to be gaining some strength before the bell in the old continent.

Chairman S. Lagarde will speak in Europe later that afternoon according to the minutes. In terms of the data, the annual GDP data for Germany should be complemented by trade balance data across the wider euro area. On the other side of the pond, all eyes will be on retail sales, industrial production, the Consumer Sentiment Index, and the New York Fed speech by J. Williams.

The EUR/USD is recovering and already flirting with the key area of 1.1500 or 2-month highs. The sharp decline in the US dollar came after disappointing US inflation numbers in December. Still, it did not change the view that the Federal Reserve could start a tightening cycle at its March meeting, reflecting the divergence between the ECB and the Fed would further deepen. In contrast, the continued spread of the Coronavirus pandemic remains the lone factor to consider when it comes to growth prospects and investor morale.

ECB C. Lagarde speaks on Friday about the full-year German GDP growth in 2021. Moreover, the US retail sales data will be the key event today.

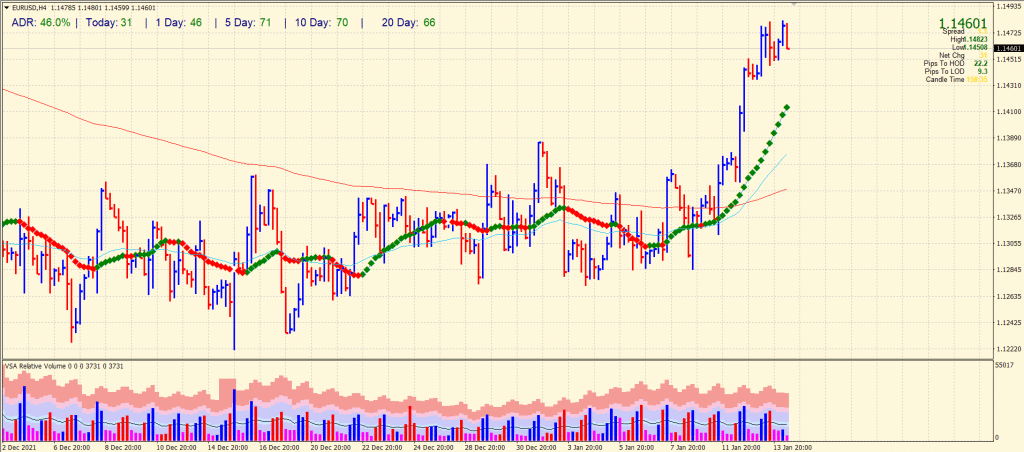

EUR/USD Price Technical Analysis: Bulls Pause

(Click on image to enlarge)

The EUR/USD price is consolidating under 1.1480. The bulls look to rest now, and we may see a pullback towards the 1.1420 area before any further bullish continuation. The price is well above the key SMAs on the 4-hour chart. However, the volume data is mixed, and the pair has done a 40% average daily range so far. Therefore, the probability of pullback is quite high.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more