Shares of The Walt Disney Company (NYSE: DIS) have dropped 9.3% over the past year as investors have been concerned about the performance of Disney’s direct-to-consumer business segment, Disney+.

In fiscal Q4, even as Disney+’s paid subscribers soared 60% year-over-year to 118.1 million, many of these paid subscribers were Disney+ Hotstar subscribers. The company’s management stated on its earnings call that subscribers to Disney+ Hotstar, a popular Indian streaming platform, made up 37% of Disney+’s paid subscriber base.

The higher percentage of Disney+ Hotstar subscribers also dragged down its average monthly revenue per paid subscriber. Disney+’s average monthly revenue per paid subscriber dropped 15% year-over-year to $4.08 in FY 2021.

Will this trend continue in Disney’s upcoming earnings? The company is expected to announce its Q1 2022 earnings on February 9.

Tigress Financial analyst Ivan Feinseth is optimistic that Disney’s streaming services should see an uptick in subscribers going into 2022, as it has “a massive slate of new series and movies premiering in 2022 and beyond.”

When it comes to Disney’s other business segments including theme parks, the analyst expects that there could be a “significant pickup in Economic Profitability as prudent cost-cutting and expense and balance sheet management during the pandemic will drive significant leverage to an Economic Profit recovery” in 2022.

Feinseth expects that this economic profitability could be driven by a “significant pent-up demand” for entertainment, travel, and movies in 2022, and a “massive slate of new content” that is up for release in theatres and on its streaming services.

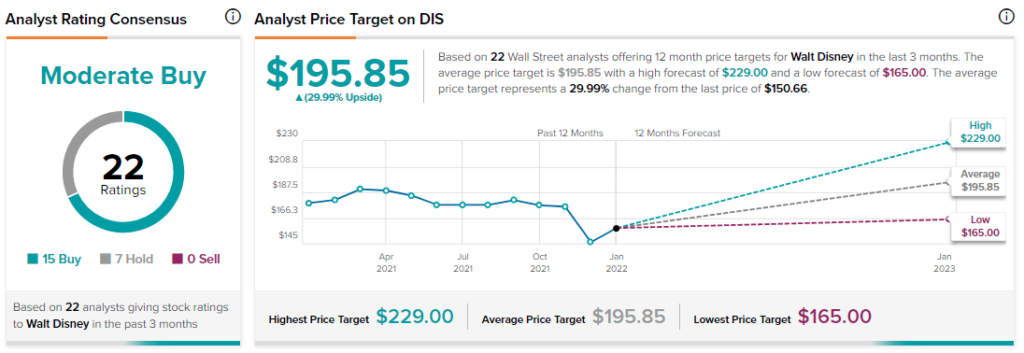

It is the revenue-generating and value creation opportunity from Disney’s content across all its business segments that Feinseth is bullish about. As the analyst put it, “Content is King, and DIS is the King of Content.” As a result, the analyst has a Buy rating and raised his price target from $227 to $229 (52.2% upside) on the stock.

The rest of the analysts on the Street are cautiously optimistic about Disney, with a Moderate Buy consensus rating based on 15 Buys and seven Holds. The average Disney stock prediction of $195.85 implies upside potential of approximately 30% to current levels for this stock.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.