AUD/USD Weekly Forecast: Bulls Pause Above 0.72, Eyeing Chinese Data

Image Source: Unsplash

- The sentiment on Wall Street is directional for the AUD/USD pair.

- Australia reports positive macroeconomic data amid economic recovery.

- The AUD/USD pair remains at an inflection point without a clear direction.

The weekly forecast for the AUD/USD pair is slightly bearish as the technical levels resist gains while the US dollar attempts to gain back. On Friday, the AUD/USD pair hit a new two-month high of 0.7313, but the pair slowed its weekly gains to settle at 0.7240. Wall Street’s poor performance, particularly on Friday, undermined demand for the pair despite the dollar’s weakness.

While the US struggles with toxic inflation levels, the US Federal Reserve appears unable to respond adequately and promptly, so the Currency Board has concentrated completely on the US dollar. The US dollar fell after the country announced the consumer price index hit a four-year high of 7% year-over-year in December. Compared with the previous 4.9%, the underlying value was higher at 5.5%.

Inflation in Australia dropped to 2.8% year-over-year in December from 3.1% year-over-year, while retail sales rose to 7.3% year-over-year in November, beating the expected 3.9%. In November, the housing sector showed further growth, with home loans rising by 7.6% and building permits up by 3.6%. Meanwhile, the trade surplus decreased to $9.4 billion.

Although encouraging, figures from Australia should be viewed cautiously. The upbeat figures are attributed to the country’s economic recovery after removing its restrictive measures against the coronavirus. Early in 2021, this boom could be seen in other economies, but it did not produce the anticipated results.

Key Data/Events for AUD/USD Next Week

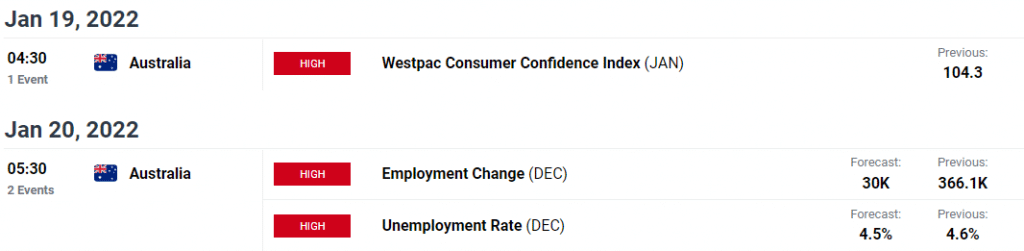

The week will be busy in Asia, as China will release retail sales and industrial production figures for December on Monday, along with fourth-quarter gross domestic product data. In addition, Australia is scheduled to release consumer confidence figures for January, consumer inflation expectations for January, and employment numbers for December later this week.

This week, there will be few macroeconomic releases as the US releases its usual weekly unemployment data and some housing-related data.

AUD/USD Weekly Technical Forecast: Bears Emerging at the Top

Technically, the AUD/USD pair remains neutral in the long-term. The technical indicators do not indicate a clear trend. The daily chart shows sellers defending the upside movement around the 100-SMA, though the price remains above the moderately bullish 20-SMA.

The technical indicators have declined and are approaching their average values. The volume data shows clues of further bearishness that may trigger next week. However, the upside is also capped by the ascending trendline.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more