Tuesday Talk: Long Weekend, Long Odds

Markets reopen in New York today after being closed Monday in observance of the Martin Luther King, Jr. Day, holiday. The market worked hard to close up on Friday, but was only partially successful. While Las Vegas Sands Corp scored a double-digit gain in Friday's trading, the odds in Washington that there will be meaningful action on Biden's BBB plan or voting rights legislation are long, at best.

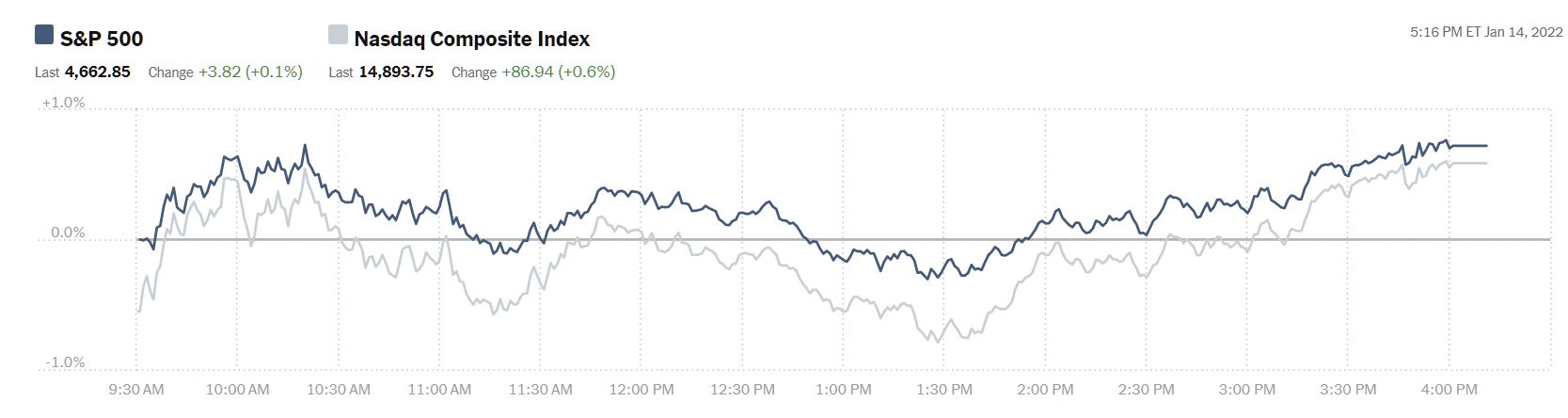

On Friday the S&P 500 closed at 4,663, up 4 points, the Dow closed at 35,912, down 202 points and the Nasdaq Composite closed at 14,894, up 87 points. Market futures are currently red with S&P futures trading down 53 points, Dow Jones futures trading down 257 points and Nasdaq 100 futures trading down, 282 points.

Chart: The New York Times

Casino gambling giants Las Vegas Sands Corp. (LVS) and Wynn Resorts (WYNN) were number one, +14.2% and number two, 8.6%, on Friday's top gainers list following news that gaming regulators in Macau decided to keep the status quo of allowing only six casino licenses on the island, ruling out the possibility of new entrants for the time being.

Chart: The New York Times

JP Morgan (JPM), WellsFargo (WFC) and Citigroup (C) reported Q4 earnings last week to mixed reviews. Today GoldmanSachs (GS) and Bank of America (BAC) are expected to report their Q4 earnings, with Morgan Stanley (MS), to follow on Wednesday.

The Staff at TalkMarkets contributor "The Fly" looks at What To Watch In Next Round Of Big Bank Earnings Reports. While the well known industry blog finds that financial sector equities remain relatively strong, a check among analysts from rival firms found some caution in current ratings.

"Bank of America analyst Ebrahim Poonawala downgraded Goldman Sachs to Neutral from Buy with a price target of $475, down from $490. "

"Societe Generale analyst Andrew Lim downgraded Bank of America to Hold from Buy with a price target of $46, down from $50. Lim expects that U.S. rates will increase only modestly and that the U.S. yield curve will likely flatten, which has negative implications for Bank of America's longer-term net NII growth, the analyst told investors."

"Barclays analyst Jason Goldberg raised the firm's price target on Morgan Stanley to $123 from $110 and keeps an Overweight rating on the shares. The analyst expects bank stocks to continue to outperform the market in 2022. While the omicron variant introduces some near-term uncertainty, the sector has "several positive trends in 2022,""

In market moves elsewhere, contributor Rachit Vats notes that Tesla Loses Top Spot In Ark Next Generation Internet ETF To This Cryptocurrency Stock.

"Coinbase Global Inc (COIN) has now grabbed the top rank in (ARKW) at about 7.6% weight and the investment management firm held 1.05 million shares, worth $240.1 million, in the cryptocurrency-related business, prior to Friday’s trade...Tesla (TSLA) holdings slipped to 220,222 shares, worth about $227 million, representing about 7.2% weight in the ETF."

Be that as it may, "Coinbase shares are down about 8.4% so far this year and have plummeted about 30% since going public last year in April."

Contributor Christopher Lewis looks at the ETH/USD Forecast: Ethereum Pulls Back Towards 200-Day EMA.

"The Ethereum (ETH-X) market initially tried to rally on Monday, but then ended up falling back towards the 200-day EMA yet again. The 200 day EMA sits just below the $3200 level, which is an area that I think a lot of people will pay attention to. Keep in mind that the 200 day EMA is not like a brick wall, it is essentially an area of interest. Because of this, even if we do break down below the 200 day EMA, I am paying closer attention to the $3000 level, which is an area that is going to be supportive, not only due to the fact that we have bounced from there, but the fact that we have a certain amount of psychology attached to a round figure like that."

See the article for Lewis' full forecast.

As the market seems poised to continue its January slide, many market commentators are sliding along with it. Not so TM contributor Joseph Calhoun who takes a different stance in his latest blog piece, Weekly Market Pulse: A Very Contrarian View.

Calhoun begins with a summary of what he views as the current common consensus before diverging to his own "contrarian" views, which is where I meet him below:

"If we assume the current consensus will be wrong, it would be nice to know how it might be wrong...C&I loans have risen in the last two recessions as corporations drew down credit lines to bolster liquidity. Loan balances fell after each of the last three recessions and then resumed their previous trend higher. That appears to be what is happening now – unless you think we’re near recession right now...Another, underappreciated positive is that US exports have recovered to a new all-time high. There has been a lot of attention on China recently and it is certainly an important economy. But China’s losses – many self-inflicted – may well turn out to be the gains of other emerging markets as manufacturing is shifted away from China. Stock markets in Taiwan, Vietnam, India and Mexico – all potential beneficiaries as other countries pull back from China – produced double-digit returns in 2021."

"What about inflation? How might it vary from the consensus? With the consensus that inflation will moderate in 2022, the surprise may be that it doesn’t moderate very much or at all...An easing of supply problems this year may well be a bad assumption... with the Fed and Wall Street’s track record on forecasting being what it is – lousy – it seems prudent to think about how they might be wrong. It would have been easy to lay out a scenario where growth comes up short but that is not a view that lacks promoters or fans. After a decade of poor growth, bearish economic views are not outliers anymore. But better than expected growth in 2022 would certainly surprise a lot of people and move markets."

"...a word on consumer sentiment. The preliminary University of Michigan survey reading for January was released last week and showed a drop from December’s already weak showing. I do not believe this survey is a reliable guide to the state of the economy any longer and hasn’t been for quite some time. The partisan political divide of this survey has become extreme in recent years."

"Omicron has definitely slowed things somewhat but the extent right now is hard to judge. The optimist in me wants to believe this will pass fairly quickly but that too is a consensus view. I would not be surprised if we continue to see weak data from the end of last year in the next couple of weeks so a bond market rally right now would not be a big surprise nor would a further pullback in risk assets. But the trend for interest rates is still up and the shift to rising growth assets is well underway. Stay positive."

Calhoun is partially contrarian, it would seem. The article is rich with information, particularly forward looking charts, worth a peek.

Contributor Mish Shedlock is concerned about the economic outlook, particularly as relates to the impact of outstanding credit market debt, and asks When Does The Sizzling Economy Hit A Recession Brick Wall?

"Total Credit Market Debt Owed

Total credit market debt owed is $85.9 trillion!

That number comes from the Fed.

How much of that can possibly be paid back?

Something Happened

“Something has happened in the last 30 years, which is different from the past,” says Minneapolis Fed president Neel Kashkari.

Yes, it has and the Fed is clueless as to what it is.

The answer is unproductive debt is a huge drag on the economy. And the Fed needs to keep interest rates low to support that debt.

This keeps zombie corporations alive and also spurs financial speculation, also a drag on growth.

When Does Recession Hit?

If the Fed does get in three rate hikes in 2022, then 2023 or 2024. And it may not even take three hikes. "

Getting back to the nitty gritty of Joe and Jane investing, TM contributor Marc Lichtenfeld suggests How To Keep Pace With Red-Hot Inflation with two stocks that have been around the block more than once.

![]()

"If, in 2013, you’d bought one of my first recommendations – Texas Instruments (TXN) – and were still holding today, aside from seeing your stock go up by nearly seven times, your yield would be 13.5%, almost double the current rate of inflation."

"...consider Enbridge (ENB). I recommended it less than three years ago, and investors are now enjoying a 7.4% yield on their original purchase price. If you’re relying on your investments for income, that income needs to be able to grow. There aren’t many safe investments that will do that."

Caveat Emptor.

In commemoration of yesterday's Martin Luther King, Jr. Day holiday, I've chosen to close today's column with these quotes from contributor Timothy Taylor's piece, Some Economics For Martin Luther King Jr. Day.

"The McKinsey Global Institute has published “The economic state of Black America: What is and what could be” (June 2021). Much of the focus of the report is on pointing out gaps in various economic statistics. In terms of income. While such comparisons are not new, they do not lose their power to shock. For example:

Today the median annual wage for Black workers is approximately 30 percent, or $10,000, lower than that of white workers … We estimate a $220 billion annual disparity between Black wages today and what they would be in a scenario of full parity, with Black representation matching the Black share of the population across occupations and the elimination of racial pay gaps within occupational categories. Achieving this scenario would boost total Black wages by 30 percent … The racial wage disparity is the product of both representational imbalances and pay gaps within occupational categories—and it is a surprisingly concentrated phenomenon.

...the case for racial equality stands fundamentally upon principles of justice, with economics playing only a supporting role."

I would say, a "major" supporting role.

Let freedom ring. Check out the link to the Stanford Education Project's multimedia presentation of Martin Luther King, Jr.'s historic "I Have a Dream" speech, delivered at the culmination of "The March On Washington For Jobs and Freedom" on August 28, 1963.

Have a good one.

I'll be back on Thursday.