MercadoLibre Stock: An Undervalued Growth Powerhouse

In a tremendously challenging environment for growth stocks, MercadoLibre (MELI) is down by almost 45% from its highs of the year, trading at the low end of its valuation range for the past decade. Opportunities to buy this stock at current valuation levels don't happen frequently.

Price action has to be interpreted in its due context. Growth stocks have been under relentless selling pressure lately, and the market is throwing out the baby with the bathwater: Panicked investors and momentum-chasing algorithms are selling off the good, the bad, and the excellent growth companies in this environment.

Fundamentally, MercadoLibre keeps delivering vigorous revenue growth and expanding profit margins, and the company has abundant room for sustained growth in the years ahead.

It is hard to know when sentiment towards growth stocks will improve again, but sentiment always comes and goes in both directions over time. For investors with a long-term horizon, MercadoLibre looks like a compelling opportunity at current prices.

MELI Stock Price Is Down But Fundamentals Are Up

We can blame it on inflation, the Fed, or some other reason. However, the fact is that volatility is normal in the stock market, and stocks don't go up in a straight line year after year. After periods of above-average returns, it is fairly normal to have pullbacks and corrections in different segments of the market.

The current bear market for growth stocks comes after explosive gains in 2020, and it has been excruciatingly painful. I am the first to admit that a pullback was needed after huge gains and record-level valuations for growth stocks in February of 2021. However, the pendulum has gone too far once again, this time in the opposite direction of extreme pessimism.

At these levels, the opportunities are exceptionally attractive for investors in fundamentally strong growth companies with a long-term horizon. Many mediocre growth stocks will never recover, and for good reasons. However, those investors who pick the right names will be well rewarded for buying at currently depressed levels.

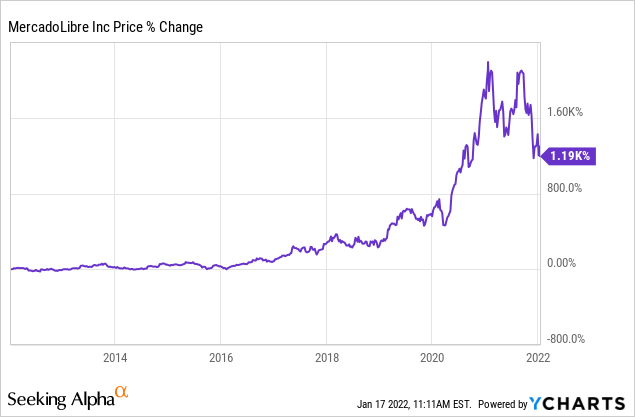

Even after the recent selloff, MercadoLibre has been a spectacular winner over the long term.

Data by YCharts

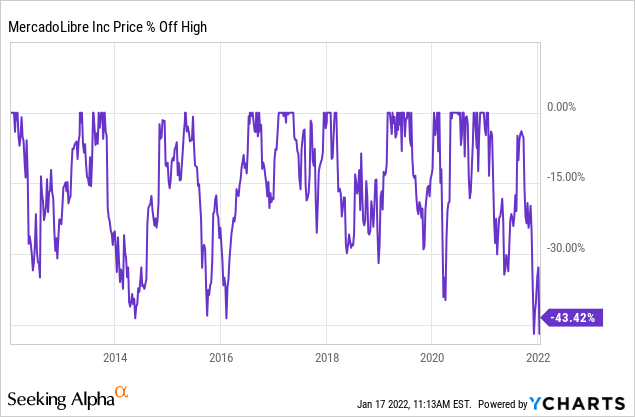

But returns are not free. Volatility is the price of admission for superior long-term gains. This massive winner has suffered multiple declines of more than 40% from its highs over the past decade.

Data by YCharts

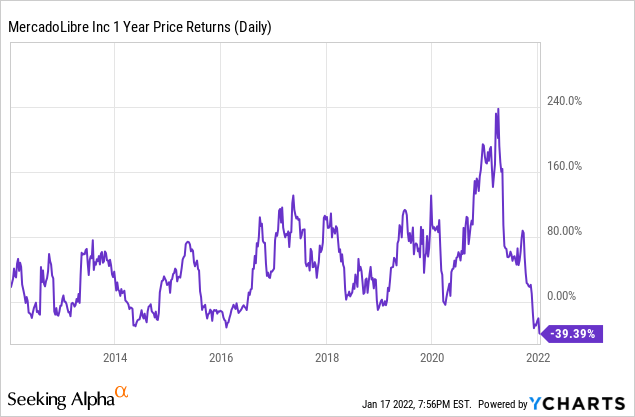

Another way to look at this is by observing returns over different one-year periods. Nothing is written in stone and the future is always a matter of probabilities as opposed to certainties. However, it is easy to see that there is some kind of reversion to the mean going on over the long term: the best gains tend to come after the largest drawdowns.

Data by YCharts

In retrospect, these past declines have been excellent buying opportunities in MercadoLibre. Looking at both current valuation and fundamental performance, there are strong reasons to believe that the recent selloff in MercadoLibre stock is providing another compelling entry point.

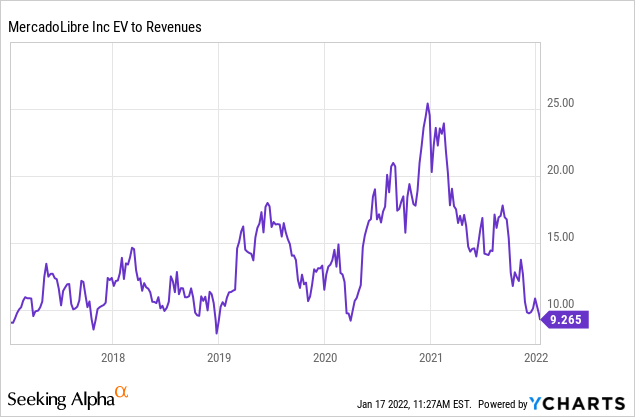

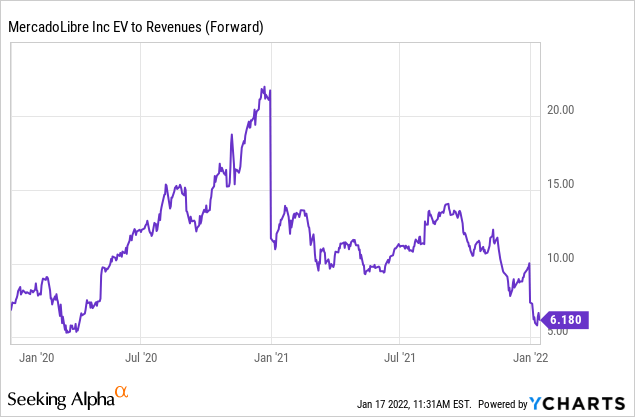

The Enterprise Value to Revenue ratio is currently below 10, which is at minimum levels in the past 10 years.

Data by YCharts

On a forward-looking basis, the EV to Revenue ratio is at around 6.

Data by YCharts

Both trailing and forward ratios are at historical lows for MercadoLibre. To provide some perspective, valuation is at the same levels from March of 2020, when the world economy was entering a sharp pandemic-driven recession, with unpredictable consequences for the economy and the financial system.

If you are looking for reasons for the decline, you will not find those reasons in the company's financial performance. Total revenue reached $1.9 billion in the third quarter, an increase of 66.5% in USD and a 72.9% increase in constant currencies. Income from operations reached $160.4 million versus $83.1 million in the same period last year.

This level of performance is quite notable when considering that the company was facing tough comparisons versus Q3 of 2020 when Latin America was in full-lockdown mode. A high bar is hard to meet, and MercadoLibre is delivering sustained growth at scale, consistently outperforming expectations.

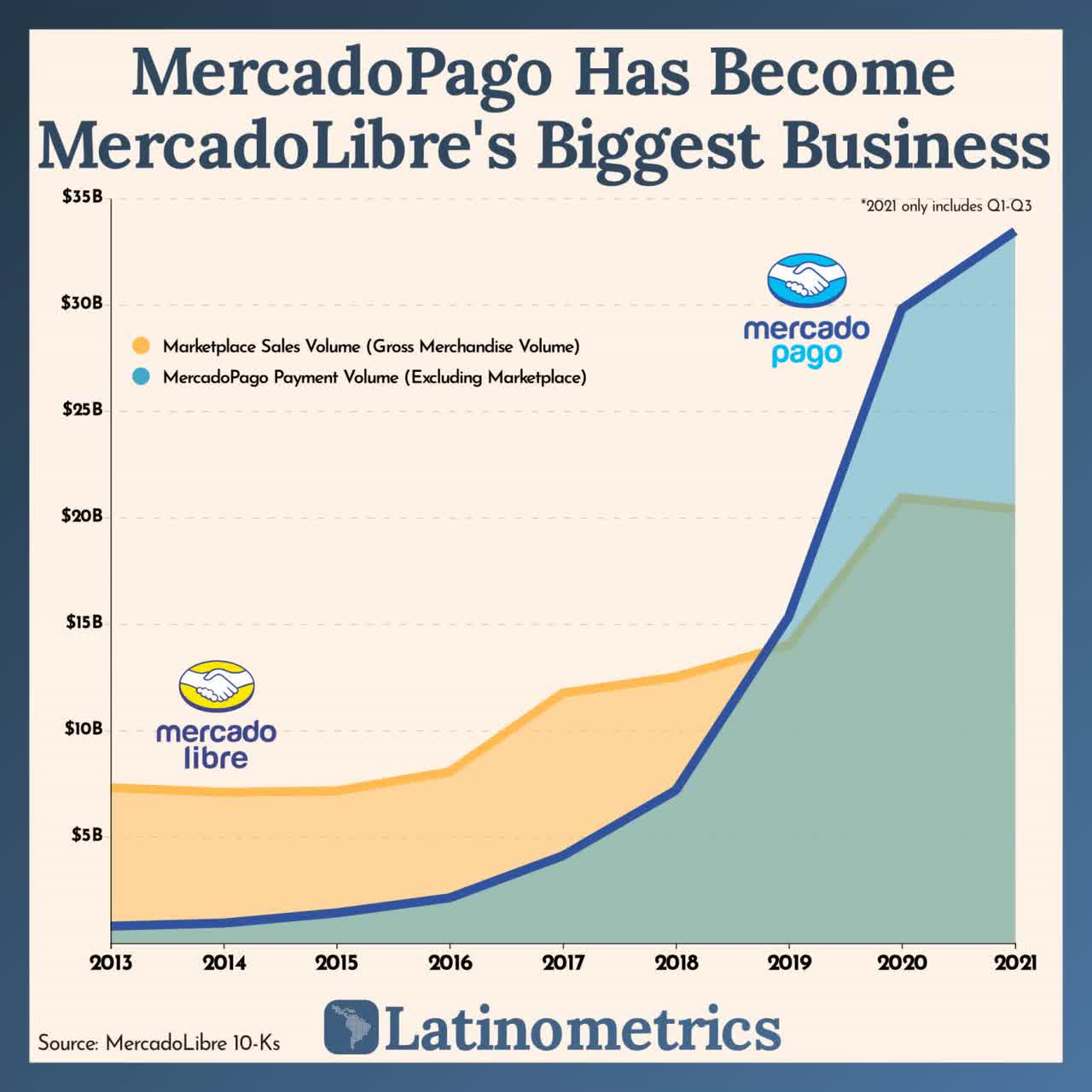

The fintech business is firing on all cylinders. Total payment volume - TPV - through Mercado Pago was almost $20.9 billion, growing 43.9% in USD and 59% on an FX-neutral basis. Total payment transactions increased 54.7% year-over-year, totaling 865.7 million transactions for the quarter

Off-platform TPV grew 59.0% year-over-year in USD and 78.8% year-over-year on an FX-neutral basis, reaching $13.4 billion. Payment transactions reached 697.4 million, a year-over-year increase of 67.3%.

MercadoLibre started building the fintech business around its e-commerce platform a few years ago, and growth has accelerated in recent years. Now Mercado Pago is much larger outside the company's marketplace than inside it, and it is also growing at a much faster speed.

MercadoPago Growth

Building logistics capabilities is expensive, but it is also a key source of competitive differentiation for MercadoLibre. In the third quarter of 2021, almost 80% of all items were delivered within 48 hours.

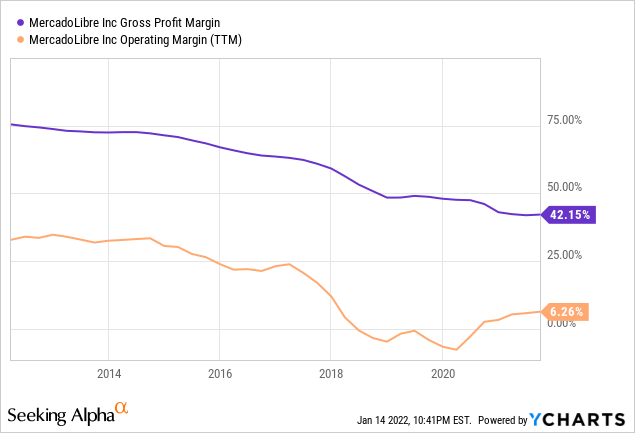

In terms of profitability, MercadoLibre used to make huge margins, above 75% at the gross level with operating margins well above 25% a few years ago.

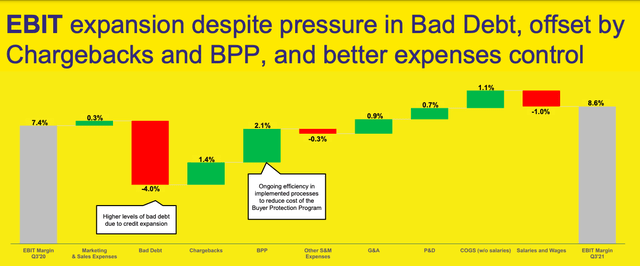

In recent years those margins have contracted due to investment in logistics and sales generation - free shipping, discounts, advertising, etc. More recently, there have been some improvements in profitability, as revenue is growing faster than expenses.

MELI Margins - YCharts

Growth companies tend to go through cycles of aggressive reinvestment based on business needs and growth opportunities. MercadoLibre has been expanding its first-party business lately, and logistics investments can be a considerable drag on margins. But the company is doing a solid job at gaining scale and expanding margins with it.

(Click on image to enlarge)

MELI margins MercadoLibre

Structurally speaking, the business model is highly profitable once reinvestment needs start growing at a slower speed than revenue. When the company has already made the investments to build the network and infrastructure in ecommerce and in fintech, every new transaction adds to profits with almost no associated extra costs, so profit margins tend to move in the right direction.

For every transaction that happens in its commerce platform, MercadoLibre is not only collecting sales fees but also payment processing and logistics fees in most cases. These higher take rates are another positive driver for the company's overall profitability metrics in the years ahead.

Moving forward, MercadoLibre has enormous room for growth in advertising. The company does not disclose much information about this business, and it is just giving the first steps in this area. However, MercadoLibre has been collecting tons purchasing of data over the years, and advertising could be a huge opportunity in the not-so-distant future.

MercadoLibre Stock - Risk And Reward Over The Long Term

No investment is without risk, in the case of MercadoLibre, macroeconomic factors are especially important. Many countries in Latin America have unstable currencies, and Brazil is having a presidential election next year, which can drive some additional volatility in MercadoLibre's biggest market.

The stock market understands this, and investors in MercadoLibre know that they need to look beyond the metrics in USD because currency fluctuations - which are obviously outside of the company's control - can have a considerable impact on the numbers when reported in USD.

Nevertheless, this is always an important source of uncertainty. Normal economic volatility - by Latin American standards - is not much of an issue. However, a permanent but destabilization in one of the company's largest markets could be a severe problem.

MercadoLibre is rapidly expanding into credit services, the company ended the third quarter with a $1.1 billion credit portfolio and over $1 billion originated during the quarter. This area of the business could be particularly vulnerable to a permanent deterioration in economic conditions.

The strategy is very compelling because a large share of the population in Latin America, both consumers and small merchants, have insufficient access to financial services and particularly credit. By leveraging its data, MercadoLibre can make smart credit decisions and capture a massive opportunity. However, this is a double-edged source, and proper risk management is of utmost importance in this area.

When you have a company with such a large opportunity, a big question to consider is whether it has the competitive strengths to capitalize on such an opportunity. In the case of MercadoLibre, it is facing rising competitive pressure from Sea Limited (SE), which has a considerable presence in Brazil and it has been entering other Latin American countries recently.

Sea Limited's Shopee has been tremendously successful at driving app downloads by leveraging the popularity of its gaming business. But Shopee is no match to MercadoLibre in terms of logistics, and it can take several weeks for a third-party logistic platform to deliver the products in Latin America. Buyers in Shopee generally go for lower-priced products, and they are willing to wait because many of those items are extremely cheap in many cases.

But still, it is hard to think that Shopee can dethrone MercadoLibre in its home market because logistics provides a massive source of competitive strength for the industry leader. In any case, Latin America is home to almost 663 million people, there is enough room for multiple players to do well in e-commerce and fintech.

The network effect provides a key source of competitive advantage for MercadoLibre. Buyers and sellers want to go with the ecommerce platform that brings more opportunities for business, so users on both sides of a transaction attract each other.

The same goes for digital payments, merchants need to accept the payment methods that bring customers to the business and consumers want a payment method that is accepted everywhere. The more the merrier, and this creates a virtuous growth cycle for a market leader such as MercadoLibre.

Mercado Pago has reached massive adoption, with 78.7 million active quarterly users as of the last quarter. MercadoPago is accepted at the most exclusive fashion boutiques in big cities, pharmacy chains, restaurants, and even by street musicians accepting Mercado Pago via their smartphones.

Once a platform reaches this scale, it is very hard to beat, especially if the company keeps innovating and adding more value to those users over time.

In the short term, whatever happens to the stock price will depend on market sentiment towards growth stocks to a good degree. It is very hard for a particular company in a segment of the market to deliver good returns when that whole segment is under tremendous selling pressure.

However, market sentiment comes and goes. Over the long term, the stock price will move in the same direction as the fundamentals. One of the most interesting facts about the stock market is that long-term return drivers can be much easier to assess than short-term factors affecting a stock price.

From the most recent Howard Marks memo:

It's much more straightforward to predict the long-term outcome for a company than short-term price movements, and it doesn't make sense to trade off a decision in an area of high conviction for one about which you're limited to low conviction.

The business fundamentals look as strong as ever for MercadoLibre, and the stock is remarkably cheap due to general market conditions. We are not in the business of making predictions, investing is about assessing the probabilities for different outcomes. Probabilistically speaking, MercadoLibre looks well-positioned for attractive returns in the years ahead.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in ...

more