Nvidia (NASDAQ:NVDA) stock delivered stellar gains and outpaced the Nasdaq composite index over the past year. To be precise, the NVDA stock price has increased about 99.3% in one year, thanks to the ongoing strength across its business segments.

It’s worth noting that for the first three quarters of FY22, Nvidia’s revenues at gaming, DC (data center), Pro Viz (Professional Visualization) segments increased by 72%, 53%, and 97%, respectively, on a year-over-year basis. Meanwhile, revenues in the auto segment are up about 13% during the same period.

While it benefits from strong demand trends, valuation concerns and profit-taking led to a pullback in Nvidia stock. It is down about 22% from its 52-week high, while it has decreased by 8.3% this year.

Further, TipRanks’ Hedge Fund Trading Activity tool shows hedge funds sold 1.5M Nvidia shares over the past three months.

What Lies Ahead?

Despite valuation concerns, Mizuho Securities analyst Vijay Rakesh has a bullish outlook on NVDA stock. While Rakesh termed Nvidia’s valuation as “steep,” he believes the “improving PCs (personal computers), AI deep learning and inferencing markets, gaming trends, automotive and datacenter position it for upside to estimates.”

Following his call with Nvidia’s CFO, Colette Kress, Rakesh noted that the momentum in the gaming segment will likely sustain “with NO Seasonality and supply constrained.” Further, the data center spending will remain elevated with better supply in the 2H22.

Rakesh sees Nvidia’s dominant competitive positioning in the DC/Gaming/ProVis markets as a key growth catalyst and has a price target of $335.

Investors Buying the Dip

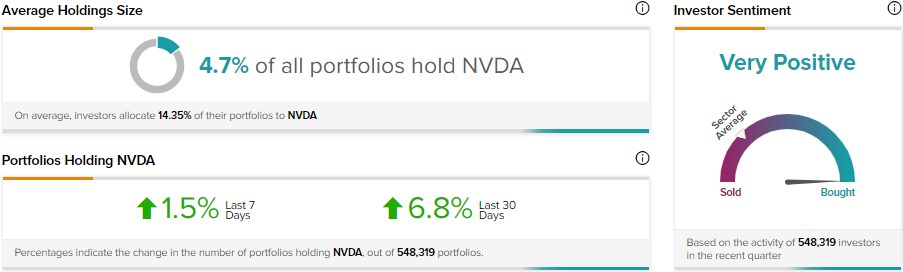

While Nvidia stock has reversed some of its gains, TipRanks’ Stock Investors tool shows that investors are buying this dip. Per the tool, 6.8% of investors holding portfolios on TipRanks have increased their stake in NVDA stock in the past month. Meanwhile, 1.5% of these investors have increased their exposure to Nvidia stock in the last seven days.

Along with investors, the majority of Wall Street analysts are also bullish about Nvidia stock. Overall, Nvidia stock has received 24 Buy and 2 Hold recommendations for a Strong Buy consensus rating. Further, the average Nvidia price target of $359.17 represents 33.3% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.