- The Turkish Central Bank is expected to remain on hold after slashing rates 500 bps.

- The US Federal Reserve will announce its monetary policy decision next week.

- USD/TRY pressures the upper end of its monthly range ahead of the event.

The Turkish Central Bank will announce its decision on monetary policy on Thursday, January 20. Markets anticipate an on-hold stance after policymakers slashed the one-week repo rate by 500 basis points between September and December 2021 to 14%.

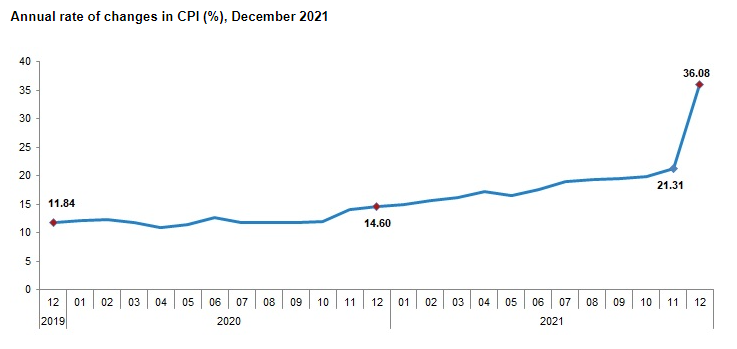

President Tayyip Erdogan is convinced that cutting rates will accelerate economic growth by boosting production, exports and credit. In fact, he stated that he would never defend interest rate hikes nor compromise on the issue, despite the Consumer Price Index jumping to 36% YoY in December 2021, the highest rate in almost two decades. Erdogan believes that higher rates will send inflation higher instead of lower.

Record inflation and lack of trust

Following the latest rate cut, the lira plunged to a record low of 18.36 vs the dollar, losing roughly 45% of its value through 2021, despite substantial economic growth. According to official data, the economy expanded 7.4% YoY in the third quarter of the year as a result of reopenings.

The December statement suggests that policymakers will pause the easing cycle and monitor its effects in the coming three months.

Erdogan sees interest rates as "an evil that make the rich richer and the poor poorer," ignoring inflation has quite a similar effect at the lower end of the range. Back in December, the Turkish government announced a rise in the gross minimum wage by 40% to TRY 5,008.5 per month in 2022, roughly $370 per month at the lira’s current value.

Source: TURKSTAT

Turkey is experiencing the same pandemic-related issues as the rest of the world. Inflation is rising as the economy expands at an uneven pace amid supply chain issues and bottlenecks following the initial lockdowns that put the globe on hold. With the pandemic far from over, there’s no end to the crisis in sight. Governments learned that restrictions are not enough to stop the spread of the virus and are now looking for a different approach. The current wild spread of contagions is seriously affecting production amid staff limitations, and the latest way to fight it is to reduce isolation periods. Still, there’s not much room for health systems to be once again on the brink of collapse.

De-dollarization process and interventions

Whatever the future brings, one thing is for sure. Turkish President Erdogan will continue to lead the central bank’s decision. Over the last two years, he sacked three central bank presidents and will not hesitate to do it again if that opposes his low rates policy.

It is worth noting that the latest Finance Minister, named in November 2021, said that inflation would come down to single digits by mid-2023, as the country will accelerate its de-dollarization process.

After USD/TRY hit the aforementioned record high, President Erdogan announced a series of measures to prevent the use of the dollar as a refugee for inflation. "We are presenting a new financial alternative to citizens who want to alleviate their concerns stemming from the rise in exchange rates when they evaluate their savings," Erdogan said.

The CBRT announced incentive measures for those converting their foreign accounts into lira deposits. Nevertheless, the relief seems temporal, and the pullback in USD/TRY has had more to do with interventions from the central bank. Bankers' calculations estimate that it has sold more than $6 billion foreign reserves to bring the pair back down to the current 13.00 price zone.

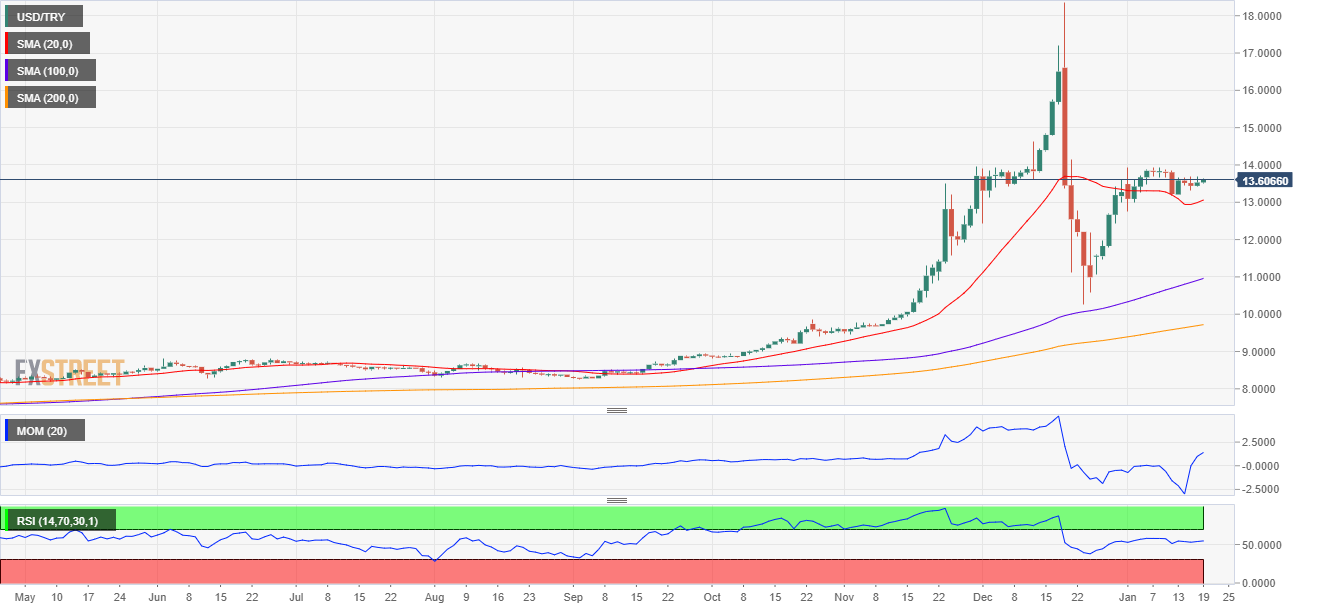

USD/TRY Technical outlook

The USD/TRY pair started 2021 trading at around 7.50; it is now trading at 13.60. After December’s wild swing, the pair has been quite stable between 12.75 and 13.65 – the highest for this month. It’s heading into the event pressuring the upper end of the monthly range.

The pair is neutral-to-bullish on the daily chart, lacking enough momentum to confirm another leg north, compatible with an on-hold stance from the central bank. Growing dollar’s demand amid soaring US government bond yields may also limit the upside for the pair, although market participants may pare dollar’s buying ahead of the US Federal Reserve monetary policy decision next week.

A rate cut is out of the question, which means downside for the pair will solely depend on the greenback’s strength. A surprise rate cut, which also has few chances, could see it skyrocketing towards a record high amid a lack of confidence in TRY.

Support levels are at 13.30 and the aforementioned 12.75, while a break through the upper end of the range could push the pair initially to 14, en route to the 14.80 price zone.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.