The cryptocurrency market succumbed to widespread selling pressure as bitcoin and altcoins pared off the gains accumulated in the prior day. Volatility returned into the cryptocurrency market on Jan. 21 amid worrying concerns on Russia’s intended crypto ban and SEC’S disapproval of another Bitcoin ETF.

The SEC officially disapproved the application for First Trust SkyBridge’s spot Bitcoin ETF, citing similar reasons for disapproving Bitcoin spot ETFs from VanEck in November and WisdomTree in December.

Bitcoin price slid to lows of $38,244 while Ethereum dropped to $2806 before a slight rebound. The majority of the crypto assets, especially in the top 100 are trading presently in red with some recording significant losses. Binance Coin (BNB), Solana (SOL), Cardano (ADA), and Ripple (XRP) have all experienced severe corrections between -6.3% to -10% in the past 12 hours.

For the second time this month, bitcoin has dipped below $40,000, hitting $38,244 mid-way through the Asia trading session. Bitcoin is down by nearly 8% in the last 24 hours, according to CoinMarketCap. Ether is also down by nearly 10%.

According to CoinGlass, there have been nearly $723 million in liquidations during the last 24 hours. Bitcoin led the liquidation pack at $291 million, followed by Ethereum at $193million. In the past 24 hours, 188,468 traders were liquidated. The largest single liquidation order happened on BitMex of XBT/USD valued at $9.91 million. Today’s price crash has so far wiped off billions from the overall crypto market as the total market valuation stands at $1.83 trillion after reaching the $2 trillion market cap earlier.

According to Crypto trader and economist, Alex Kruger, the cryptomarket’s correlation with the equities market may have likely contributed. Nasdaq crashed as Netflix earnings plunged 20%:

”Netflix earnings => $NFLX -20% => Nasdaq crashes => crypto crashes. All of the cryptos moved sharply lower due to Netflix’s earnings guidance”

He further says: ”It doesn’t have to make sense. It just happened. Somebody sold. But if you want to make sense of it, in a panicky market any reason to sell is a good reason. Netflix dumping 20% is big. And FANG plus Apple have been holding indices up if those charts fail a world of pain awaits”.

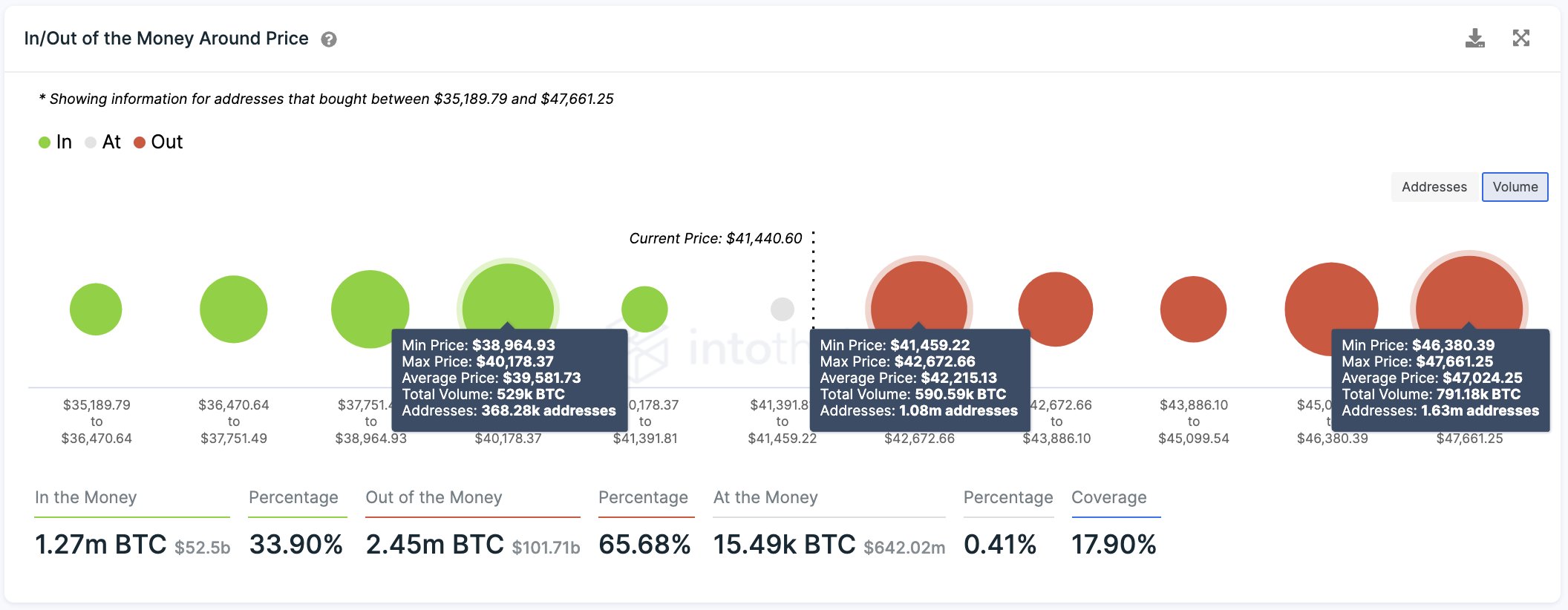

Source: IntoTheBlock

Source: IntoTheBlockIntotheBlock earlier noted in its analysis that ”BTC hangs by a thread”, suggesting that the most important support level for Bitcoin lies between $38,900 and $40,200. Such a critical demand barrier must hold to prevent BTC from a steep correction towards $30,000.

Crypto analyst, Michael van de Poppe says the loss of support could be another reason for Bitcoin’s plunge ”$42.4-42.7K couldn’t continue to hold for Bitcoin, so a nuke towards the other side of the region and, most likely, continuation towards even further downwards momentum and lower lows -> happened”

According to IntoTheBlock, the four-year cycle poses a negative catalyst for bitcoin price. The four-year catalyst denotes markets working in a four-year cycle during which bitcoin’s price rises to new highs like it did in 2013, 2017, and 2021. Crypto markets are generally split on what will happen next.

Image Credit: IntoTheBlock, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.