Tesla Shares Slide Below $1,000. Is Now A Good Time To Buy?

One of the most popular stocks during the pandemic has been Tesla (TSLA). The stock price skyrocketed, delivering 10x returns since April 2020 when the COVID-19 pandemic led to a global economic recession.

Most recently, Tesla shares traded as high as $1,200, a price level where not even the most optimistic investor could justify the sky-high valuation. Moreover, last November, Tesla’s CEO, Elon Musk, announced that he was considering selling 10% of the shares to pay taxes.

He asked his Twitter followers in a poll and obeyed the outcome. So he sold the shares, and likely did so at above $1,000/share, as the poll is dated Nov. 6, 2020.

Tesla reports its fourth-quarter and full-year 2021 results next week, on Jan. 26, at 4:30 P.M., Central Time. Is it time to buy Tesla stock, or to sit and wait for a more meaningful correction?

Tesla Charts are Bearish

From a technical perspective, the failure at the $1,200 level and the subsequent close below $1,000 are bearish developments. A double top pattern can be spotted as the price challenges the neckline.

A break below the neckline would trigger more weakness towards the pattern’s measured move, as seen in the $600 area. On such a drop, the stock price would break the rising trendline that held since the 2020 pandemic lows – yet another bearish development for Tesla’s stock price.

What do Analysts Say About Tesla’s Stock Price?

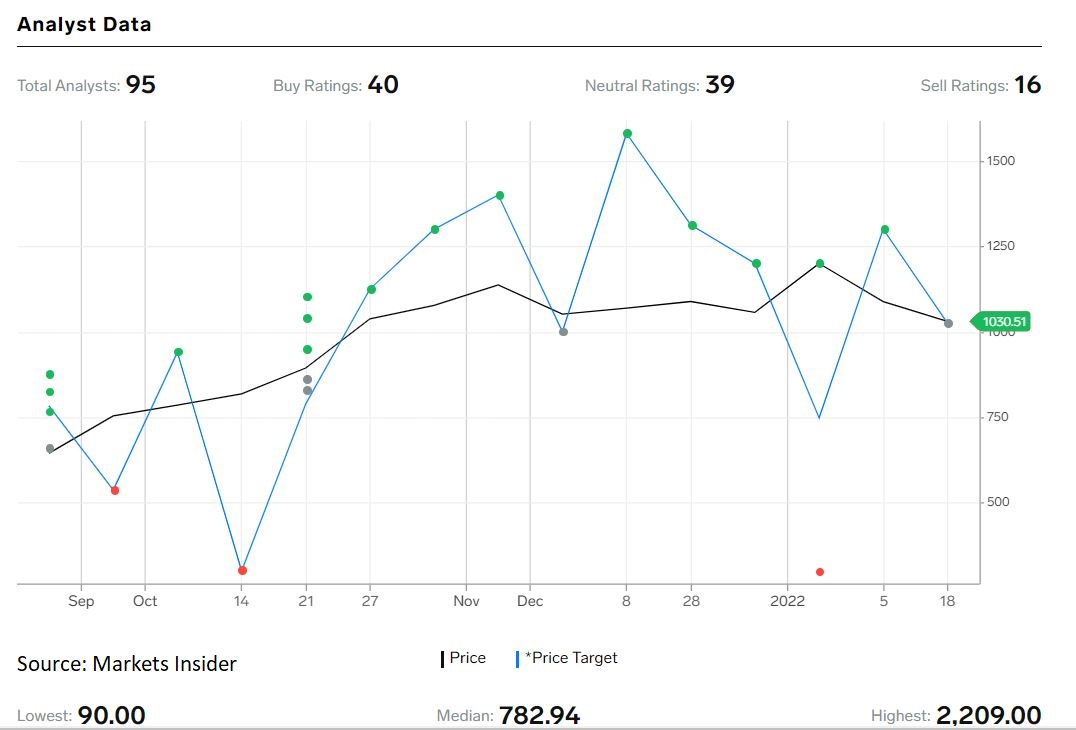

Not everyone is bullish on Tesla. In fact, most analysts are either neutral (39) or have issued a sell recommendation (16). Out of the 95 analysts covering Tesla’s stock price, 40 have issued a buy rating.

Most notably, at the start of the new trading year, Mizuho maintained its buy rating with a price target of $1,300. On the flip side, JPMorgan maintained its sell rating, with a price target of $295.

What Are Tesla’s Estimates For The Years to Come?

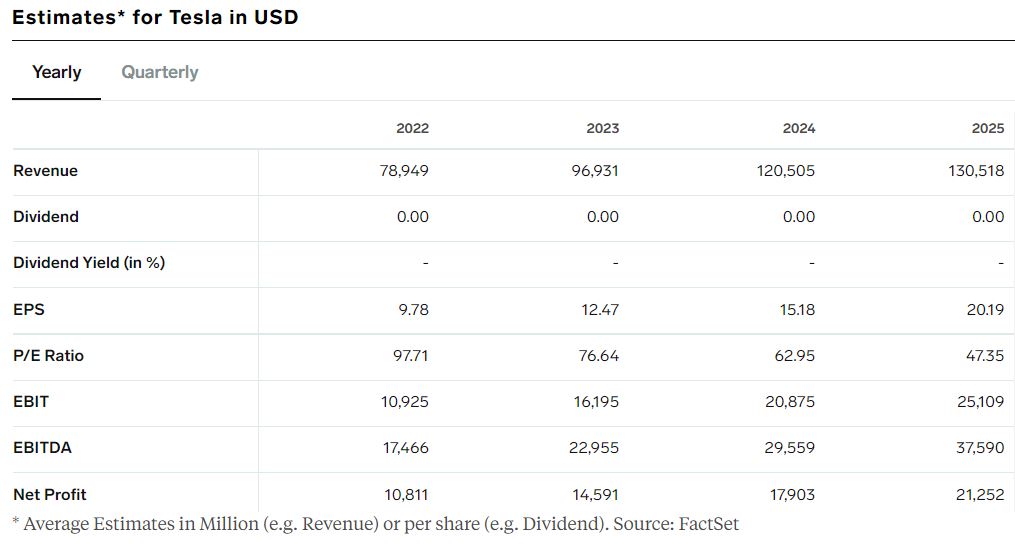

Tesla’s revenue is forecast to reach $130.51 billion by 2025, and net profit is forecast to more than double and reach $21.25 billion by the same date. However, the company trades at a P/E ratio of 97.71, meaning that an investor will need more than 97 years of accumulated earnings to equal its investment cost today.

Disclaimer: None of the content in this article should be viewed as investment advice or a recommendation to buy or sell. Past performance/statistics may not necessarily reflect future ...

more