Key Takeaways

A pending change in the sector classification for more than a dozen S&P 500 constituents will impact 28 sector ETFs managing over $300 billion in assets.

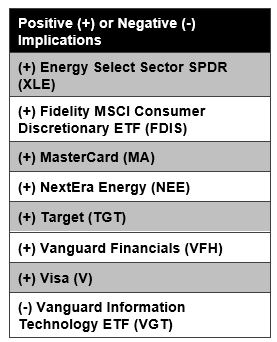

A pending change in the sector classification for more than a dozen S&P 500 constituents will impact 28 sector ETFs managing over $300 billion in assets.- GICS-based changes will move current Information Technology companies Mastercard (MA) and Visa (V) into Financials and NextEra Energy (NEE) and Target (TGT) into the Energy and Consumer Staples sectors, respectively.

- These shifts will reduce the stock-level concentration of Energy Select Sector SPDR ETF (XLE) and Vanguard Information Technology ETF (VGT), but also make past performance dedicated analysis of sector ETFs less meaningful.

Fundamental Context

Two major equity index providers are planning on shifting the sector or industry classifications of nearly 1,000 companies. After the market closed on January 21, S&P Dow Jones Indices and MSCI, which together run the GICS classification system used for the S&P 500, MSCI Emerging Markets, and many other widely followed benchmarks, announced a preliminary list of companies that will be part of a different sector or sub-industry. The index providers are still in the midst of their consultation with the investment community and any changes will be implemented in March 2023. However, based on our analysis, there are some significant changes for U.S. companies with market capitalizations greater than $100 billion that will also have a major impact on sector-focused ETFs. The delayed implementation will help investors and asset managers prepare.

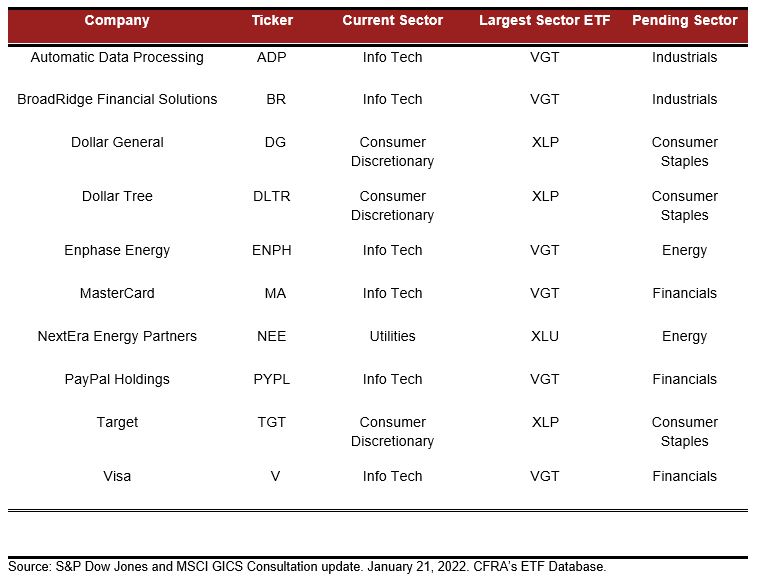

Seven S&P 500 GICS sectors will either be gaining or losing constituents following the pending changes. At present, MA, V, and PayPal Holdings (PYPL) are members of the Information Technology sector but are set to move to the Financials sector along with American Express (AXP) and Capital One Financial (COF). Meanwhile, Dollar General (DG), Dollar Tree (DLTR), and TGT are slated to shift from the Consumer Discretionary sector to the Consumer Staples one along with Costco Wholesale (COST) and Walmart (WMT). In addition, the energy sector is expected to add current utility NEE and current information technology members Enphase Energy (ENPH) and SolarEdge Technologies (SEDG). Lastly, the Industrials sector will soon welcome technology companies Automatic Data Processing (ADP) and Broadridge Financial Solutions (BR).

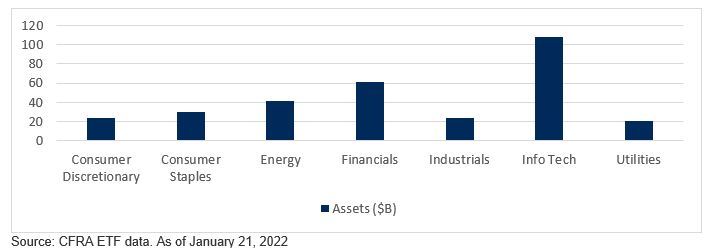

More than $300 billion of U.S. sector-focused ETFs will be impacted. Fidelity, Invesco, State Street Global Advisors, and Vanguard each offer a suite of sector ETFs tracking U.S. sectors based on the GICS structure and run by S&P Dow Jones r MSCI. Combined, the 28 ETFs tied to the seven sectors manage $305 billion in assets. For example, looking at ETF holdings, NEE is the largest in the market-cap weighted Utilities sector ETFs offered by Fidelity, State Street, and Vanguard. NEE recently comprised 17% of the assets of $13 billion Utilities Select Sector SPDR (XLU) – more than double the next two largest positions, Duke Energy (DUK) and Southern Company (SO). The pending removal of XNEE would result in more diversification across the remaining 27 positions. Meanwhile, NEE’s addition to energy ETFs including the $32 billion XLE would also reduce concentration as the ETF recently had 44% of assets in Chevron (CVX) and Exxon Mobil (XOM). With a recent market capitalization of $162 billion, NEE would be the third-largest position in the fund, ahead of EOG Resources (EOG).

Figure 1: Assets in U.S. Sector ETFs tracking a GICS based Index ($B)

What is inside your financial or technology ETF will also be changing. At yearend, V and MA represented a combined 4.8% of the assets of $51 billion Vanguard Information Technology ETF (VGT) as the fourth and fifth largest holdings, while PYPL was just outside the top-10. Yet in 2023, these companies could be top five positions in $12 billion Vanguard Financials ETF (VFH). Currently, V and MA have market caps in line with or greater than Bank of America (BAC) and Wells Fargo (WFC), VFH’s third and fourth-largest positions. We expect financial ETFs to have to sell stakes in existing positions to make room.

Figure 2: Examples of S&P 500 Companies Stocks Expected to Shift Sectors

Before finishing shopping for a consumer ETF, it will be important to look inside the cart. For example, Fidelity MSCI Consumer Discretionary ETF (FDIS), which manages $2 billion in assets, has an approximate 2% stake in TGT. Yet the mega-cap company is slated to move to Fidelity MSCI Consumer Staples ETF (FSTA) to join the top-10 with WMT and Altria Group (MO). Consumer Staples Select Sector SPDR ETF (XLP) and Vanguard Consumer Staples ETF (VDC) will also have exposure to TGT.

At CFRA, we are strong believers that what is inside an ETF is a key driver of its future return and we think focusing solely on past performance or index methodology has limitations. Index-based ETFs are not static and require regular due diligence to understand how they are positioned. If you own a sector ETF tracking an S&P Dow Jones Index or an MSCI one for your clients or directly, there’s a high likelihood that what you hold today will be different than it will be in just over a year. Meanwhile, the performance of XLU and VGT has been aided by stakes in NEE, V, and some other companies that will be sold to properly track the underlying benchmark. CFRA’s holdings-based star ratings on sector ETFs will dynamically reflect the latest available holdings to provide a forward-looking assessment.

Todd Rosenbluth is Director of ETF & Mutual Fund Research at CFRA.