Weekly Waves: EUR/USD, Bitcoin And US 30

Our weekly analysis on Elliott Waves takes a close look at the EUR/USD, the Bitcoin cryptocurrency, and the US30 stock market.

Our Elliott Wave outlook indicates a downtrend continuation on the EUR/USD and the end of a bearish 5 wave pattern on both BTC/USD and the US30 stock market.

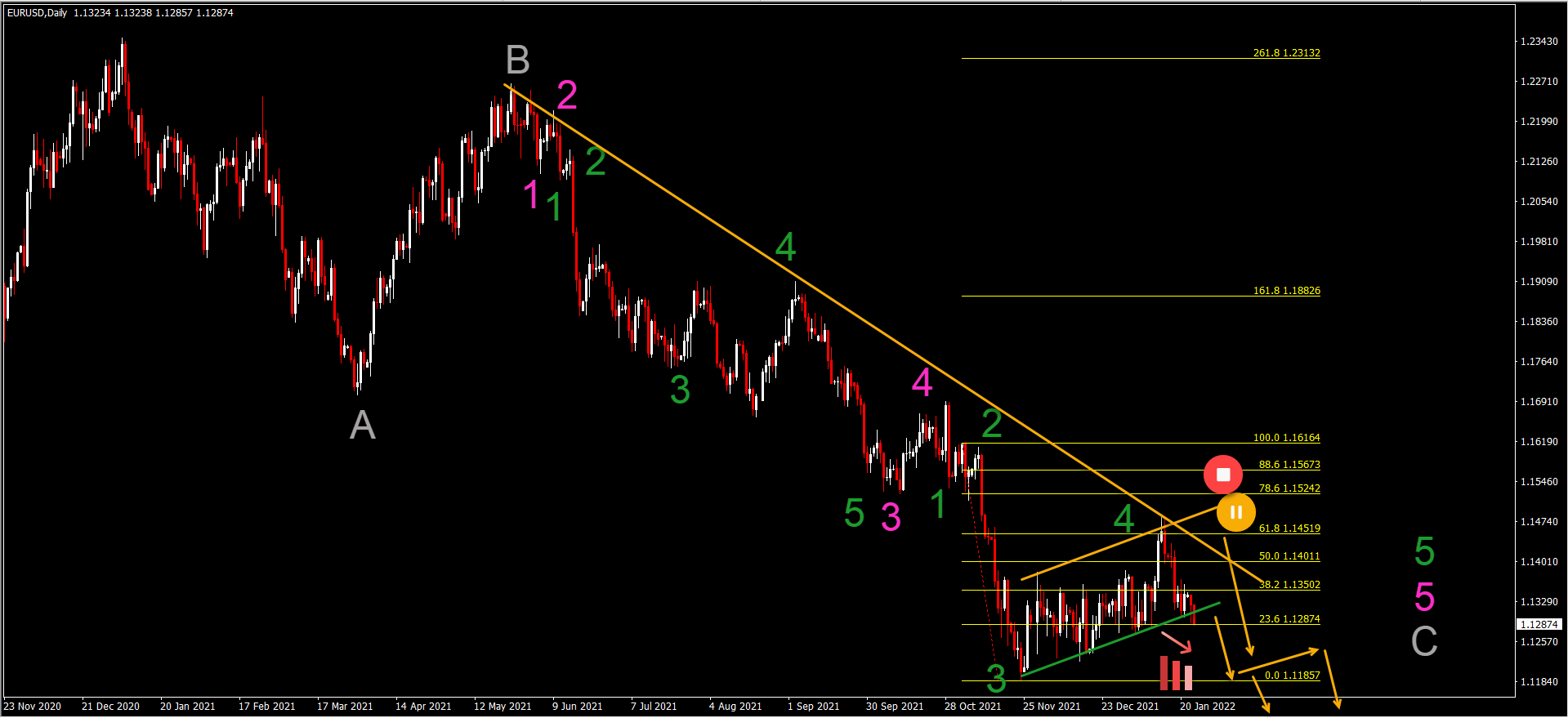

EUR/USD Retraces and Bounces at 61.8% Fib Resistance

The EUR/USD failed to make a bearish breakout below the bear flag chart pattern in the past 2 weeks. But now price action has made a bearish bounce at the 61.8% Fibonacci level and is retesting the support line again.

- This time around, a bearish breakout seems likely. A daily candle close below the support trend line (green) would confirm the break.

- The main target is the round level at 1.10. The bearish price swing could complete a wave 5 within wave 5 of wave C.

- An unexpected bullish break above the 61.8% Fibonacci resistance would place this bear flag pattern on hold whereas a strong bullish move invalidates it (red circle).

- The EUR/USD seems to be building an ABC (grey) pattern within a larger triangle pattern.

(Click on image to enlarge)

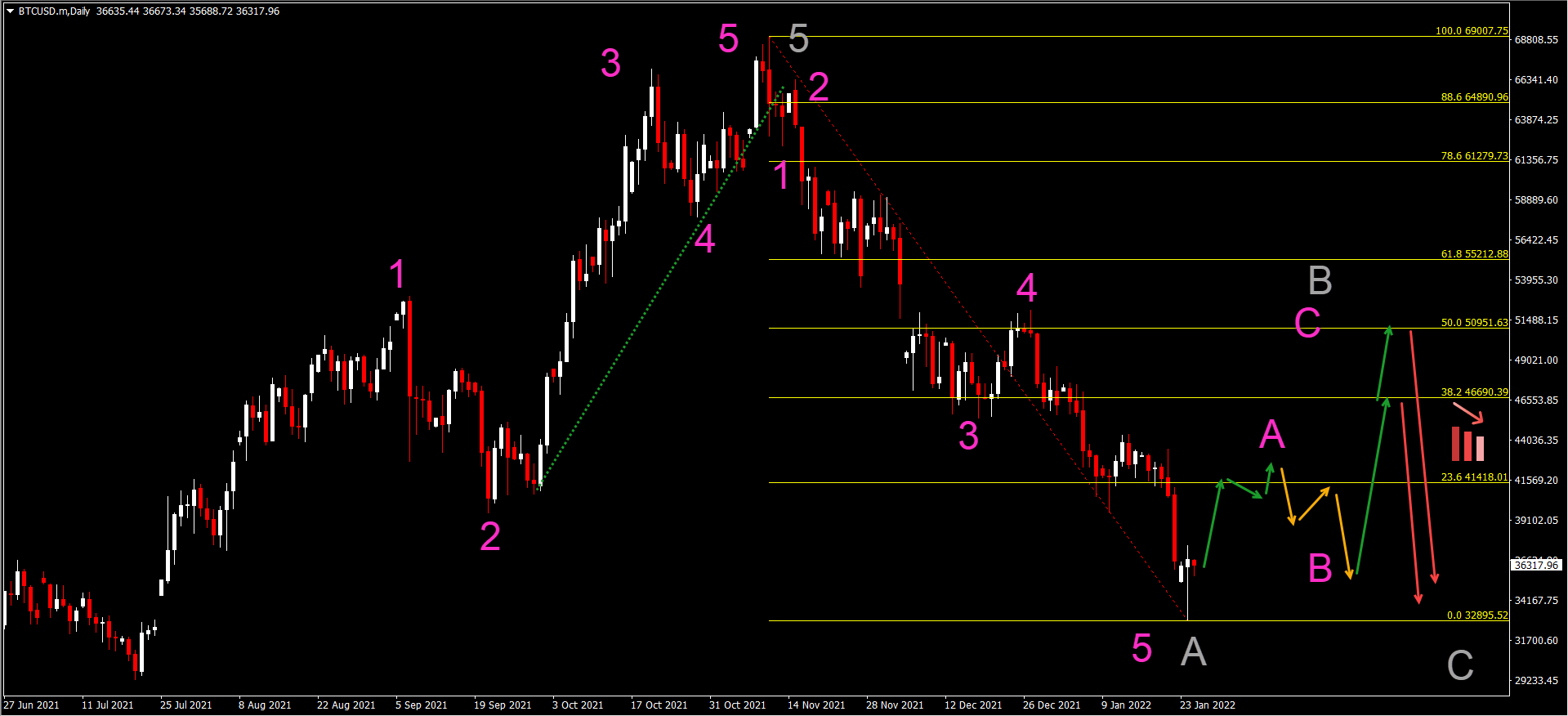

BTC/USD Finished Bearish Wave A

The Bitcoin crypto pair (BTC/USD) has seen some hard hits in its price during recent weeks. Can it fall further?

- The short answer is yes. The uptrend seems over and a strong and long bearish correction is expected according to our current Elliott Wave analysis.

- However, a 5 wave bearish pattern seems to be completed. The bullish pinbar candlestick pattern could confirm a bullish reversal.

- If the price action does complete the bearish price swing, then price action has completed 5 waves (pink) in wave A (grey).

- The next price swing should be an ABC (pink) pattern in wave B (grey). After the ABC is completed, wave C (grey) down should resume.

- The main resistance levels of wave B (grey) correspond to the 38.2% and 50% Fibonacci levels.

(Click on image to enlarge)

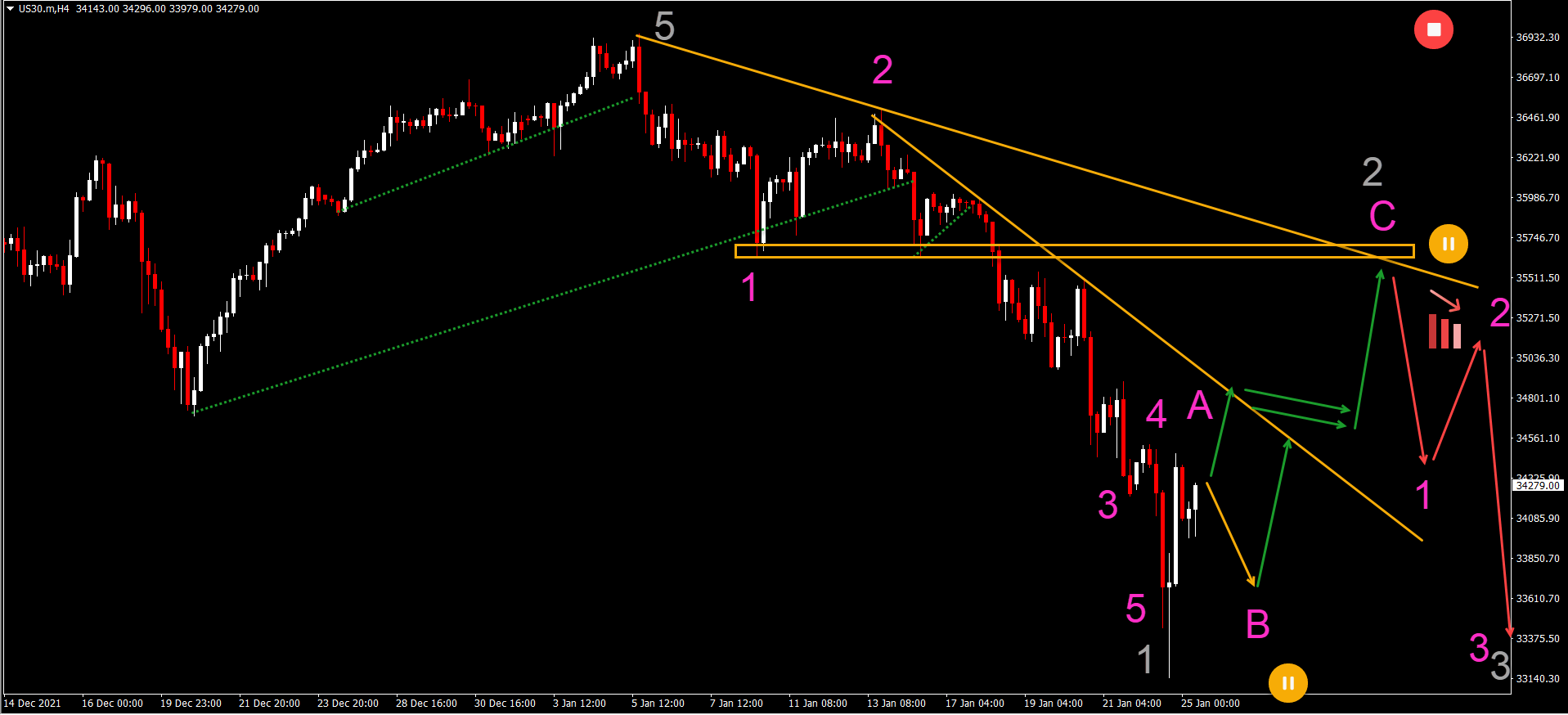

US30 Also Shows 5 Bearish Waves

Bitcoin seems to be highly correlated to the stock market. Many of the waves are the same and the US30 also is showing a completed 5 wave pattern in a wave 1 (or A) reversal:

- 5 waves (pink) seem completed in wave 1 (grey) or wave A.

- A bullish ABC (pink) is expected in wave B (grey).

- A bearish bounce at the resistance should end wave 2 and start wave C (grey).

- A break below the bottom indicates a continued downtrend whereas a break above the resistance could indicate bullish strength.

(Click on image to enlarge)

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more