J&J Beats On Q1 Earnings, Suspends COVID Jab Sales View

Photo by Mohammad Shahhosseini on Unsplash

Johnson & Johnson’s (JNJ - Free Report) first-quarter 2022 earnings came in at $2.67 per share, which beat the Zacks Consensus Estimate of $2.60. Earnings increased 3.1% from the year-ago period.

Adjusted earnings exclude intangible amortization and some other special items. Including these items, J&J reported first-quarter earnings of $1.93 per share, down 16.8% from the year-ago quarter.

Sales of this drug and consumer products giant came in at $23.4 billion, which missed the Zacks Consensus Estimate of $23.8 billion. Sales rose 5% from the year-ago quarter, reflecting an operational increase of 7.7% and a negative currency impact of 2.7%.

Organically, excluding the impact of acquisitions and divestitures, sales rose 7.9% on an operational basis compared with a 12.3% increase seen in the previous quarter.

First-quarter sales in the domestic market rose 2.7% to $11.4 billion. International sales rose 7.2% on a reported basis to $12.0 billion, reflecting an operational increase of 12.6% and a negative currency impact of 5.4%. Excluding the impact of all acquisitions and divestitures, on an adjusted operational basis, international sales rose 12.9% in the quarter.

Segment Details

Pharmaceutical segment sales rose 6.3% year over year to $12.9 billion, reflecting 9.3% operational growth and 3% negative currency impact. Excluding the impact of all acquisitions and divestitures, on an operational basis, worldwide sales rose 9.3%. Pharmaceutical segment sales were short of the Zacks Consensus Estimate of $13.8 billion.

The year-over-year sales increase was led by higher penetration and new indications across key products, such as Darzalex and Stelara. Other core products like Invega Sustenna and new drugs, Erleada and Tremfya contributed significantly to sales growth. However, sales of J&J’s single-dose COVID-19 vaccine were much below expectations. The sales growth was also dampened by lower sales of key medicines, Imbruvica and Xarelto and generic/biosimilar competition to drugs like Zytiga and Remicade.

Darzalex sales rose 36% year over year to $1.86 billion in the quarter. Stelara sales grew 6.5% to $2.29 billion in the quarter. Stelara sales were below the Zacks Consensus Estimate of $2.42 billion.

Imbruvica sales declined 7.7% to $1.04 billion. J&J markets Imbruvica in partnership with AbbVie (ABBV - Free Report). Rising competitive pressure in the United States due to new oral competition has been hurting sales of this AbbVie partnered drug since the past few quarters.

PAH revenues of $852 million declined 1.1% year over year. Invega Sustenna/Xeplion/Invega Trinza/Trevicta sales rose 8.6% to $1.05 billion in the quarter. Simponi/Simponi Aria sales rose 1.5% to $571 million while Prezista sales decreased 8.3% to $501 million.

Xarelto sales declined 13.8% in the quarter to $508 million while sales of Invokana/Invokamet declined 14.6% to $128 million.

Among the newer medicines, Erleada generated sales of $400 million in the quarter, up 53% year over year. Tremfya recorded sales of $590 million in the quarter, up 41.3% year over year.

Zytiga sales declined 15.6% to $539 million in the quarter due to generic competition. Sales of Remicade were down 14.7% in the quarter to $663 million.

J&J’s single-dose COVID-19 vaccine generated sales of $457 million in the first quarter compared with $1.62 billion in the fourth quarter of 2021. Please note that J&J is selling its vaccine on a not-for-profit basis.

The MedTech (previously Medical Devices) segment sales came in at $6.97 billion, up 5.9% from the year-ago period, reflecting an operational increase of 8.5% and a negative currency movement of 2.6%.

Excluding the impact of all acquisitions and divestitures, on an operational basis, worldwide sales rose 8.6%.

The Consumer segment recorded revenues of $3.59 billion in the reported quarter, down 1.5% year over year, reflecting a 0.8% operational increase and a 2.3% negative currency impact.

Excluding the impact of acquisitions and divestitures, adjusted operational sales rose 1.6% worldwide.

Higher sales of over-the-counter (OTC) products were offset by external supply constraints (due to raw material availability and labor shortages), which hurt sales of the skin health and beauty franchise.

2022 Outlook

J&J lowered its earnings and sales expectations for 2022. The company suspended its previously issued sales guidance for its COVID-19 vaccine and overall sales expectations, including revenues from the COVID-19 vaccine.

Excluding revenues from the COVID-19 vaccine, J&J expects to generate revenues from its base business in the range of $94.8 billion to $95.8 billion, lower than the $95.9 billion to $96.9 billion guided previously.

Excluding the COVID-19 vaccine, operational constant-currency sales are expected to increase in the range of 6.5%-7.5%.

The adjusted operational sales (excluding currency impact, acquisitions/divestitures) growth guidance is the same as the operational constant-currency sales discussed above.

The adjusted earnings per share guidance were lowered from a range of $10.40-$10.60 per share to $10.15-$10.35.

The earnings range indicates an increase of 3.6%-5.6%, lower than the 6.1%-8.2% expected previously. On an operational, constant-currency basis, adjusted earnings per share are expected to increase 8.2%-10.2%.

Earlier, including COVID-19 vaccine sales, J&J expected sales to be in the range of $98.9 billion-$100.4 billion. The guidance included $3.0 billion-$3.5 billion in revenues from the COVID-19 vaccine. This guidance now stands suspended.

Dividend Increase

J&J separately announced a 6.6% increase in the quarterly dividend, from $1.06 per share to $1.13 per share. This adds up to an annual dividend of $4.52 per share compared with the previous rate of $4.24 per share.

Our Take

J&J reported mixed first-quarter results as it beat estimates for earnings but missed the same for sales. Its Pharmaceuticals unit sales fell short of expectations. External supply constraints continue to limit sales from the Consumer segment. The MedTech segment has, however, shown some improving trends.

Its COVID-19 vaccine sales were quite low, which led management to suspend its sales guidance for the vaccine. Management said that a surplus supply and demand uncertainty coaxed it to suspend the guidance for COVID-19 vaccine sales. This probably hints that revenues from the vaccine will fall short of its earlier guided range of $3.0 billion - $3.5 billion in 2022.

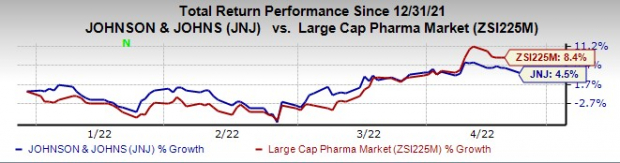

Its financial guidance was also lowered. J&J’s shares were down slightly in pre-market trading. This year so far, J&J’s shares have risen 4.5% compared with the industry’s 8.4% growth.

(Click on image to enlarge)

Image Source: Zacks Investment Research

In November 2021, J&J announced plans to separate its Consumer Health segment into a new publicly-traded company, leaving behind a new J&J with its Pharmaceuticals and Medical Device units. The separation is expected to be executed in 2023.

Zacks Rank and Stocks to Consider

J&J currently has a Zacks Rank #3 (Hold).

Johnson & Johnson Price, Consensus, and EPS Surprise

(Click on image to enlarge)

Johnson & Johnson price-consensus-eps-surprise-chart | Johnson & Johnson Quote

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more