By Kara Marciscano, CFA

Associate, Research

Megatrends have been among the key focal points for investors in recent years, as they offer growth opportunities in the context of the structural changes that are shaping our world. To support the proliferation and continued functioning of a range of megatrends, very specific types of infrastructure must be in place.

For this reason, WisdomTree believes that investing in real estate infrastructure with a focus on powering the growth of many different megatrends, or the ‘New Economy,’ represents an exciting investment opportunity at the junction of thematic investing and real estate.

The WisdomTree New Economy Real Estate Fund (WTRE) provides exposure to both megatrends and the diversification potential associated with the real estate sector:

Collaboration for Expertise in Thematic Investing within Real Estate

To capture this exciting thematic investment opportunity within New Economy real estate, WisdomTree is collaborating with CenterSquare Investment Management LLC (CenterSquare), a global investment manager focused on actively managed public and private real estate, equity, and private real estate debt strategies. CenterSquare’s management team has an average of 30+ years of experience, with expertise across real assets and the liquidity spectrum.

WTRE seeks to track the price and yield performance, before fees and expenses, of the CenterSquare New Economy Real Estate Index (CSNERE).

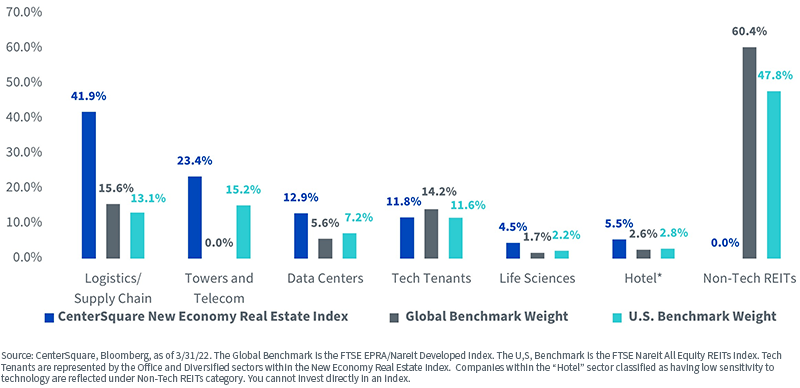

CSNERE provides differentiated sector exposures relative to broader real estate benchmarks,1 and specifically provides more exposure to technology-focused sectors.

Sector Breakdown: CenterSquare New Economy Real Estate Index vs. Benchmarks

For definitions of terms in the chart above, please visit the glossary.

WTRE—Capturing Opportunities in Real Estate Created by Technological Disruption

WisdomTree believes that technology-focused real state exposure represents an increasingly important component of the future real estate market.

Built into WTRE’s strategy is a screen that targets companies with high technology exposure and strong balance sheets. The companies in WTRE must pass the following filters:

For definitions of terms in the chart above, please visit the glossary.

WTREs weighting mechanism is designed to form a portfolio of securities that are technology focused and have attractive growth and valuation characteristics relative to the investable universe. The index methodology assigns a higher weight to companies with (1) stronger technology scores, (2) higher earnings, dividend and cash growth (3) and more attractive valuations relative to their levels of cash flow, earnings and dividends.

WTRE may be a fitting solution for investors seeking to replace or complement their global real estate exposure with a diversified basket of companies across the spectrum of data centers, cell towers, life sciences labs, last-mile distribution and cold storage facilities.

1 The global benchmark is the FTSE EPRA/Nareit Developed Index. The U.S. benchmark is the FTSE Nareit All Equity REITs Index.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in real estate involve additional special risks, such as credit risk, interest rate fluctuations, decreases in property value and the effect of varied economic conditions The fund invests a significant portion of its assets in the communication services sector. This sector can be significantly affected by, among other things, government intervention and regulation, technological innovations that make existing products and services obsolete, and consumer demand. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.