Protalix PRX-102: Likely Approval Could Be A Game Changer

- PLX is a biotech company using its own platform to produce a promising pipeline of proteins used as a treatment for a series of rare genetic diseases.

- One of these is already approved and selling in Brazil (and the rest of the world by partner Pfizer).

- PRX-102 is the drug that stands a good chance of being accepted against Fabry disease, with three P3 trials delivering good results.

- European approval could come in a year, US approval probably takes a little longer. The company has a committed partner in Chiesi and can look forward to substantial milestone payments and royalties.

- The shares seem fairly modestly prized but they are not risk free.

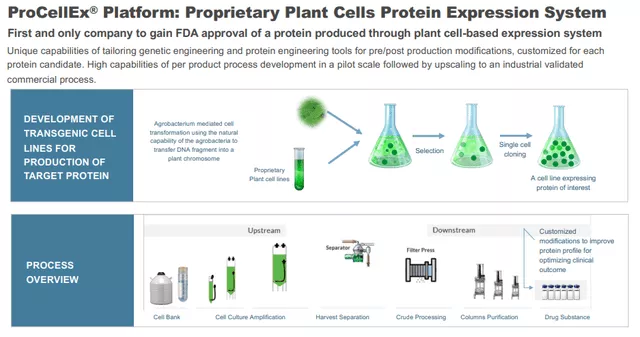

Protalix Biotherapeutics (PLX) is a clinical-stage biotech company that focuses on the development and commercialization of recombinant therapeutic proteins based on its proprietary ProCellEx plant cell-based protein expression system.

The company is already selling one of these proteins, Elelyso, for the treatment of Gaucher disease. It has a pipeline for a number of others, most notably PLX-102 which completed three phase III clinical trials for the treatment of Fabry diseases.

The company has agreements and partnerships with Pfizer (PFE), Fundacao Oswaldo Cruz, and Chiesi Farmaceutici.

Platform

(Click on image to enlarge)

The company's proprietary protein expression system, an alternative for mammalian-based cell production, offers a host of advantages. Management believes that the platform enables the company to develop proprietary recombinant proteins that are therapeutically equivalent or superior to existing recombinant proteins currently marketed for the same indications.

Because the company is targeting biologically equivalent or better versions of highly active, well-tolerated, and commercially successful therapeutic proteins, they believe their development process is associated with relatively less risk compared to other biopharmaceutical development processes for completely novel therapeutic proteins. Here is basically how it works:

(Click on image to enlarge)

And how it scales:

Elelyso

The platform has already produced one FDA-approved drug, Elelyso (taliglucerase alpha), which was approved in 2012 for long-term enzyme replacement therapy for type 1 Gaucher disease. Taliglucerase alpha is the company's first commercially available plant cell culture-produced protein product.

(Click on image to enlarge)

In the latest available filing, the quarterly revenue from selling Elelyso is $4.5M (Q3 2021, up from $3.3M in Q3 2020). BioManguinhos alfataliglicerase is currently estimated to be used by approximately 25% of Gaucher patients in Brazil.

This has to scale up for it to become interesting as the cost of production is a good part of that ($3.7M, including stock-based comp). There are no sales in the EU as:

However, the CHMP also concluded that the medicine cannot be granted marketing authorisation in the EU because of the ten-year market exclusivity that had been granted for Vpriv, which was authorised in August 2010 for the same condition. Market exclusivity for orphan medicines is given as an incentive for companies to develop medicines for rare diseases, which may otherwise not be developed due to the high costs and small patient populations. The exclusivity means that another medicine cannot be authorised for the same condition if it is similar to the medicine already authorised. In this case, the CHMP concluded that Elelyso is similar to Vpriv, as they are both enzyme replacement therapies that work in the same way.

In any case, since Pfizer has worldwide marketing rights (apart from Brazil, where the company has full rights and sells EL) to Elelyso after a deal with Protalix in 2015, it wouldn't really matter. Pfizer gets 100% of the revenues ex-Brazil but restitutes Protalix at cost. From the 10-K:

Pursuant to the Amended Pfizer Agreement, Pfizer retains 100% of revenue and reimburses 100% of direct costs. For the first 10-year period after the execution of the Amended Pfizer Agreement, we have agreed to sell drug substance to Pfizer for the production of Elelyso, subject to certain terms and conditions, and Pfizer maintains the right to extend the supply period for up to two additional 30-month periods, subject to certain terms and conditions. In a subsequent amendment, we agreed that after the completion of the first 10-year supply period, the supply term would automatically extend for a five-year period. Any failure to comply with our supply commitments may subject us to substantial financial penalties. The Amended Pfizer Agreement includes customary provisions regarding cooperation for regulatory matters, patent enforcement, termination, indemnification and insurance requirements. We maintain distribution rights to taliglucerase alfa in Brazil.

The amended agreement was concluded in 2015.

Pipeline

Here is an overview of the product pipeline:

(Click on image to enlarge)

So, in summary, the company has:

- Elelyso for the treatment of Gaucher disease.

- PRX-102, a therapeutic protein candidate, which is in phase III clinical trials for the treatment of Fabry diseases;

- PRX-110, Alidornase alfa is a plant cell-expressed recombinant human DNase I chemically modified to resist inhibition by actin, thus enhancing enzymatic activity. It has undergone a P2 trial for Cystic Fibrosis patients in 2018, in which it was well-tolerated without causing adverse events. It is now developed for other indications and the company has licensed alidornase alfa for inhaled indications to SarcoMed USA, which intends to begin a clinical trial for pulmonary sarcoidosis.

- PRX-115, a plant cell-expressed recombinant PEGylated Uricase for the treatment of gout; and

- PRX-119, a plant cell-expressed PEGylated recombinant human DNase I product candidate for the treatment of NETs-related diseases.

PRX-102

PRX-102 (or Pegunigalsidase alfa) against Fabry disease, which can be complicated to diagnose but a serious condition, caused by:

mutations in the GLA gene, which encodes the enzyme alpha-galactosidase A. This enzyme usually breaks down a fatty substance called globotriaosylceramide (Gb3), but in Fabry patients Gb3 builds up, causing symptoms such as pain crises, hearing loss and kidney and heart disease. The disease varies in severity depending on patients’ enzyme activity levels.

Clinical progress

Where do we stand?

(Click on image to enlarge)

Three trials were ongoing simultaneously, two of which concluded with the BALANCE final results expected in June this year. In summary:

BRIDGE

- Open-label switch-over 12-month study of patients 2 years on Replagal and at least 6 months stable doses, switch over to 1mg/kg twice a month PRX-102

- Final results December 2020

- 20 of 22 patients completed the study, 18 of which remained on PRX-102 voluntarily after completion

- Substantial improvement in renal function

- The mean annualized eGFR slope of the study participants improved from -5.90 mL/min/1.73m 2 /year while on Replagal to -1.19 mL/min/1.73m 2 /year on PRX-102 in all patients.

BRIGHT

- 30 Patients, 12-month open-label switch-over from Fabrazyme or Replagal, treated for 3 years and on stable dose every two weeks to PRX-102 2mg/kg once a month.

- 29 subjects completed the study (14 doses)

- 27 subjects on 2mg/kg once a month, 2 subjects on 1mg/kg twice a month

- Final results March 18 2022

- The mean (SE) eGFR slope, at the end of the study, for the overall population, was -2.92 (1.05) mL/min/1.73m2/year indicating stability.

- The results are favorable but Replagal isn't available in the US and was used in a lower dose in the trial.

BALANCE

- P3 study for Fabry patients with impaired renal function previously treated with Fabrazyme (twice a month)

- Randomized 2:1 ratio PRX-102/Fabrazyme (patients previously on Fabrazyme for at least 6 months stable doses)

- Primary endpoint annualized rate of decline of eGFR slope

- Interim results June 2021

- Two groups, ITT (all 77 patients) and PP (74 patients, that completed 12 months of treatment without protocol violations) greatly overlapping

- ITT results below the non-inferiority margin, ITT above it

- Final dosing last patient Oct 2021

- Final results April 4, 2022 show non-inferiority interval outcome is met with PRX-102 generating fewer adverse events and lower neutralizing antibody activity (that is, lower immunogenicity).

- 69 patients continued with PRX-102 after the trial concluded in a long-term extension study.

PRX-102 stands a good chance of regulatory approval (both in the EU as well as the US) if:

- It's outright superior to alternatives (even if that's not required by regulators) in terms of eGFR slope (which is probably difficult to prove with the short duration and limited tests).

- And/or is not inferior and/or allows less frequent dosing and/or other benefits favorable safety, that is, lower immunogenicity (producing a lower immune response, even if the latter is not required by regulators).

Superiority on the eGFR slope is probably difficult to prove (as it is likely to take years more and a larger patient group) although the BRIDGE study showed this with relation to Replagal, albeit patients on the latter were on a lower dose.

Luckily as a result of the approval of Fabrazyme in March 2021, the outcome for the BALANCE study seems to have changed from superiority to non-inferiority as superiority was no longer required for a traditional FDA approval (for Europe, this was already the case).

This looks like a good bet and is further supported by the 20 out of 22 patients in the BRIDGE study that remained voluntarily on PRX-102 after the study was completed, 18 of these 20 were switched to the extension study.

It looks likely that a twice-monthly dose is better than a once-monthly double dose although the final BRIGHT results at least demonstrated that it is safe to switch to a 2mg/kg a month frequency, which will be included in both marketing applications (for US and EMA).

A long-term extension study with this dose and regimen is ongoing but it remains to be seen what kind of case the company can make for a supposed dose advantage, although management is optimistic here.

Lower immunogenicity also looks to be an advantage (see below). The change in the regulatory environment (the approval of Fabrazyme from Sanofi) is also a bit of a hurdle with the company having to resubmit their BLA (Biologics License Application), from company PR:

the FDA, in principle, agreed that the data package proposed to the FDA for the BLA resubmission has the potential to support a traditional approval of PRX–102 for the treatment of Fabry disease. The planned data package for the BLA resubmission, given the changed regulatory landscape in the United States, will include the final two–year analyses of the phase III BALANCE clinical trial.

This looks to produce some delays, the full BALANCE results will become available in Q2 this year, submission and the FDA decision will likely take this well into 2023. This produced a bit of a selloff:

(Click on image to enlarge)

But better news from the regulatory front, the company has submitted for EU approval, which will take about a year. And there are additional studies ongoing as well, from company PR:

the PRX-102 clinical program currently includes extension studies for patients who completed the BRIDGE, BRIGHT and BALANCE studies, as well as a Phase I/II clinical trial of PRX–102. Currently, more than 100 patients who participated in such studies continue to be treated in the extension studies, and additional patients completing the BALANCE study are expected to join the extension studies.

As a note, there now are already more than 120 patients who participated in the three P3 trials. Investors reacted more positively to the final results of the BALANCE study, from the PR:

The study met our pre–defined criteria for non-inferiority of the primary endpoint of kidney function in a head–to–head active comparison on both the Intent–to–Treat (ITT) and Per Protocol (PP) analysis sets. These topline results show that PRX–102 was comparable to agalsidase beta in controlling eGFR decline, which is a key measure of Fabry disease progression, and continue to demonstrate a favorable tolerability profile for PRX–102.

There is quite a bit of evidence on lower immunogenicity from these studies, this is what we got back from the company:

- The low number of patients developed ADA in the naïve subjects

- No new subject in the F50 (i.e. none of the patients who were ADA negative at baseline) became positive following Unigal treatment

- The rate of patients with ADA with Neutralizing activity was reduced in the PRX-102 arm in Balance but not reduced in the Fabrazyme arm. Reduction of the rate of patients with neutralizing ADA is also seen in the other studies (naïve, bridge, bright)

- To note that the subjects were already treated with Fabrazyme for a mean of ~6 years before entering balance and they continued to show significant levels of antibodies to Fabrazyme

So all in all, one might conclude that PRX-102 isn't worse in terms of renal deterioration but also not better while generating fewer adverse events and benefiting from lower immunogenicity and these results hold (albeit with some indications that, while stable, the improvement in eGFR slope and plasma lyso-Gb3, the indications for Fabry disease progression, are a little less robust) on lower dose frequency.

One also has to be aware of the fact that younger patients benefit more from therapy, before the onset of major kidney damage and PRX-102's approval for pediatric use is way off.

The market

(Click on image to enlarge)

Evaluate

(The graph is a little old as two yet-to-be-approved therapies, Lucerastat and AVR-RD-01, have run into trouble and are unlikely to play a role.)

Protalix IR presentation

ERT, Enzyme replacement therapy (Replagal and Fabrazyme) is the current standard of care, replacing the missing functional alpha-galactosidase A with two monthly doses but has a number of disadvantages. From NCBI:

Enzyme replacement therapy (ERT) with recombinant α‐galactosidase A (r‐αGAL A) for the treatment of Fabry disease has been available for over 15 years. Long‐term treatment may slow down disease progression, but cardiac, renal, and cerebral complications still develop in most patients. In addition, lifelong intravenous treatment is burdensome.

The most important one is that the long term effectiveness is doubtful as it doesn't seem to prevent the progression of the disease:

Long term ERT does not prevent disease progression, but the risk of developing a first or second complication declines with increasing treatment duration. ERT in advanced Fabry disease seems of doubtful benefit.

In addition, some 40% of patients develop an immune response, rendering the therapy less effective or even useless. Protalix PRX-102 has a couple of advantages with respect to ERT therapy:

- Substantially longer half-life

- Lower immune response

Protalix IR presentation

Due to a longer half-life exceeding 80 hours, which is 35x more than the two hours of alternatives like Fabrazyme from Sanofi and Replagal from Takeda. As a result, it maintains effective levels for much longer in the body which also enables the administration of a single monthly dose.

In addition, and even more importantly, it also provokes a lower immune response and can better preserve kidney function. Here is Dr. Robert Hopkin, associate professor, Clinical Paediatrics, Cincinnati Children’s Hospital Medical Centre, Ohio (Clinical Trials Arena):

While Fabrazyme is a largely unmodified version of human alpha-galactosidase A, pegunigalsidase alfa pegylates the enzyme, thereby hiding some of the protein epitopes to which the body reacts and develops antibodies, Hopkin explained. As a result, pegunigalsidase alfa could lead to less infusion response from patients, fewer infusion reactions, and more drug delivered to the cells that need it, he added.

Galafold from Amicus Therapeutics (FOLD) serves a part (roughly 40%) of patients who have a more benign variant of Fabry, where the misfolded enzyme can be mended. It was approved for teenagers in the EU last year. It isn't yet approved in the US.

Alternatives under development

- Venglustat (Genzyme)

- Lucerastat (Idorsia)

- AVR-RD-01 (Avrobio)

- Gene therapy

Then there is Venglustat from Genzyme, which is an SRT (oral substrate reduction therapy), which is has been given fast track designation by the FDA for Fabry quite a while back, in 2015 and is currently in a phase 2. It can be used in combination with ERT therapy as the working differs. Venglustat has had a couple of setbacks for other diseases

Lucerastat, a glucosylceramide synthase inhibitor developed by Idorsia as an SRT therapy but there was a significant setback:

Data from the Modify study suggest it does just that: Idorsia said yesterday that there was a “substantial and consistent reduction of plasma Gb3”; however, the trial did not meet its primary endpoint, reduction in neuropathic pain at six months, measured using the modified brief pain inventory-short form 3 score.

Jefferies analysts previously noted that this was an unusual endpoint, versus the more traditional Fabry outcomes of kidney or heart function, and this could provide a reason for the failure.

Idorsia hasn't given up entirely, but the chances of success seem to have been reduced considerably.

Another alternative, Avrobio's AVR-RD-01 has been running into trouble earlier last year:

Enrollment in a phase 2 trial of AVR-RD-01 has been halted after new data found that five patients may be resistant to engraftment, or when new blood-forming cells begin growing to make healthy blood stem cells, the company said Tuesday.

And it has now been axed altogether.

Gene therapy holds considerable promise and there are a couple of candidates with some promising early results, like:

ST-920 from Sangamo Therapeutics had some promising results in a P1 small trial:

Four people have been treated at the first two therapy doses being evaluated — 5 trillion vector genomes per kg of body weight (vg/kg) and 10 trillion vg/kg. As of the Sept. 17 data cutoff date, all showed above normal alpha-GalA activity, which has been sustained for one year in the first person treated, and for 14 weeks (about three months) in the most recently treated patient. These findings represent an alpha-GalA activity increase between two- and 15-fold above the mean of the normal range, Sangamo reported in a press release. Based on results to date, the company has begun planning a Phase 3 clinical trial.

But there is still a long way to go. The latest update from Freeline for FLT190 is also promising:

"Today we are pleased to announce that enzyme expression data from the second patient in our Phase 1/2 dose-finding trial of FLT190 are highly encouraging, with expression of alpha-galactosidase A reaching near-normal levels and the patient thus far remaining off enzyme replacement therapy since dosing," said Michael Parini, Chief Executive Officer of Freeline. "These results were achieved in our lowest dose cohort and already FLT190 appears to be having a significant impact on α-Gal A activity and disease process in Fabry, which is the underlying goal and promise of the FLT190 program. We also learned that our proactive immune management regimen, which is being deployed across all of our programs, has been effective as no elevations of liver enzymes have been observed throughout the treatment period."

But as with ST-920, it's very early days. And the third gene therapy, 4D-310 from 4D is comparable to the other two:

A single dose of 4D-310, an investigational gene therapy from 4D Molecular Therapeutics (4DMT), appears generally safe and restored the levels of alpha-galactosidase A (Gal A), the faulty enzyme in Fabry disease, in the first three men enrolled in a Phase 1/2 clinical trial.

Notably, all three patients were free from enzyme replacement therapy (ERT) at their last follow-up assessment, ranging from six weeks to six months. Moreover, their levels of globotriaosylsphingosine, or Lyso-Gb3 — a biomarker of Fabry disease — either remained low or were significantly reduced, according to a company webcast.

So the picture is mixed concerning the competition. Gene therapy looks to be the most serious competition, but it has a long way to go and the evidence is based on very small trials.

Economics

(Click on image to enlarge)

Protalix has two partnership agreements with Chiesi which is providing it with capital ($50M upfront payments and up to $45M in development cost) and up to $1B in milestone payments and tiered royalties.

The companies signed an ex-US Agreement in October 2017 with the following conditions:

- Upfront payment to Protalix Ltd. of $25.0M.

- Additional payments of up to $25.0M in development costs with a maximum of $10.0M per year.

- Additional payments of up to a maximum of $320.0M as regulatory and commercial milestone payments (although this was reduced to $295M in exchange for a $10M cash infusion in May 2021).

This is especially interesting as the company filed for EU regulatory approval last month, approval takes up to a year. The agreement for the US market (from July 2018) contains the following:

- $25M upfront payment.

- Up to $20M in development payments with a maximum of $7.5M per year.

- Up to $760M in regulatory and milestone payments.

- Tired (15%-40%) royalty payments.

Based on a fairly conservative 20% market penetration assumption and a sales ramp of 5 years, Ari Zoldan has valued PRX-102 at $551M but that's almost a year and a half ago.

With some of the coming competition hobbled and the recent application for EU sales, it could exceed that. On the other hand, while we expect regulatory approval, this is still some time off and not iron clad.

Financials

From the 10-K (Click on image to enlarge)

And here is the cash burn, which greatly improved the last couple of quarters. Operational cash outflow was $10.3M for 2021. The company had $39M in cash and deposits and $58.5M in notes outstanding at the end of Q4, that's good for at least until after the anticipated approval and the cash could be further bolstered by any milestone payments from Chiesi and growth in revenue from Elelyso.

Data by YCharts (Click on image to enlarge)

The company gets additional finance from selling shares and warrant and options execution. There is quite a bit more dilution coming (10-K):

At December 31, 2021, there were outstanding options to purchase common stock issued covering approximately 2.3 million shares of our common stock with a weighted average exercise price of approximately $4.42 per share. Also at December 31, 2021, there were approximately 1.8 million shares of common stock available for future for issuance in connection with future grants of incentives under our amended 2006 stock incentive plan, approximately 21.5 million shares of common stock reserved for issuance upon conversion of our outstanding 2024 Notes and approximately 14.6 million shares of common stock reserved for issuance upon the exercise of our outstanding warrants.

Most of these warrants have an exercise price of $2.36 per share so that looks within reach, although that will also bring in quite a bit of additional cash.

The company has a market capitalization of $53M and an EV of $72M, which doesn't seem overly onerous.

Conclusion

We see a number of reasons to be positive about the shares:

- We think approval in the EU and US is likely, opening up a substantial market opportunity.

- The company has a generous partner in Chiesi.

- The company already earns growing revenue from an approved drug and has a pipeline with other compounds for rare diseases.

- The company has a proprietary platform that is much cheaper than alternatives and has other advantages in producing these compounds.

- The company is well funded for at least a couple of years, probably more.

However, there are also some risks, approval is likely but isn't guaranteed and reimbursement and market sales could disappoint, although we assume approval will bring some of these substantial Chiesi milestone payments.

There is also a chance better drugs become available in the future given the development of certain gene therapies, but these aren't going to be on the market anytime soon.

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their ...

more

Sounds very promising. Just picked up some $PLX.