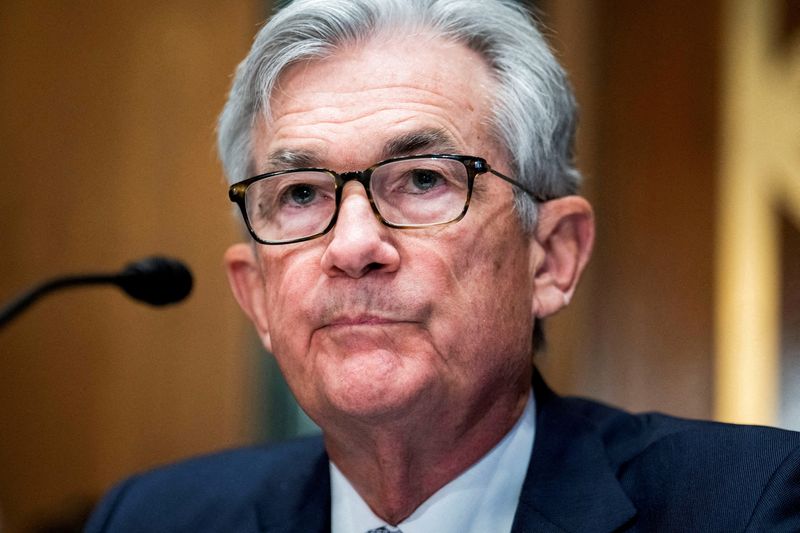

WASHINGTON (Reuters) -Federal Reserve Chair Jerome Powell on Tuesday pledged that the U.S. central bank would ratchet interest rates as high as needed to kill a surge in inflation that he said threatened the foundation of the economy.

"What we need to see is inflation coming down in a clear and convincing way and we're going to keep pushing until we see that," Powell said at a Wall Street Journal event. "If we don't see that, we will have to consider moving more aggressively" to tighten financial conditions.

"Achieving price stability, restoring price stability, is an unconditional need. Something we have to do because really the economy doesn't work for workers or for businesses or for anybody without price stability. It's the bedrock of the economy really."

Acknowledging the possible "pain" that controlling inflation might cause in terms of slower economic growth or higher unemployment, Powell said there were "pathways" for the pace of price hikes to ease without a full-blown recession.

But if inflation does not fall, Powell said the Fed would not flinch from raising rates until it does.

"If that involves moving past broadly understood levels of 'neutral' we won't hesitate to do that," Powell said, referring to the rate at which economic activity is neither stimulated nor constrained. "We will go until we feel we are at a place where we can say 'yes, financial conditions are at an appropriate place, we see inflation coming down.'"

The Fed has raised its benchmark policy rate by three-quarters of a percentage point this year, and is on track to increase it again in half-percentage-point increments at its next two meetings in June and July. Market interest rates on Treasury bonds, 30-year mortgages and other forms of debt have risen much faster in a financial tightening predicated on upcoming Fed actions.

What happens next - how much more the central bank hikes rates, and how fast - depends on how the economy and inflation evolve, something Powell said the Fed would evaluate "meeting by meeting, data reading by data reading."

His remarks solidified expectations in rate futures markets that the Fed's target rate would reach at least 2.75% to 3.00% by the end of this year and perhaps more, steadily rising from the current range between 0.75% and 1%. CME Group's (NASDAQ:CME) FedWatch tool on Tuesday showed a greater than one-in-four prospect for the policy rate to end the year at between 3.00% and 3.25%, up from about a one-in-10 chance on Monday.

'UNTIL SOMETHING BREAKS'

Economists meanwhile are divided between those who feel inflation will collapse on its own and let the Fed do less, and those who feel the central bank may need to hike in increments of three-quarters of a percentage point to ever get control of inflation that reminds some of the shocks of the 1970s and early 1980s.

Data in recent weeks have been chock with conflicting signals.

Retail sales, hiring, and manufacturing output all show an economy that is itself unflinching, so far, in the face of higher borrowing costs.

"The economy is strong. Consumer balance sheets are healthy. Businesses are healthy," Powell said, contending that strength is one reason the Fed can push interest rates higher and slow growth enough to cool inflation without causing the sort of painful contraction the central bank has used in the past to clamp down on prices.

At the same time, the war in Ukraine is making food and fuel more expensive around the world, while a new round of coronavirus lockdowns in China threatens to keep prices rising for manufactured goods and industrial inputs.

Coupled with still strong consumer demand in the United States, that could force the Fed into even tougher action.

The Fed targets an inflation rate of 2% annually, but prices using the central bank's preferred measure are currently rising at more than three times that level. Inflation that is too fast can distort household and business planning, and, more to the point for the sense of urgency felt by Powell and his Fed colleagues, erode the ability of the central bank to keep it under control.

"Once the Fed starts hiking, they continue to hike until something breaks. Now the question becomes is what we should be looking at as a potential break? The equity market? Is it credit? Is it housing? I think that's going to be this cycle's big unknown," said Ian Lyngen, head of U.S. rates strategy at BMO Capital Markets in New York.