Speculators Bullish On Bitcoin

Image Source: Pexels

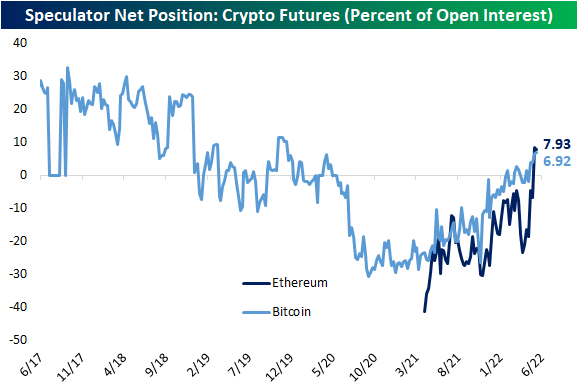

Bitcoin has been relatively flat in the past couple of weeks in the wake of the Terra blowup. That is also in spite of further declines for equities which have been highly correlated to cryptos lately, especially on an intraday basis. As the two largest cryptos—Bitcoin and Ethereum—have traded more or less sideways, speculators appear to be getting a little more bullish.

As we do each week, in last night’s Closer we highlighted how positioning data from the CFTC’s Commitments of Traders report showed speculators are positioned net long (meaning there is a higher share of open interest that are long the future than short) in Ethereum and Bitcoin futures.

The latest data, as of last Tuesday, showed a net 7.93% of Ethereum futures were long. That was down slightly from the prior week, but it remains one of the strongest readings since the data began roughly one year earlier.

Bitcoin open interest is similarly net long, with the latest reading rising to the highest level since November 2019. That means the highest share of speculators are anticipating higher Bitcoin prices since before the pandemic when the crypto was trading below $10,000; nearly a third of what it is at today. Open interest back then was also a fraction of what it is now.

Click here to learn more about Bespoke’s premium stock market research ...

more