Energy Price Caps Could Be A Game Changer For European Utilities

Despite turmoil in the gas and power markets, most European utilities have performed well financially.

The surge in energy prices has pushed European governments to take action to protect consumers. Among those plans, price caps could be a game changer for the sector.

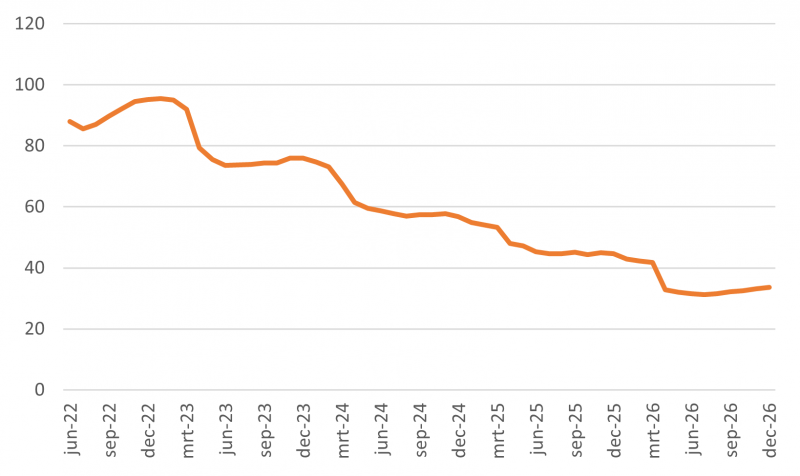

Elevated natural gas prices expected to last another two years

The post COVID-19 economic recovery resulted in higher energy demand at a time when the global natural gas supply was already tight. The Russia-Ukraine conflict has aggravated the situation with various energy sanctions on Russia, a major supplier of oil, gas, and coal for Europe.

Recently, Gazprom announced the stoppage of its gas deliveries to Poland, Finland, the Netherlands, and Denmark for not honoring the contracts using the ruble. Energy suppliers consider the decision to be a breach of contract given that the euro is the currency agreed upon in the contracts signed with Gazprom. Total Russian supply cuts to the EU now amount to around 23bcm, which is about 15% of the total Russian supply to the EU.

These losses are still considered to be manageable given the strong LNG inflows we are seeing. According to Gazprom, they do not expect further supply cuts to any other EU buyers, given that those buyers have either paid or have already been informed that flows to them will be stopped. But as the geopolitical situation escalates further, additional countries/suppliers may experience gas stoppages from Russia.

The current market situation is expected to keep natural gas prices at high levels for at least another two years.

Dutch TTF gas forward contracts

EUR/MWh equivalent

Source: Eikon, ING

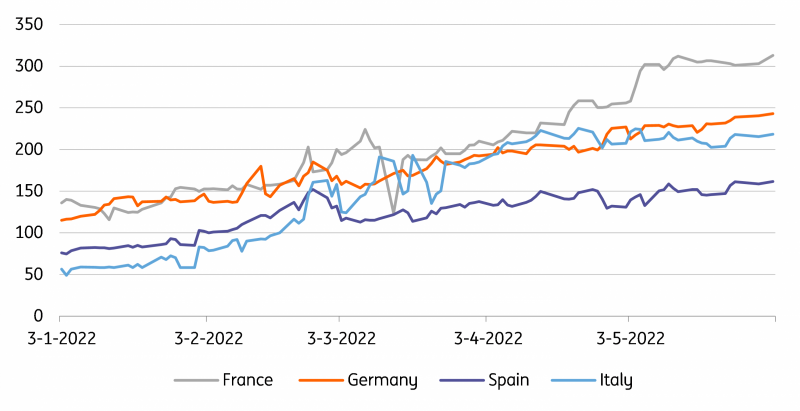

Power prices have skyrocketed due to several factors

Natural gas is used by households, corporates, and industry. It is also used by utilities to operate their natural gas power plants to produce electricity. Across Western Europe, natural gas represented 17% of the energy used by utilities to produce power in 2021. The share of natural gas for power production ranges between 25% and 15%, depending on the profitability of the technology. Soaring natural gas tariffs have pushed wholesale and retail power prices up considerably since the beginning of 2021. Other elements have also played a crucial role, including high carbon prices, the decommissioning of coal power plants, and the reduced availability of nuclear power plants, which also explain high energy prices overall.

1-Year baseload power forward wholesale contract

EUR/MWh

Source: Eikon, ING

The majority of European utilities are well positioned to face the turmoil

In the United Kingdom, about 30 gas and power suppliers have gone bankrupt since the beginning of 2021. These players, mostly pure retailers with a business model based on energy supply and contracting new customers on low tariffs in order to gain market share, suffered from a price squeeze amid surging wholesale prices. Some 2.6 million households, about 9% of the UK total, had to be allocated to a different utility.

Utilities differ in their business models. Integrated utilities generally operate along the value chain, profiting from four main revenue streams.

The four main revenue streams for European integrated utilities

Source: ING

While some European suppliers did not survive the turmoil due to their specific business models, most large European utilities, representing between 80% and 90% of domestic market share, are well protected.

In 2021 and the first quarter of 2022, results showed that large European utilities have benefited from soaring power prices overall, with earnings up from 2020. Depending on the specific utility, 2022 guidance is either stable or stronger than the previous year. The few utilities that have suffered financially, although far away from the threat of bankruptcy, are suppliers with a large energy trading department that were wrongly positioned in regard to hedging strategies. 2022 will also see large asset impairments for the Nordic and German utilities particularly active in Russia.

Furthermore, the majority of the large European gas and power suppliers have a very diverse business profile with multiple revenue streams, allowing them to face headwinds without serious damage. Most of them are geographically diversified, too. For instance, Southern European utilities have a strong presence in North and Latin America, where the markets offer different dynamics and regulations. German utilities operate across Western and Eastern Europe as well as in the United Kingdom. Some utilities have both a European and a worldwide geographical footprint. The business mix of European utilities also offers an advantage. Integrated utilities benefit from activities across the value chain with power and gas networks offering stable cash flows determined by regulatory packages. These utilities are also diversified in terms of power generation assets with a share of renewables that keep growing and that run at a low marginal cost.

European governments take action

Soaring energy prices and overall inflation pushed European governments to react. This was facilitated by the European Commission with the Energy Price Toolbox, that ‘allowed’ local governments to provide income support or lower energy taxes. The protection of consumers against the soaring cost of living led to specific support packages.

In 2021, the French government introduced a yearly “chèque énergie” worth between €48 and €277, for eligible households, according to their income and size of the household. The cheque can be directly used to pay electricity and gas bills or other related energy services such as energy-saving work.

In the Netherlands, the average yearly energy bill for households was expected to increase by €1,264 due to higher energy prices, according to the Dutch statistics bureau. As a result, the Dutch government introduced several support measures for all households, such as lower energy taxes and an increase in the lump sum discount on energy bill taxes. These measures amount to €565 for a household with average energy use (1,170 m3 gas and 2,384 kWh). On top of that, low-income households get an additional €800 of support through the municipality.

As the energy crisis deepened, the British government announced a support package in February 2022 to help households cope with the soaring cost of living. It is providing a £15 billion energy bill rebate package, worth up to £550 each for around 28 million households. All domestic energy customers in Great Britain will receive a £400 grant to help with the cost of their energy bills through the Energy Bill Support Scheme. This money will not need to be paid back. Households liable for council tax in Bands A-D in England will also receive a £150 council tax rebate (which has already started to be paid out) to help with the rising cost of bills. This support will apply directly to households in England, Scotland, and Wales.

Tax on windfall profits to finance support schemes

On the European utilities’ side, direct governmental support to consumers has been the preferred option. There was no attempt to intervene directly or disrupt energy markets or to interfere with business models and profits.

In September 2021, the Spanish government said it would retain €2.6bn of utilities' profits from generating electricity from renewables and hydropower. Such assets are said to generate windfall profits given the lower cost of these technologies and high energy prices.

After having spent c.€16bn on energy measures, Italy proposed in May 2022 a retroactive tax of 10% on energy companies’ windfall profits between October 2021 and March 2022. The tax is expected to help finance new sets of measures worth €4.4bn.

Although not concerning utilities, the UK government is considering the introduction of a 25% windfall tax on North Sea oil & gas producers. This new measure, announced at the end of May 2022, is designed to partly fund the cost of living support package for UK households. At the same time, the measure includes tax relief on new investment in oil and gas extraction, which could soften the impact of the windfall tax for the players' frontloading investments.

While taxes on windfall profits tend to reduce corporates’ bottom line and impact the companies’ equity valuation, energy price caps are probably the most dreaded tools that governments can impose on utilities to shield consumers from skyrocketing prices. Some countries, such as Romania, Hungary, France and the UK have implemented either retail or wholesale price caps. We look at some of these examples and potential consequences below.

Spain and Portugal cap wholesale gas price reference for power plant use

In March 2022, Spain and Portugal searched for additional solutions to limit the rise in energy prices. Both obtained the European Commission’s agreement to impose a wholesale price cap reference for natural gas used for power generation. Both countries are finalizing details before implementing the plan. The price of reference for wholesale natural gas used to generate electricity would be set at €40/MWh for a period of six months. After that period, the reference price would gradually increase to reach a maximum of €70/MWh after 12 months.

The Spanish government believes the measure will avoid the tremendous retail electricity price spikes seen in the last 12 months when gas power plants set the marginal market cost. The plan would also reduce by 37% the electricity bills of residential consumers, and industrial customers could see savings of up to 70%. By containing wholesale power prices around €130/MWh on average, utilities benefiting from low marginal cost technologies (onshore wind, solar, and hydropower) will see their profits limited.

Retail price cap: the UK example proves the limits

Put in place years before the energy crisis that started with the COVID-19 pandemic, the UK regulator OFGEM imposed a price cap in the form of a yearly maximum power and gas amount that can be charged to residential customers. For a household with typical energy use, the cap was set at £1,277 on 1 October 2021. Although £139 higher than the previous price cap, the scheme resulted in many utilities selling power and gas to residential customers at very low margins and sometimes at a loss.

The price cap, along with the fragile business model of some energy suppliers, was the cause of multiple bankruptcies across the UK energy supplier market. In reaction to the market turmoil, the price cap for some 22 million UK customers was revised upwards for the period April-September 2022, with a £693 increase for the average household to £1,971 per annum. As natural gas and electricity wholesale prices continue their ascent, the maximum household bill is now expected to be capped at around £2,800 for the period October 2022-March 2023.

France: volume and wholesale price cap leads to extreme consequences

The French power market is dominated by nuclear power plants that can provide up to 80% of the country’s electricity needs when availability is at its maximum. The incumbent, EDF, majority-owned by the French State, operates all nuclear power plants in the country. Under the AREHN regulation, EDF has had to provide a part of its nuclear power production to alternative players at a determined wholesale price. In order to contain power price inflation, the French regulator has imposed a larger wholesale volume to EDF. From the usual 100TWh, EDF needs to sell 120TWh to competitors in 2022 at a price of €46.20/MWh (up from €42/MWh previously).

The French utility still hopes to reverse the decision but recently, the regulator made a proposal to increase the volume in 2023 to 130TWh at a price capped at €49.50/MWh. The increase in price sounds positive, but this is without taking into account the current market wholesale price that has traded at an average of €200/MWh since the beginning of the year. The second, and most important element, is the fact that half of EDF’s 56 nuclear reactors have been halted for technical issues as well as planned maintenance.

With extremely reduced power output, EDF needs to find electricity on the markets at very high prices while selling about 40% of its current production to alternative players at a discounted wholesale price. The latest estimate for buying the missing power output on the markets was valued by EDF at €10bn. With average earnings before interest and depreciation of about €15bn in the last years, the measure to contain power prices will dramatically reduce the company’s earnings when investment in its nuclear fleet and renewables are at the highest.

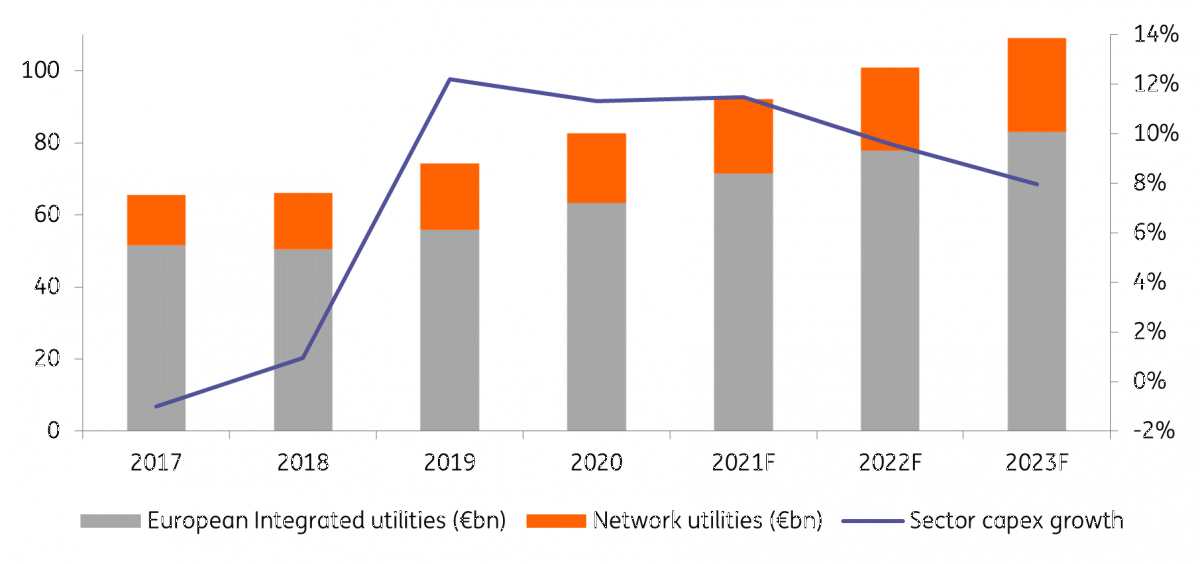

Energy transition investment at stake

With a planned Russian coal, oil and gas phase-out, the European Union reiterated its ambition to develop renewable energy further. The REPowerEU package proposes to enhance long-term energy efficiency measures, diversify energy supplies, purchase energy with joint efforts, and to massively scale and speed-up renewable energy in power generation. While these ambitions are laudable, it remains questionable to what extent companies can deliver.

Between 2017 and 2021, the European utility sector has increased investment by an average of 8% per annum. In 2022, investment is expected to surge by 12% compared to 2021. The top 40 European utilities will together spend more than €100bn in 2022. Utilities’ business plans show that the coming years include heavy capital expenditure rollouts, with yearly progressions of around 8%. About 75% of these investments fall under the energy transition theme with projects in renewable energy as well extension and digitalization of networks. The recently revised European Union’s green energy ambitions could mean an even larger escalation in investment.

Top 40 European utilities: investments 2017-2023F

In € billion

Source: Company data, ING

European utilities’ reactions to higher taxes and announced price caps have been threats to the level of investment they will roll out in Europe in the short and medium-term. Following the price caps imposed on grids and energy bills in Romania and Hungary, German utilities operating in the countries communicated their intention to revise capital expenditure downward. The utilities could even consider exiting these markets as earnings are severely hit due to price cap customer support schemes.

The initially proposed tax in Spain, expected to have a significant impact on net profits, was softened by the regulator when Spanish utilities threatened to reduce capital expenditure. Recently, similar noises could be heard from the oil & gas companies operating in the North Sea. The windfall tax on profits could limit investment plans, including in green energy.

European oil & gas majors have also become important players in the energy transition plans with, for some of them, strong ambitions in renewables, hydrogen, and biofuels. Capping energy prices eats into the profits of utilities. As such, they can be a real game changer for utilities. Hence, this needs to be done wisely as utilities can only live up to growing investment ambitions with solid profit margins. Losses or bankruptcies among the larger utilities must be prevented as they are likely to add to market turmoil and backfire on the ambitions of the EC to speed up the transition to a net-zero economy.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more