Warren Buffett Stocks: The Coca-Cola Company

Berkshire Hathaway (BRK-B) has an equity investment portfolio worth more than $360 billion, as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can ‘cheat’ from Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Buffett’s Berkshire Hathaway owned 400 million shares of Coca-Cola (KO), for a market value of about $24 billion. This makes Coca-Cola one of the larger holdings in Berkshire Hathaway’s massive portfolio, as well as making Berkshire one of the largest shareholders of Coca-Cola. The stock makes up just under 8% of Berkshire’s total stock portfolio.

In this article, we’ll take a close look at Coca-Cola’s business, it’s growth opportunities and its total return prospects.

Business Overview

Coca-Cola is one of the world’s largest beverage companies and is the single largest non-alcoholic beverage maker. It owns a vast portfolio of hundreds of different products, including its ubiquitous sparkling beverage brands like Coke and Diet Coke, as well as teas, coffees, nutritional drinks, juices, milks, waters, and more.

The company distributes its products through a network of distribution points that spans almost every country in the world, and the company sells more than two billion individual servings every day globally.

Coca-Cola was founded in 1886, generates about $42 billion in annual revenue, and its market cap stands today at $258 billion. Coca-Cola is a mega-cap stock.

In addition, Coca-Cola is a Dividend King, having boosted its annual dividend for 60 consecutive years.

Growth Prospects

Coca-Cola’s growth stagnated from 2017 to 2020, when earnings-per-share oscillated around $2.00, but no real progress was made. That was during the time when the company was divesting most of its bottling operations, which caused revenue to fall.

However, this was planned as the remainder of the company – the actual beverage-making components – have much higher profit margins than the commoditized bottling business.

Now that the transformation is complete, Coca-Cola is back to growth, and we think its recent portfolio additions position it well for the future.

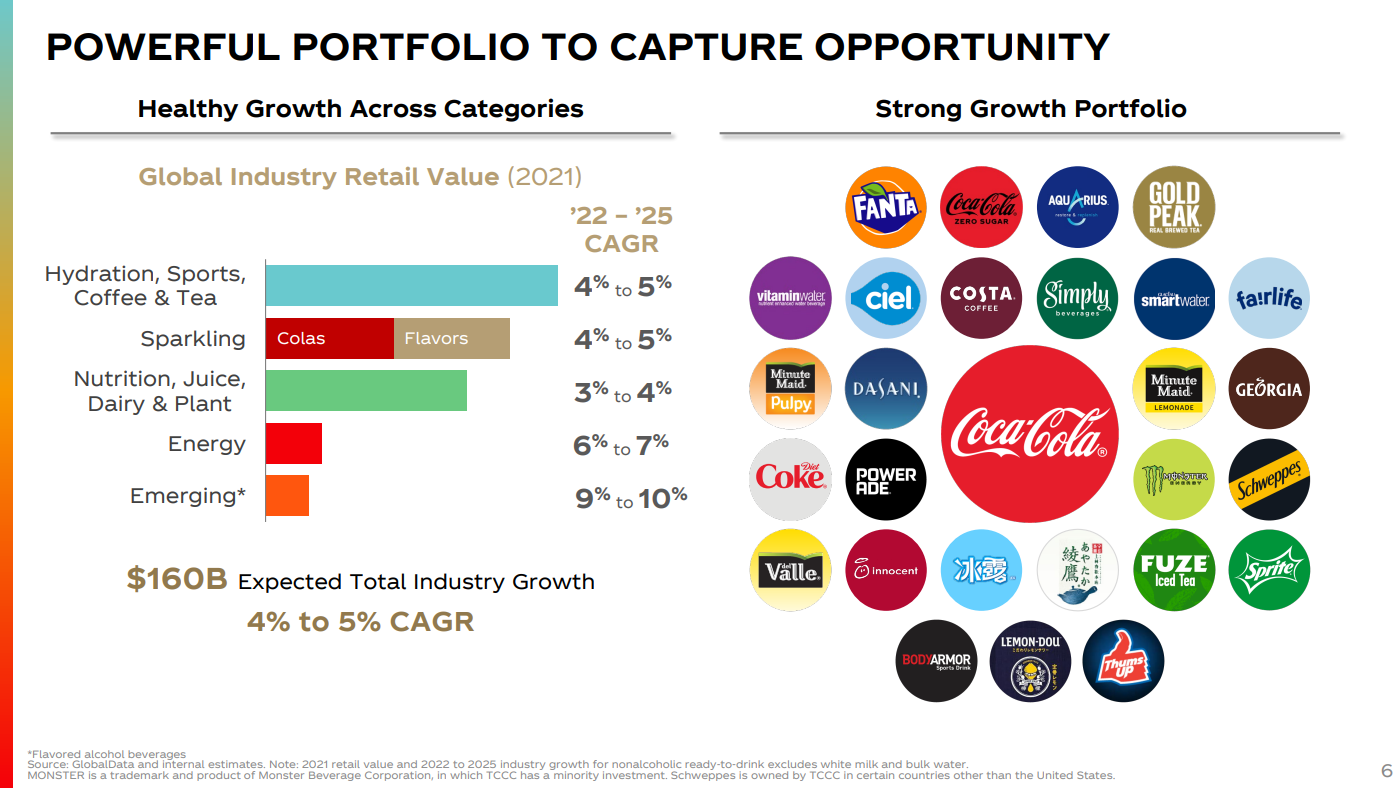

Source: Investor presentation, page 6

The company has recently moved heavily into teas and coffees, including its purchase of Costa. Coca-Cola has been ramping its exposure to these non-sparkling categories, and the company believes not only in the growth potential of this category but in its massive total market size globally, as seen above. We believe the company’s portfolio is a massive advantage over competitors, positioning it for robust earnings growth for many years to come.

Coca-Cola’s legacy brands – such as its Coke, Diet Coke, Sprite, and other sparkling beverages – have stagnated or even contracted in recent years. However, the company has developed and acquired its way to diversifying away from relying upon those brands for growth, and we believe it is better for it.

Recent, sizable acquisitions include Costa, a coffee chain based in the UK, Fairlife, a dairy producer that makes filtered milks, and BodyArmor, a maker of enhanced water drinks. In all cases, Coca-Cola is going after markets where it doesn’t already have sizable market share, and its diversified strategy to growing is something we think will pay off in the future for shareholders.

We note recent cross-branding efforts as well, which takes advantage of the company’s enormous portfolio to create unique products. One such example is Coca-Cola Coffee, which combines its namesake sparkling beverage with Costa coffee.

Competitive Advantages & Recession Performance

Coca-Cola’s competitive advantage is in its portfolio of hundreds of brands, as well as its unrivaled distribution network around the world. The company’s ability to test new products or variants of existing products in specific markets, and then distribute the winners quickly around the globe is something no company can match.

It also possesses very strong brand loyalty among hundreds of millions of consumers around the world.

This all helps Coca-Cola’s recession resistance, which is also quite good. The company held up very well during the Great Recession:

- 2007 earnings-per-share of $1.29

- 2008 earnings-per-share of $1.51 (17% increase)

- 2009 earnings-per-share of $1.47 (3% decline)

- 2010 earnings-per-share of $1.75 (19% increase)

Not only did Coca-Cola survive the Great Recession, it thrived. Coca-Cola grew earnings-per-share by 36% from 2007-2010. This shows the durability and strength of Coca-Cola’s business model.

While beverages such as what Coca-Cola sells aren’t necessities, consumers treat them as an affordable luxury, even in tough times, so the company’s revenue and earnings are well protected against recessions. We believe that Coca-Cola’s earnings will hold up nicely during future downturns.

Valuation & Expected Returns

Coca-Cola’s price-to-earnings ratio in the past decade has mostly been in the low-20s, which is where we find fair value. We expect the valuation to remain around 23 times earnings long-term, which takes into account the company’s growth prospects, its higher profit margins following bottling divestitures, and its earnings stability.

Today shares trade for about 25 times earnings, so the stock is slightly overvalued. That could pose a ~1% annual headwind to total returns in the coming years.

The dividend yield is 2.9% today, which is fractionally below the company’s recent average of just over 3%. This also suggests that perhaps Coca-Cola is slightly overvalued at present.

However, when we combined the valuation headwind, the ample dividend yield, and the expected growth rate of 6%, we believe shareholders can achieve total returns in excess of 7% annually in the next five years. That’s good enough for a hold rating for Coca-Cola, and we’d be buyers on a meaningful pullback in the share price.

Final Thoughts

We see Coca-Cola as an attractive dividend stock for long-term investors, given its earnings predictability, its revamped business model that is focused on margins, and its unparalleled suite of non-alcoholic brands.

While the stock is slightly overvalued, the yield is still double that of the S&P 500, and we see meaningful growth ahead. We rate Coca-Cola a hold and note that on a pullback, it would be an exceptional dividend stock purchase.