- Gold Price rebounds from six-day lows but buyers remain wary.

- Upbeat mood keeps USD bears in control despite a pause in the yields sell-off.

- Central banks' rate hike bets cool off amid looming recession risks.

The R-word is back on the radars, prompting markets to scale back aggressive rate hike expectations from major central banks worldwide. Cooling hawkish expectations is helping calm investors’ nerves, weighing negatively on the safe-haven US dollar at the expense of gold price. However, stabilizing US Treasury yields, following the recent retreat, are keeping the further upside elusive in the bright metal. The market’s perception of risk sentiment, in the facing of lingering inflation and recession worries will continue to drive the US dollar price action, in turn, influencing XAUUSD. Attention now turns towards next Monday’s US Durable Goods data and the ECB Forum in Sintra, where the central banks’ heads are likely to participate in a panel discussion on the monetary policy.

Also read: Gold Price Forecast: XAUUSD looks set to test $1,800 after symmetrical triangle breakdown

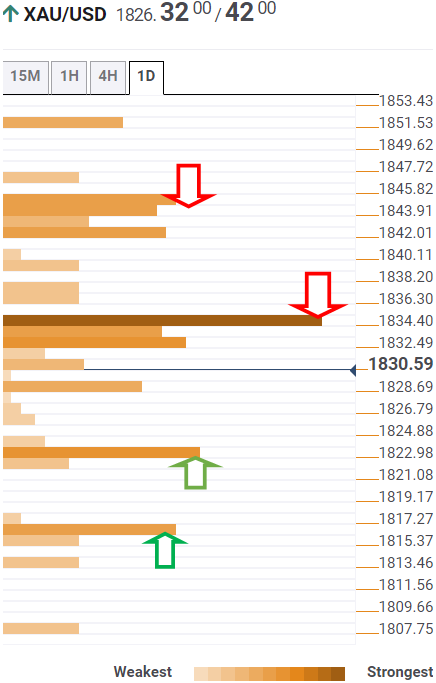

Gold Price: Key levels to watch

The Technical Confluence Detector shows that Gold Price is retreating after running into strong offers at $1,831, which is the intersection of the Fibonacci 38.2% one-day, SMA200 one-hour and the previous high four-hour.

The yellow metal is retracing further towards the previous day’s low of $1,823, where the Fibonacci 23.6% one-week coincides.

A breach of the latter will trigger a sharp drop for a test of the confluence of the Fibonacci 23.6% one-month and pivot point one-day S1 at $1,816.

The Bollinger Band one-day Lower at $1,812 will be the line in the sand for gold optimists.

On the flip side, acceptance above the aforesaid resistance at $1,831 will challenge the powerful barrier at $1,835. At that level, the SMA5 one-day, Fibonacci 38.2% one-week, one-month and one-day converge.

The Fibonacci 61.8% one-day at $1,838 will test the bearish commitments on the additional upside. A dense cluster of strong resistance levels around $1,843 will be the level to beat for XAU bulls. That level comprises the SMA200 one-day, SMA100 four-hour and the Bollinger Band one-day Middle.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.