Darden Restaurants, Inc. (NYSE: DRI) has delivered better-than-expected results for the fourth quarter of Fiscal 2022 (ended May 29, 2022). While the company’s earnings surpassed the consensus estimate by 1.4%, its sales surprise in the quarter was 2.4%.

Shares of this $14.4-billion restaurant company inched up 0.4% to close at $115.60 on Thursday. However, the stock slipped 1% in the extended trading session.

Quarterly Highlights

The company’s earnings in the quarter were $2.24 per share, above the consensus estimate of $2.21 per share. Compared with the year-ago tally (adjusted), the bottom line grew 10.3% on the back of growth in revenues, partially offset by an increase in costs and expenses.

Revenues of $2.6 billion were above the consensus estimate of $2.54 billion. Also, the top line was 14.2% ahead of the year-ago tally. Same-restaurant sales in the quarter grew 11.7% year-over-year.

On a segmental basis, sales at Olive Garden increased 8.2% year-over-year, while sales at LongHorn Steakhouse grew 22.8%. Fine Dining sales expanded 40.7% and revenues of the Other Business segment surged 21.5%.

Exiting the quarter, the company owned 1,867 restaurants (including 884 Olive Garden restaurants), higher than 1,834 at the end of the year-ago quarter.

The total operating costs and expenses increased 15.8% year-over-year to $2,264.7 million. This includes the impact of an increase of 22.4% in food and beverages costs, 20.1% in restaurant labor charges, and 9.8% in restaurant expenses. Operating income in the quarter was $338.2 million, up 4.7% year-over-year.

Annual Highlights

In the year, Darden Restaurants’ revenues at $9,630 million increased 33.8% year-over-year. Earnings stood at $7.39 per share, reflecting an increase of 71.5% from the previous year’s adjusted earnings per share.

Exiting the fourth quarter, the company had cash and cash equivalents of $420.6 million, down 65.4% from the year-ago quarter. Long-term debts were at $901 million, down 3.1% year-over-year.

In Fiscal 2022, the company’s net cash flow from operating activities advanced 6% to $1,264.6 million, and its capital expenditure at $376.9 million represented an increase of 47.9%.

Projections

For Fiscal 2023 (ending May 2023), the company anticipates revenues to be within the $10.2-$10.4 billion range and growth in same-restaurant sales to be 4%-6%. Also, the company plans on adding 55-60 new restaurants to its kitty.

Earnings in the year are forecast to be $7.40-$8 per share. Inflation is forecast at 6%.

Official Comments

The President & CEO of Darden Restaurants, Rick Cardenas, said, “As we begin our new fiscal year, our focus remains on driving profitable sales, investing in the guest experience and simplifying operations. Darden’s strategy, and our strong balance sheet, positions us well regardless of the operating environment.”

Capital Deployment

Darden Restaurants rewarded shareholders with $563 million of dividends (up 177.9% year-over-year) and share buybacks of $1,071.3 million (versus $45.4 million in the previous year).

Also, the company announced that its board of directors has approved the payment of a quarterly cash dividend of $1.21 per share. Shareholders on the company’s record as of July 8 will be eligible for dividends. The disbursement date is August 1.

It is worth mentioning here that the quarterly rate represents a 10% hike from the previous rate of $1.10 per share.

Also, the company got approval for a $1 billion share buyback program, which will replace any existing authorization.

Analysts’ Rating

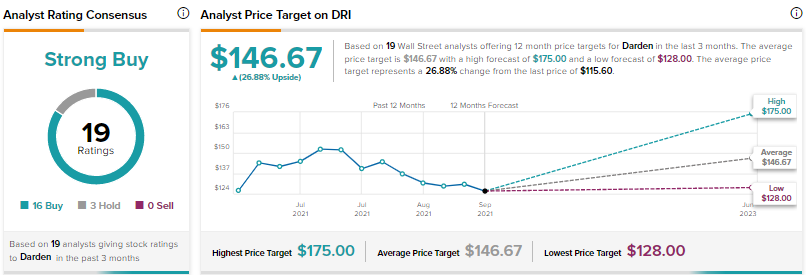

On June 23, 2022, Chris O`Cull of Stifel Nicolaus reiterated a Buy rating on DRI and a price target of $135 (16.78% upside potential).

Another analyst, Andrew Strelzik of BMO Capital maintained a Hold rating on the stock while lowering the price target to $130 (12.46% upside potential) from $140.

The analyst opines that the company’s earnings projection for Fiscal 2023 is below the $8.10 per share consensus estimate. Strelzik has lowered his earnings estimates on the company.

Overall, the company has a Strong Buy consensus rating based on 16 Buys and three Holds. DRI’s average price target of $146.67 suggests 26.88% upside potential from the current levels. Shares of DRI have declined 17.3% over the past year.

Crowd Wisdom

Per the TipRanks’ tool, investor sentiments on DRI are Very Positive. In the last 30 days, the number of portfolios with investments in DRI stock have increased by 5.2%.

Conclusion

Despite inflation worries, Darden Restaurants has a solid growth potential, which is backed by the growing number of restaurants and rising revenues and profitability. Further, its initiatives to reward shareholders with share buybacks and dividends enhance its investment appeal.