Warren Buffett Stocks: Amazon

Image Source: Unsplash

Berkshire Hathaway (BRK-B) has an equity investment portfolio worth more than $360 billion as of the end of the 2022 first quarter. Berkshire Hathaway’s portfolio is filled with quality stocks. You can ‘cheat’ from Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

As of March 31, 2022, Buffett’s Berkshire Hathaway owned just over 533 thousand shares of Amazon (AMZN) for a market value exceeding $62.1 million. Amazon currently constitutes a little over 0.02% of Berkshire Hathaway’s investment portfolio.

This article will analyze this Internet and direct marketing retailer company in greater detail.

Business Overview

Founded in 1995 by Jeff Bezos, Amazon.com began as an online bookstore. Today the company has become one of the world’s largest online retailers and cloud services providers. Headquartered in Seattle, WA, the $1.14 trillion market cap company employs over 1,608,00 people.

On April 28, 2022, Amazon reported its first-quarter results, which ended on March 31, 2022. For the quarter, earnings missed expectation by $15.78. The net loss was $3.8 billion in the first quarter, or $7.56 per diluted share, compared with a net income of $8.1 billion, or $15.79 per diluted share, in the first quarter of 2021.

The first-quarter 2022 net loss includes a pre-tax valuation loss of $7.6 billion included in non-operating expenses from its common stock investment in Rivian Automotive, Inc.

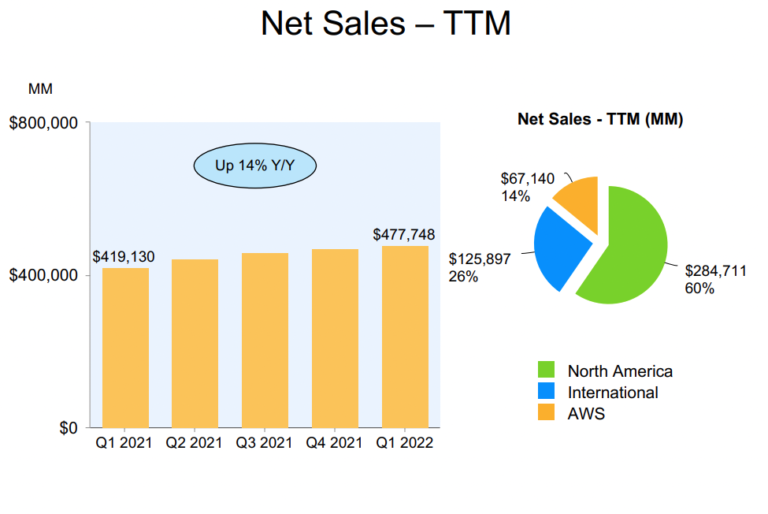

Revenue increased 7% to $116.4 billion in the first quarter, compared with $108.5 billion in the first quarter of 2021. This was in line with expectations. On a Trailing 12 Months (TTM) basis, revenues have been growing 14% year-over-year. North America makes up 60% of the company’s total revenue, whereas 26% is from international.

Source: Investor Presentation

Growth Prospects

The growth drivers for the company come from its AWS segment and advertising. These segments earn higher margins than the rest of the business. We also expect them to drive margins higher over time.

Over the next five years, we project AWS revenue will grow at a 25% CAGR, and advertising revenue will grow at a 19% CAGR. In total, Amazon should grow around 15% CAGR through 2027.

We also expect e-commerce to continue to take share from brick-and-mortar retailers. Thus, we additionally expect Amazon to gain more online sales.

Competitive Advantages & Recession Performance

Amazon has a collection of competitive advantages, with a low-price offering coupled with exceptional logistical capabilities, execution, and customer experience. The “Amazon effect” weighs heavy on competitors, and it has become a real challenge for various industries. For almost two decades, Amazon has been disrupting the traditional retail industry.

Due to an outstanding operating history, Amazon’s balance sheet is in excellent shape. As of the most recent report, Amazon held $36.2 billion in cash, $161.6 billion in current assets, $420.5 billion in total assets against $142.3 billion in current liabilities, and $48.7 billion in total long-term debt. Overall, the company has an AA credit rating from S&P.

Amazon performed well in both the Great Recession and during the COVID-19 pandemic. Earning grew in 2008 by 25% compared to 2007. In 2009, earnings rose 46% compared to 2008. During the COVID-19 pandemic, earnings grew by 82% from 2019 to the end of 2020.

Valuation & Expected Returns

Earnings were down significantly for the first quarter. We think this will continue for the year. Thus, we expect the company to earn $0.76 per share. Based on the current share price, this gives us a PE of 56.8X earnings. This looks to be very high, but Amazon has always had a high PE. For example, over the past five years, the company has averaged a PE of 77.6X earnings.

After this down year in earnings, we expect the company to return to earning growth and to grow earnings at a 15% annual rate over the next five years. This should provide mid to low double-digit returns over the next few years.

Final Thoughts

Amazon is a great company and has performed very well over the last two decades. At the recent price, the company looks to be slightly undervalued and presents a good buying opportunity. The company has an outstanding balance sheet and is set to continue to grow earnings after this year.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ...

more