Shares of e-commerce behemoth Amazon (AMZN) has been incredibly turbulent of late, struggling to put in a bottom following its brutal 42% plunge from peak to trough.

Undoubtedly, CEO Andy Jassy has had his hands full amid a growing number of macro headwinds. Jassy has done wonders for web services growth, but it’s unclear if the man can fill the big shoes left by Jeff Bezos. Though Jassy may have his fair share of critics after Amazon stock’s recent bout of underperformance, I’d argue that he’s the right man for the job. Investors are just overly jittery and are misunderstanding the firm’s road forward.

With rates climbing higher by the month, investors want to see enhanced profitability, not higher expenses. And certainly not overinvestment amid inflationary pressures.

Unionization attempts, wage pressures, higher input costs, and all the sort have weighed heavily on Amazon’s margins in recent quarters. Amazon’s margins were so meager that the company actually delivered a surprise quarterly earnings loss of $0.38 in its first quarter. The earnings miss was rare. And for some, it was alarming, with early signs in the retail scene pointing to a recession.

Inflation truly is a beast that swindles just about everybody, as Warren Buffett once said.

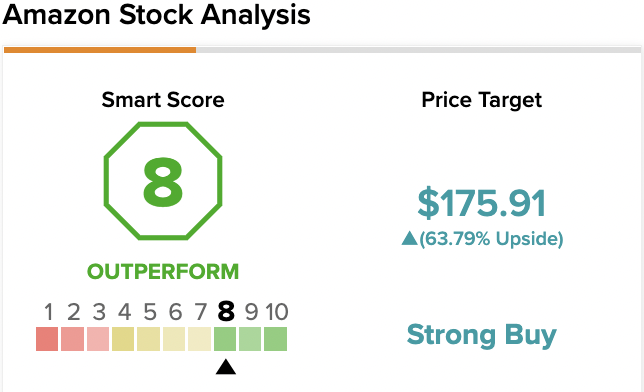

On TipRanks, AMZN scores an 8 out of 10 on the Smart Score spectrum. This indicates a high potential for the stock to outperform the broader market.

Can Amazon Make it Through a Consumer Slowdown?

Though a consumer-facing slowdown could intensify into year-end, weighing on retail sales while margins are weighed down, I’d argue that the long-term trajectory still looks good. Looking past the haze of storm clouds lies a very bright environment for Amazon.

The company continues to invest heavily in growth initiatives while continuing to make strides to improve upon long-term margins. Now, recent inflationary headwinds will continue to weigh margins down for at least another few quarters. However, once things begin to normalize, Amazon could be in a spot to really make up for lost time.

Could the perfect storm of tailwinds follow the perfect storm of headwinds? If COVID-era tailwinds can be replaced by inflationary headwinds in such a hurry, I’d argue a move back into a more favorable environment is also plausible.

In any case, Amazon is doing a lot of things right at the company-specific level. And for that reason, I remain bullish in spite of the rising risk of recession.

Amazon’s Big Bet on Robotics Could Pay Off

Amazon isn’t just going to wait around for macro margin pressures to go away. It’s investing heavily in warehouse automation, which could help the firm boost long-term margins. Undoubtedly, recent unionization efforts have likely accelerated progress on robotics.

The company already has workers and robots working in sync at select warehouses. With the advent of a fully-autonomous robot named Proteus, though, it seems like Amazon is ready to bring warehouse automation to the next level.

While Amazon notes that it will help reduce the risk of injury at warehouses, one can’t help but wonder if such autonomous innovations are more about enhancing the bottom line.

What makes Proteus so intriguing is not just its full autonomy, but its ability to carry heavy payloads. Such a warehouse robot may not only apply upward pressure on margins over the long run, but it could also bring down delivery times for Prime customers.

It will be very interesting to see where Amazon’s latest warehouse robotics tech takes it. For now, the market seems to be discounting the innovations and their longer-term impact on margins and earnings growth.

Buy with Prime Could Bolster Sales Growth

Has Amazon really overinvested in capacity? Analysts certainly seem to think so after the firm’s latest quarterly flop. Still, I think Amazon’s disruptive “Buy with Prime” service is ready to take share away from third-party-focus rivals such as Shopify (SHOP).

Amazon’s logistics service offering could scale remarkably well as new automation innovations are rolled out across warehouses. Indeed, it will be hard for rivals, like Shopify, to keep up. Though Shopify’s acquisition of Deliverr seems to be a direct response to Amazon’s latest push, I’d argue that such a deal is unlikely to prevent the wave of disruption that’s to come with Amazon’s push into logistical services.

Wall Street’s Take

According to TipRanks’ analyst rating consensus, AMZN stock comes in as a Strong Buy. Out of 38 analyst ratings, there are 36 Buy recommendations, one Hold recommendation, and one Sell recommendation.

The average Amazon price target is $175.91, implying an upside of 63.79%. Analyst price targets range from a low of $107 per share to a high of $212 per share.

The Bottom Line on Amazon Stock

Amazon is a disruptive force that’s ready to take its influential capabilities to the next level. As the company serves other digital retailers while incorporating cutting-edge robotics, it’s hard not to love Amazon stock while it’s down by so much from its high.

Sure, hard times lie ahead for most retailers. But beyond those hard times is an environment where Amazon could be even more dominant than it was in 2020.

Read full Disclosure