Shares of The Walt Disney Company (NYSE: DIS) shares are down 38% year-to-date even after the entertainment giant delivered strong results for the second quarter (ended April 2, 2022) of fiscal 2022. Disney’s Q2 FY22 revenue grew 23% to $19.2 billion, driven by the strong recovery in the company’s domestic parks thanks to reopening of the economy. The top-line also gained from the continued growth in streaming services. Adjusted EPS increased 37% to $1.08.

However, investors seem worried that a challenging macro environment and a potential recession could impact consumers’ discretionary spending, thus hurting Disney’s business.

Focus on Long-Term Growth

Disney has been enhancing its theme parks through new offerings and efficient services to attract more consumers.

Disney is also expanding its Disney+ streaming services to boost revenue. It ended Q2 FY22 with over 205 million subscriptions across all its direct-to-consumer offerings, including 9.2 million added in Q2 FY22 (compared to the fiscal first quarter). These numbers include 137.7 million Disney+ subscribers, of which 7.9 million were added in Q2 FY22. Disney is on track to reach its target of 230 million to 260 million Disney+ subscribers by FY24.

Disney also plans to launch an ad-supported Disney+ subscription offering in the U.S. by the end of 2022, and in international markets in 2023.

Disney is also making significant investments in content to drive higher subscriptions. The company plans to invest $32 billion on content in FY22 across all its platforms, including one-third in sports content.

While these investments might weigh on near-term profitability, the company is optimistic that Disney+ will achieve profitability in FY24.

Wall Street’s Take

Bank of America analyst Jessica Reif Cohen increased her Q3 FY22 earnings estimates for Disney “due to lower projected [direct-to-consumer] losses” compared to previous expectations. Cohen stated that the theme park attendance is “resilient” despite concerns over macroeconomic challenges.

Cohen noted that visitors are “rarely” canceling trips once bookings are done. The analyst also feels that Disney’s recent decision to cancel annual passes at Disneyland is a “positive indicator for booking trends and overall demand.” Further, the analyst feels that a return of international visitors might offset any potential weakness in the U.S. demand.

The analyst also highlighted that the company launched its Disney+ streaming service in over 40 countries in the fiscal third quarter, which might accelerate sequential net additions.

Cohen also listed other near-term catalysts that could help the stock rebound, including continued strength in theme parks, continued rollouts of its direct-to-consumer subscriptions, the roll-out of the ad-supported subscription, and sports betting optionality at ESPN.

Cohen lowered her price target to $122 from $140 but maintained a Buy rating on Disney stock.

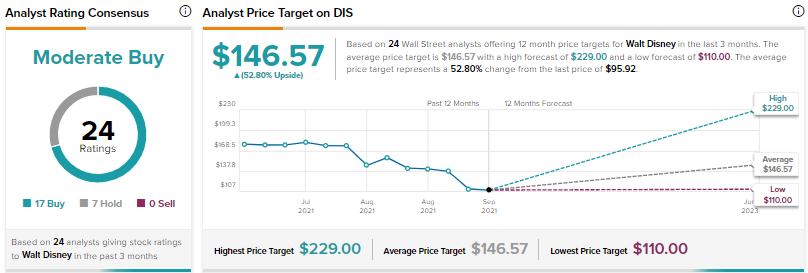

Overall, the Street is cautiously optimistic on Disney stock with a Moderate Buy consensus rating based on 17 Buys and seven Holds. The average Walt Disney price target of $146.57 implies 52.80% upside potential from current levels.

Conclusion

While macro pressures could weigh on Disney’s near-term performance, several analysts are optimistic about the company’s growth strategies and its ability to further expand its business over the long-term.

Read full Disclosure