ExxonMobil Corporation (NYSE: XOM) grabbed many eyeballs on Tuesday after two of its associates in Canada agreed to sell their stakes in XTO Energy Canada ULC. The buyer in the transaction is Whitecap Resources Inc.

Shares of the $385.5-billion oil and gas exploration and production company rose 2.7% to close at $91.50 on Tuesday. The stock inched up another 0.2% in the extended trading session.

Inside the Headlines

XTO Energy Canada is a producer of oil and natural gas in Western Canada. ExxonMobil Canada Ltd. and Imperial Oil Resources Ltd. are the owners of XTO Energy Canada.

The assets to be sold include holdings in the Duvernay shale (72 thousand net acres), the Montney shale (567 thousand net acres), and Alberta region. These assets produce nine thousand barrels of crude, natural gas liquids, and condensate per day, and 140 million cubic feet of natural gas daily.

The sellers will receive $1.47 billion of cash consideration from Whitecap Resources. The completion of the transaction, expected in the third quarter of 2022, is subject to the receipt of regulatory approvals.

The transaction is in line with ExxonMobil’s efforts to use the majority of its resources in the upstream operations of important assets.

Stock Rating

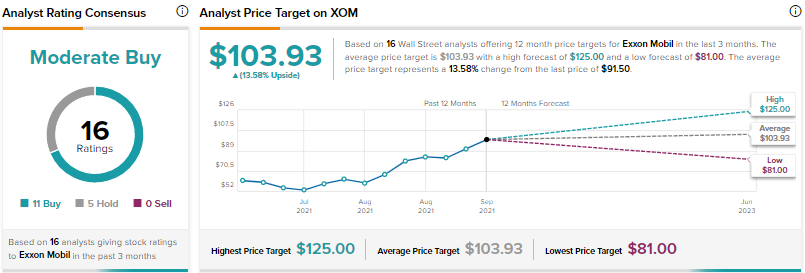

On TipRanks, Exxon has a Moderate Buy consensus rating based on 11 Buys and five Holds. Exxon’s average price forecast of $103.93 suggests 13.58% upside potential from current levels. Over the past year, shares of XOM have grown 46.1%.

Eight days ago, Jeanine Wai of Barclays maintained a Buy rating on XOM with a price target of $111 (21.31% upside potential).

Bloggers Are Bullish

According to TipRanks, financial bloggers are 90% Bullish on XOM versus the sector average of 74%.

Conclusion

The decision to divest XTO Energy Canada has been taken in the best interest of shareholders. Resources from this transaction may be used in strengthening other important operations of the company.

Read full Disclosure