Euro Forecast: ECB Reveals Anti-Fragmentation Measures – Setups For EUR/GBP, EUR/JPY, EUR/USD

ECB’S NEW PLAN REVEALED

June has been a chaotic month for the Euro, trading in ranges around and north of +/-4% versus its major counterparts. Why? At first, it was the June European Central Bank policy meeting that spooked investors into thinking a Eurozone debt crisis redux could be around the corner.

Then the Governing Council had an emergency meeting less than a week later in order to calm down Eurozone sovereign bond markets. Like in the early- and mid-2010s, peripheral bond yields, particularly those in Greece and Italy, began to widen out rapidly versus their core (e.g. Dutch, French, and German) counterparts.

Details of how the ECB plans to prevent spreads from widening out again have now emerged. According to Reuters, based on conversations held with ECB policy officials at their annual conference in Sintra, Portugal, the ECB will take proceeds from maturing Dutch, French, and German debt and purchase Greek, Italian, Portuguese, and Spanish debt. Yes, the PIGS are back.

It’s too soon to say whether or not the ECB’s plan will work. But for now, markets are taking the news kindly: the Euro has reversed its losses on the session, erasing some of its losses over the past few days in process. It remains the case that EUR/JPY and EUR/GBP rates remain on the path of bullish breakouts, while EUR/USD rates continue to trade into the middle of a range carved out since late-April.

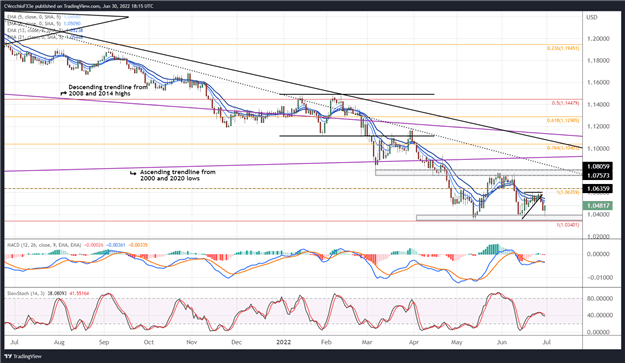

EUR/USD RATE TECHNICAL ANALYSIS: DAILY CHART (JUNE 2021 TO JUNE 2022) (CHART 1)

EUR/USD rates broke out of a short-term ascending triangle to the downside earlier this week, but found support in a familiar region around 1.3049/97, range support over the past two months. It’s very much the case that, despite the volatility in recent days, the range in place since late-April continues to define price action. EUR/USD rates are below their daily 5-, 8-, 13-, and 21-EMAs, and the EMA envelope is in bearish sequential order. Daily MACD is trending lower below its signal line again, while daily Slow Stochastics have turned lower below their median line. Nevertheless, as stated last week, “range trading remains the preference until either support around 1.0349/97 breaks to the downside or resistance around 1.0757/1.0806 is breached to the upside.”

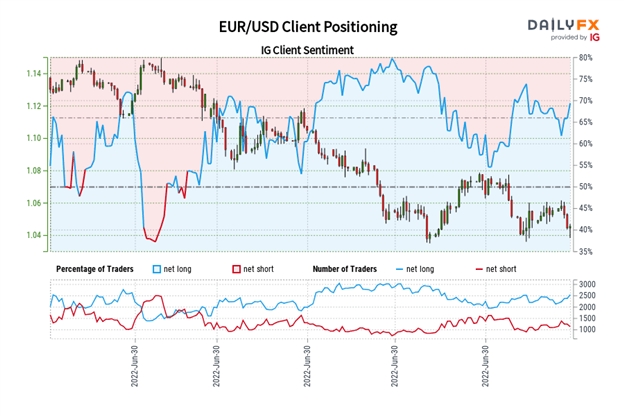

IG CLIENT SENTIMENT INDEX: EUR/USD RATE FORECAST (JUNE 30, 2022) (CHART 2)

EUR/USD: Retail trader data shows 70.26% of traders are net-long with the ratio of traders long to short at 2.36 to 1. The number of traders net-long is 8.51% higher than yesterday and 8.11% higher from last week, while the number of traders net-short is 11.09% lower than yesterday and 0.45% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

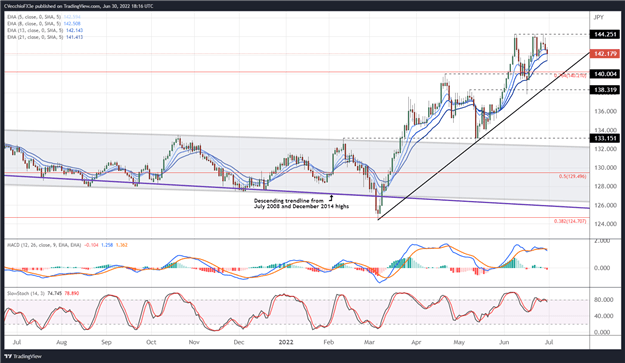

EUR/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (JUNE 2021 TO JUNE 2022) (CHART 3)

Last week it was noted that “a return to the 2022 high at 144.25 appears likely,” which is what happened this past Tuesday. But no breakout transpired, with the pair continuing to hold within the confines of an ascending triangle carved out dating back to the March low. Momentum is slightly less bullish, with the pair below its daily 5-, 8-, and 13-EMAs, but the EMA envelope is in bullish sequential order. Daily MACD is trending lower albeit above its signal line, while daily Slow Stochastics are straddling overbought territory. A bullish breakout attempt above 144.25 may still be in the cards.

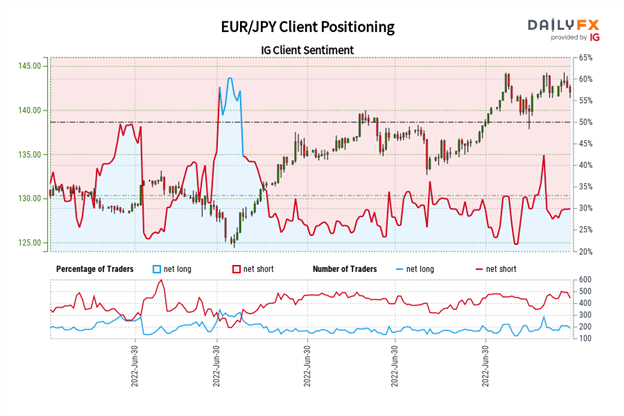

IG CLIENT SENTIMENT INDEX: EUR/JPY RATE FORECAST (JUNE 30, 2022) (CHART 4)

EUR/JPY: Retail trader data shows 29.94% of traders are net-long with the ratio of traders short to long at 2.34 to 1. The number of traders net-long is 3.74% higher than yesterday and 13.45% higher from last week, while the number of traders net-short is 6.39% lower than yesterday and 12.36% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/JPY prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/JPY price trend may soon reverse lower despite the fact traders remain net-short.

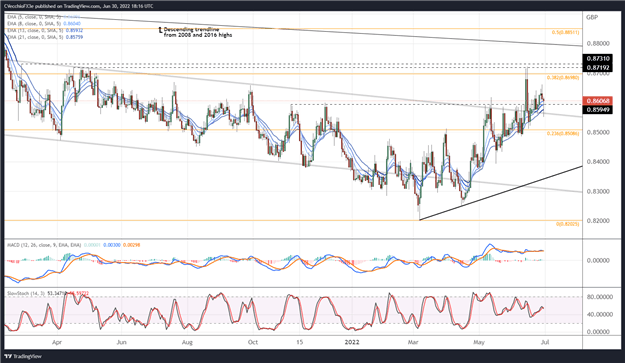

EUR/GBP RATE TECHNICAL ANALYSIS: DAILY CHART (FEBRUARY 2021 TO JUNE 2022) (CHART 5)

EUR/GBP rates have posted a major bullish reversal today, with the wick of a daily hammer candle piercing each of the daily 5-, 8-, 13-, and 21-EMAs. Notably, the pair found support at former descending channel resistance in the process, reaffirming the outlook that a bullish breakout is in process. Thus, on balance, when looking at closing prices, nothing has really changed: EUR/GBP rates are continuing along a slow, steady grind to the topside. Momentum indicators remain tilted bullish, with daily MACD trending higher above its signal line, while daily Slow Stochastics have stabilized around their median line. It remains the case that “a slow, steady grind towards the 38.2% Fibonacci retracement of the 2020 high/2022 low range at 0.8698” is still in the cards.

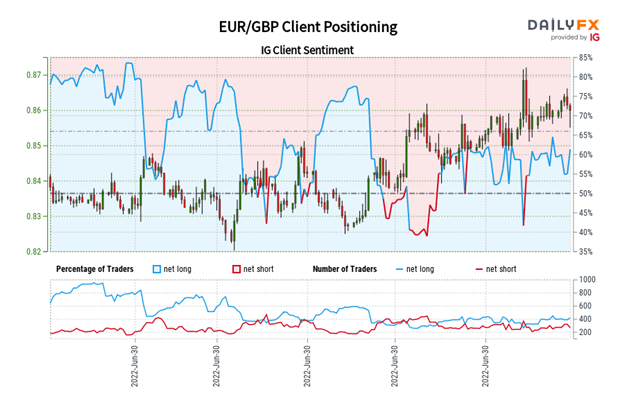

IG CLIENT SENTIMENT INDEX: EUR/GBP RATE FORECAST (JUNE 30, 2022) (CHART 6)

EUR/GBP: Retail trader data shows 63.91% of traders are net-long with the ratio of traders long to short at 1.77 to 1. The number of traders net-long is 13.68% higher than yesterday and 5.47% lower from last week, while the number of traders net-short is 23.27% lower than yesterday and 3.56% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/GBP prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/GBP trading bias.