Warren Buffett Stocks: Kroger Co.

Berkshire Hathaway (BRK-B) has an equity investment portfolio worth more than $360 billion as of the end of the first quarter of 2022. That makes it one of the largest investment firms in the world, particularly as it invests its own capital.

Berkshire Hathaway’s portfolio is filled with high-quality stocks, mostly ones that pay reliable dividends to shareholders. The good news is that it is possible to follow large investors like Berkshire Hathaway through 13F filings. These required filings allow investors to understand what large investors buy and sell each quarter. Given this, investors can follow Berkshire Hathaway’s moves and evaluate accordingly for their own portfolios.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Buffett’s Berkshire Hathaway owned about 58 million shares of Kroger Co. (KR), for a market value of about $2.8 billion. While this is just under 1% of Berkshire’s total equity portfolio, it represents an 8% position in Kroger shares, making Berkshire a significant shareholder.

In this article, we’ll take a detailed look at Kroger’s prospects as an investment today.

Business Overview

Kroger is a grocery retail chain in the US. The company operates supermarkets that contain both food and drug stores, hardline and softline retail, and fuel. The company operates about 1,600 fuel centers in the US, and about 2,700 supermarkets under various brands.

Kroger has a chain of namesake stores, but it has many other brands, including jewelry stores, various other grocery chains, and more. The company’s total footprint spans 35 states in the US, and the company employs more than 400,000 people. Kroger was founded in 1883, generates about $147 billion in annual revenue, and trades with a market cap of $35 billion.

Kroger reported first quarter earnings on June 16th, 2022, and results were well ahead of expectations on both the top and bottom lines. Total revenue was up 8% year-over-year, beating estimates by $1.55 billion at $44.6 billion. Earnings-per-share on an adjusted basis came to $1.45, which was 17 cents ahead of estimates.

Comparable sales were up 4.1% without fuel, lead by Fresh Department comparable sales of +5.2%, and its private label brands producing 6.3% higher sales.

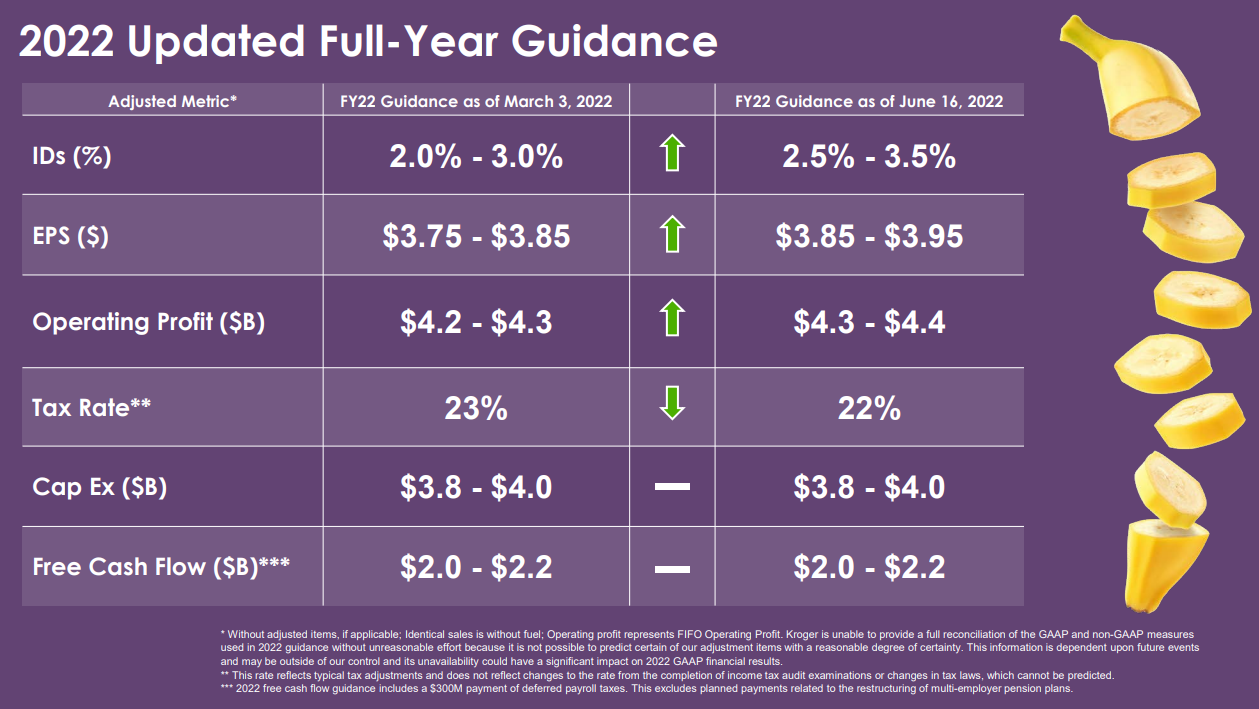

Kroger repurchased $665 million, and there’s $301 million remaining following Q1 results. Kroger boosted guidance for the year to sales ex-fuel of +3%, and for adjusted earnings-per-share to be around $3.90. Operating income guidance was boosted slightly, and the company expects a modestly lower tax rate, the combination of which was responsible for the earnings-per-share bump.

Source: Investor presentation, page 8

Free cash flow is expected to be in excess of $2 billion this year, which is unchanged from prior guidance, but was good enough for management to boost its dividend by 24% to a new payout of 26 cents per share quarterly. That is Kroger’s 17th consecutive year of dividend increases.

Following Q1 results, we updated our estimate accordingly to $3.90 in earnings-per-share.

Growth Prospects

Kroger has posted outstanding growth in the past decade, averaging more than 11% expansion annually. However, part of this was driven by the Harris Teeter acquisition, as well as pandemic-fueled earnings as grocery stocks became hugely in demand as restaurants and food service shut down during the pandemic. Therefore, we don’t see 11% as sustainable, and rather, we estimate 3% growth going forward.

We believe Kroger can achieve this growth through modest sales increases of around 1% to 2% annually, a very small measure of margin expansion as it leverages costs down with a higher top line, and share repurchases. We see the combination of these factors as sufficient to produce 3% annual earnings-per-share growth, but believe that Kroger will find it difficult to grow much more than that. The pandemic brought forward a huge amount of earnings growth, and now that the earnings base is quite high, growth from here will likely prove difficult.

Competitive Advantages & Recession Performance

Competitive advantages can be difficult to come by in a commoditized industry, such as grocery retail. As a result, we believe Kroger lacks a moat against the competition. However, Kroger is a well-entrenched incumbent with decades of brand recognition with consumers, in addition to massive scale. It is one of the largest retailers in the US by revenue, which we believe helps it compete on price. In a commoditized industry, competing on price is quite valuable.

Kroger should see strong recession resilience given it sells mostly consumer staples, which shouldn’t see meaningfully lower demand during recessions. In addition, the company produces much more cash every year than is needed to run the business and pay the dividend, so even if earnings were to decline, we see the dividend as safe. The payout ratio for this year is just 27% of earnings, even accounting for the large dividend increase.

Valuation & Expected Returns

Kroger’s resurgence during and after the pandemic saw the valuation of the stock reflate to normalized levels. While that was great for shareholder returns, it means that looking forward, prospects are more muted. Shares trade today for 12.1 times earnings, which is still under our fair value estimate of 13 times earnings. Should the valuation tick higher over time to fair value, we’d expect a modest 1.5% tailwind to total returns.

The dividend yield is 2.2% today, following the big recent increase, and we expect 3% earnings-per-share growth. All told, we believe Kroger can produce 6.5% total returns in the years to come which is good enough for a hold rating.

Final Thoughts

Kroger offers investors a safe, defensive stock that pays a market-beating yield and should be quite resilient during recessions. However, the stock is very near fair value, and its growth prospects aren’t particularly enticing. Given these factors, and 6.5% estimated annual total returns, we see Kroger as a hold for defensive, income-oriented investors.