Small-cap investing might seem like one of the most contrarian ideas in the face of a recession, but with the space having already priced in recession risk, there are undeniable valuation opportunities happening within small-caps right now, if you don’t mind riding out the volatility.

“The prospect of a Fed-induced recession to combat historical inflation has priced in valuation discounts so steep they’re difficult to ignore. If history is any indication, the future for small caps may be brighter than the grim near-term forecasts suggest,” wrote Brian Manby, senior analyst, research at WisdomTree, in a recent blog post.

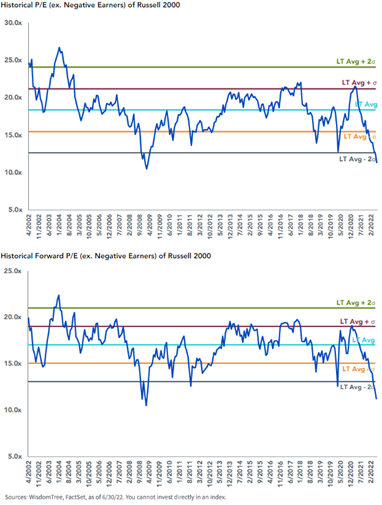

Small-cap markets are known to be riskier in general because of the higher number of companies that aren’t profitable, particularly so in challenged economic times. Manby explained that even when these unprofitable companies are taken out of the Russell 2000 Index, the price-to-earnings and forward price-to-earnings ratios are deeply discounted at historic lows.

Image source: WisdomTree blog

The P/E of the Russell 2000 and the forward P/E ratio are trading well below their long-term averages; volatility in May sent P/E two full standard deviations below the average, and they are currently at a 30% discount with a range between 12x–13x.

Markets have already priced in recession risks for small-caps much heavier than their large- and mid-cap counterparts, largely because of the disproportionate affect on margins and earnings for small businesses in a recessionary environment. Whereas small-caps have historically operated at a 5% P/E premium compared to large-caps, that relationship has slowly eroded in recent years.

The forward P/E ratio of the Russell 2000 to the Russell 1000 (a large-cap representative) is less than the long-term average, and the same is true for mid-caps as well.

“For those who believe a recession is imminent, it is understandably counterintuitive to dignify an asset class notoriously sensitive to economic growth amid rising interest rates and expectations of reduced earnings and profit margins,” Manby said. “But for the intrepid small-cap investor, the future has historically looked bright after similar periods.”

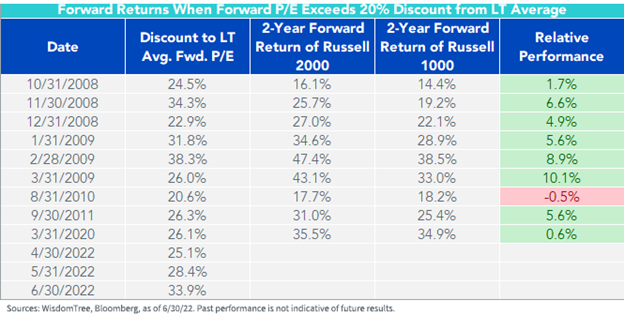

Over the course of the last 20 years, small-caps have fallen below a 20% discount compared to their forward P/E long-term average just nine times. Eight of those times saw small-caps recover and go on to outperform their large-cap peers by around 5% over a two-year period. A number of these instances happened after major economic downturns, such as the beginning of the COVID-19 pandemic and the Financial Crisis, and saw small-caps benefit from a tailwind.

Image source: WisdomTree blog

The Small-Cap Play With WisdomTree

A popular choice this year for advisors and investors has been dividends, and the WisdomTree US SmallCap Quality Dividend Growth Fund (DGRS) offers a smart play within the small-cap space. DGRS invests in small-cap U.S. equity companies that pay dividends and display growth characteristics, and it applies a quality and growth screen to securities. The fund seeks to track the WisdomTree U.S. SmallCap Quality Dividend Growth Index, a fundamentally weighted index based on dividend projections for the next year that screens U.S. small-cap companies for long-term earnings growth expectations, return on equity, and return on assets.

Another dividend play is the WisdomTree U.S. SmallCap Dividend Fund (DES), which invests in dividend-paying small-cap companies from U.S. equity markets. The fund seeks to track the WisdomTree U.S. SmallCap Dividend Index, an index comprised of the bottom 25% of dividend-paying companies by market cap that make up the WisdomTree U.S. Dividend Index after the 300 largest companies have been removed. The index is fundamentally weighted based on dividend projections for the next year.

The WisdomTree U.S. SmallCap Fund (EES) offers broad exposure to U.S. equity small-cap companies and seeks to track the WisdomTree U.S. SmallCap Index. The index is fundamentally weighted based on aggregate earnings of small-cap companies, and companies must have a P/E ratio of at least 2 for inclusion. The fund invests 95% of its assets in the index or similar securities under normal conditions.

For more news, information, and strategy, visit the Modern Alpha Channel.