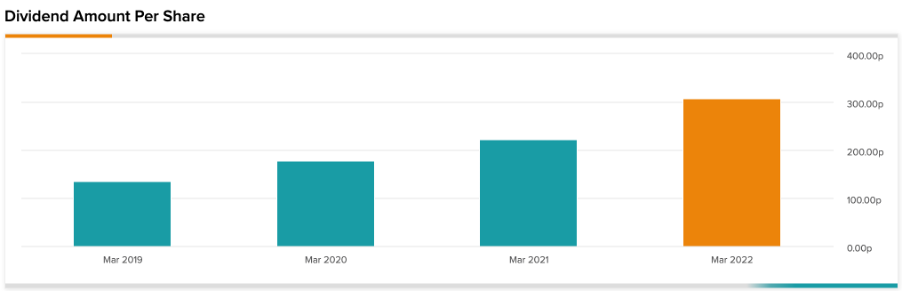

Rio Tinto (GB:RIO) has posted its interim results for H1 2022. The company’s operations were hit by falling iron ore prices and higher inflation rates harmed their profitability. As a result, it slashed its ordinary dividend per share by 29% to $2.67 and also cancelled its special dividend, unlike last year. Investors are concerned, but do not seem deterred from buying this dividend gem.

The company’s net earnings fell by 28% to $8.9 Million. Net cash from operating activities was at $10.5 Billion, which was 23% lower than the H1 of 2021.

The share price of the company remains highly volatile, just like the commodities it deals in. In the last three years, the stock is up by 37.6%, and then down by 12.3% year-over-year.

It’s still dividend heaven

Despite the cut, this year’s interim dividend remains the company’s second highest payout at 50% of underlying earnings. For the full year 2021, the company had a payout of 79%, which was the highest so far.

The dividends in 2021 also included a special dividend of $2.47, so the comparison might be unfair. Also, in 2021, the earnings were largely enhanced by soaring commodity prices after the pandemic.

Rio implemented a dividend policy in 2016, to keep its payout between 40 and 60% of its underlying earnings. Considering this, this payout is right in the middle of the range despite the fall in earnings. If we go a little back and see Rio’s dividend payout ratio, it has an average of 74% over the past six years. This is a testament to the company’s policy of returning value to its shareholders.

The company expects to hit this range in the future and will also reward shareholders with special dividends considering the volatile nature of its business.

Rio’s dividend yield is pretty impressive at 12.06% as compared to the sector average of 1.9%.

The main culprits – Weak demand in China and falling iron ore prices

Rio Tinto is a leading mining company and it operates in the exploration, mining, and processing of mineral resources. The company has a huge dependency on iron ore and it generates the majority of its revenues from it. Therefore, the falling iron ore prices have directly affected its results.

Rio supplies a huge amount of its iron ore to China, which is the biggest market. However, the decline in China’s real estate and construction sectors has affected the company’s sales. The demand from China will not recover any time soon, as the economy is headed towards an economic slowdown. The restrictions on carbon emissions have hit the iron ore and steel production industries with a strong hammer.

As a result of this gloomy outlook, iron ore prices fell below $100 a tonne in July 2022.

To minimise this dependency, the company is focusing on other metals such as lithium, which is called the metal of the future. Lithium will power electric transportation in the future and will have a huge demand from markets such as India.

The company has completed the acquisition of the Rincon lithium project in Argentina, which has a capacity of 3,000 tonnes per year. Rio will spend $190 Million to start a lithium carbonate plant, which will start production in 2024.

View from the city

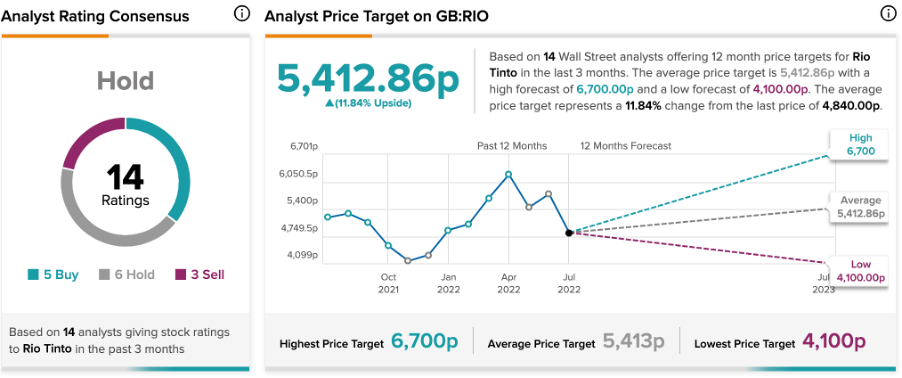

According to TipRanks’ analyst rating consensus, Rio Tinto stock is a Hold. The company has a total of 14 ratings, including five Buy, six Hold, and three sell recommendations.

The average price target is 5412.9p, with a high and a low forecast of 6,700p and 4,100p, respectively. The price target implies around 11.84% of upside potential.

Analysts have reiterated the stock’s Buy and Hold ratings, after the announcement of results.

Liam Fitzpatrick of Deutsche Bank has kept the target price unchanged but has the highest upside potential of 18.7% on the target price.

Liam was ranked 1,255 out of 7,949 analysts on TipRanks. Overall, Liam has a 51% success rate and an average return of 8.2%.

Conclusion

The near-term outlook for iron ore and base metals remains weak. The demand from China will decrease in the future, but other markets and metals would make up for that.

In the long-term, the company is on track to reduce dependency on fossils and transform into a green energy player. And the icing on the cake is the dividend policy with the payout of between 40-60% of earnings. Overall, the sentiment on the stock remains bullish.