Investors weren’t expecting much from tech giant Amazon’s (AMZN) second-quarter earnings. AMZN stock had shed more than 20% of its value coming into its quarterly update. However, it proved the naysayers wrong with its recent second-quarter earnings report, which showed why the e-commerce specialist is one of the biggest winners in the market. Hence, we are bullish on AMZN stock at this time.

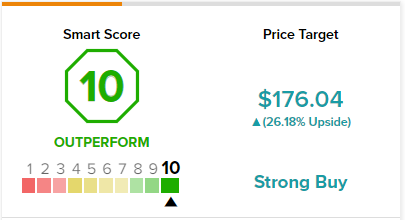

Also, on TipRanks, AMZN has a ‘Perfect 10’ Smart Score rating. This indicates a high chance for the stock to outperform the broader market.

Despite a challenging environment, Amazon was able to weather the storm and speed past analyst expectations and its own guidance. Its stellar results were led by its cloud titan Amazon Web Services (AWS), which continues to grow rapidly.

Additionally, its Advertising revenue is also on the move. The importance of the two segments to earnings was alluded to by my colleague Shrilekha Pethe. Long-term stock investors breathed a sigh of relief and have much to celebrate over the company’s future.

Impressive Revenue and Earnings Beat Points to Greater Upside Ahead

As stated earlier, market analysts and investors weren’t expecting much from Amazon’s second-quarter results. Hence, the earnings surprise kick-started a rally in AMZN stock which is quite the anomaly in the current bear market. It delivered strong beats against analyst estimates and came above the management’s top-end guidance.

Sales came in at an impressive $121.2 billion for the quarter, beating analyst expectations by about $2 billion. Moreover, management guided revenues to fall between the $116 billion and $121 billion mark. Given the tough macroeconomic conditions at this time, the revenue beat is a testament to the strength of its businesses.

Furthermore, it also came in around the top end of its operating earnings guidance of $4 billion, achieving a handsome $3.3 billion. AMZN reported a net loss for the period at $2 billion, which includes the $3.9 billion loss associated with its investment in Rivian automotive. Excluding its Rivian investment, it would’ve posted an impressive net profit figure. Adjusted EPS came in at $0.18, beating estimates of $0.13.

Its third-quarter update also came in virtually in line with analyst estimates. The midpoint of its $125 million to $130 billion guidance was slightly ahead of analysts’ estimates of $127 billion. Moreover, earnings could comfortably surpass analyst estimates for the third quarter as well.

AWS Never Ceases to Amaze

AWS has been the crown jewel for Amazon over the past several years. It’s arguably the company’s future as it looks to focus more on high-margin, recurring revenue areas. Moreover, it continues to take up a hefty share of Amazon’s total sales every quarter. During the second quarter, it once again had a tremendous showing, posting double-digit growth.

Over the past 12 months, AWS generated strong operating profits, which continues to be a main growth driver for the business. It boasts an incredible EBIT of $22.4 billion, with sales of $72.1 billion in the past year. Moreover, it generated operating margins of 31% during the same period.

During the second quarter, AWS sales grew 33% compared to last year’s figures. Investors should look for the segment to continue growing at an incredible pace and becoming a major contributor to sales. According to the company CFO Brian Olsavsky, AWS is “still in the early stages of enterprise and public sector adoption of the cloud.” Moreover, he sees massive opportunities ahead to take the segment’s multi-billion dollar annual run rate to even greater heights.

AWS has had the first-mover advantage in the space, having been founded in 2006, two years before Google Cloud and Azure. Though it moved at a sluggish pace early on, it has quickly established itself as a growth juggernaut. It is the number one cloud business and has led the digital transformation trend. Therefore, it should continue to grow sensationally for the foreseeable future.

Wall Street’s Take on AMZN Stock

Turning to Wall Street, AMZN stock maintains a Strong Buy consensus rating. Out of 40 total analyst ratings, 39 Buys, one Hold, and zero Sell ratings were assigned over the past three months.

The average AMZN price target is $176.04, implying 26.2% upside potential. Analyst price targets range from a low of $118 per share to a high of $270 per share.

Conclusion: Amazon Impressed the Market and Can Keep Doing So

Amazon surprised analysts with its second-quarter results, reiterating its bull case repeatedly. Its stock went on a post-earnings rally, and if investors were psyched over its second quarter, they should be elated with its outlook. It expects 13% to 17% year-over-year growth in Q3, comfortably exceeding current results. Combine that with the spectacular performance from AWS, and you’re left with a business that should continue impressing the stock market.