Is There Any Chance Of An Interest Rate Cut In 2023?

As investors navigate the uncertain economic environment, the question on everyone’s mind is: when will the Fed pivot? With the U.S. economy slowing and unprecedented debt levels putting America in a precarious position, the consensus assumes that the Fed will let inflation rage to avoid widespread bankruptcies. Therefore, gold, silver, and mining stocks will surge as the dovish pivot approaches.

It’s Not a Choice

Moreover, our subscriber shared an article that outlines “why the Fed will have to change course.” In a nutshell: it presents the same arguments that perma-investors have cited since the Fed threatened to taper its asset purchases. However, while these narratives garner plenty of attention, they’re out of touch with economic reality and historical precedent.

For example, I’ve stated on many occasions that dealing with inflation is not a choice, and while the consensus assumes that a Fed pivot will set everything alight, a realization is the worst-possible economic outcome.

To explain, let’s conduct a history lesson. The Fed wrote an essay about “The Great Inflation” from 1965 to 1982. Moreover, when discussing the origins of the crisis, the report stated:

“Motivated by a mandate to create full employment with little or no anchor for the management of reserves, the Federal Reserve accommodated large and rising fiscal imbalances and leaned against the headwinds produced by energy costs. These policies accelerated the expansion of the money supply and raised overall prices without reducing unemployment.”

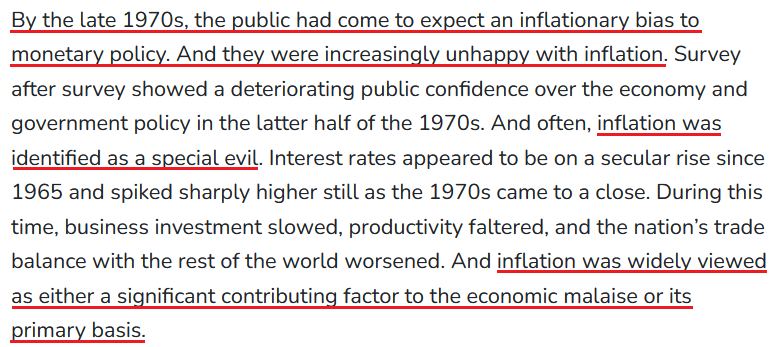

Sound familiar? More importantly, when inflation raged and a weakened U.S. economy led to a rise in unemployment, Americans and politicians soon realized that inflation was the greater evil. The report stated:

“As businesses and households came to appreciate, indeed anticipate, rising prices, any trade-off between inflation and unemployment became a less favorable exchange until, in time, both inflation and unemployment became unacceptably high. This, then, became the era of ‘stagflation’.”

“In 1964, when this story began, inflation was 1 percent and unemployment was 5 percent. Ten years later, inflation would be over 12 percent and unemployment was above 7 percent. By the summer of 1980, inflation was near 14.5 percent, and unemployment was over 7.5 percent.”

Remember, inflation is like termites; it eats away at the U.S. economy until it crumbles. Therefore, the greater risk is not curbing inflation. The report continued:

“Once in the position of having unacceptably high inflation and high unemployment, policymakers faced an unhappy dilemma. Fighting high unemployment would almost certainly drive inflation higher still while fighting inflation would just as certainly cause unemployment to spike even higher.”

However, with the destructive nature of inflation now obvious (we’re not there yet in 2022), the answer to the “trade-off” was clear, and the narrative shifted dramatically. For starters:

Source: U.S. Fed

Then:

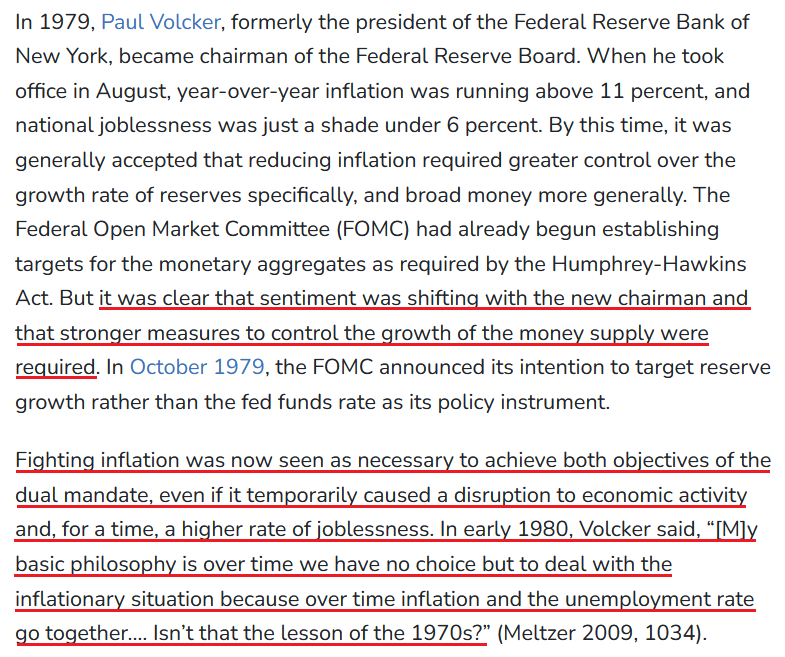

Source: U.S. Fed

As such, the idea that the Fed can pivot and inflation will subside may be the biggest bubble in the financial markets. Not only does it lack economic logic, but it is antithetical to historical precedent. To that point, while the chorus calls for Fed easing, I warned on Aug. 5 that unanchored inflation forced the Fed to raise interest rates during the 1970s and 1980s recessions. I wrote:

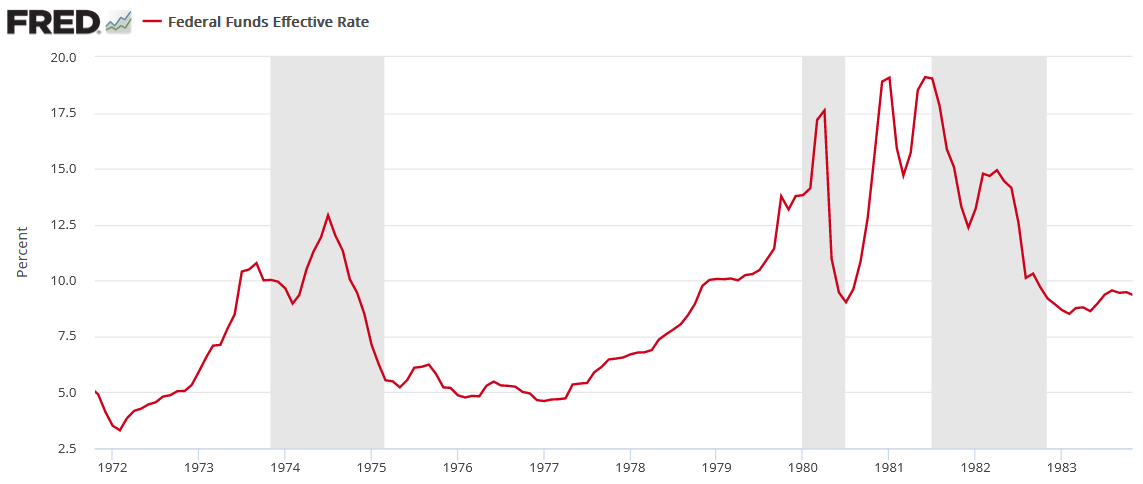

To explain, the red line above tracks the FFR during the 1970s and 1980s, and the vertical gray bars represent recessions. For one, unanchored inflation forced the Fed to raise interest rates during (not just before) all three recessions. In addition, the ~1974 and ~1982 recessions show how after the Fed cut rates to support economic growth, the central bank had to reverse course and raise the FFR once again. As such, the consensus underestimates how difficult it is to slay inflation once it gets going.

Furthermore, it’s important to remember that Arthur Burns was the Fed Chairman from 1970 to 1978, and he was much less hawkish than Paul Volcker (who was Chairman from 1979 to 1987). As a result, the rate cuts on the chart above that began in 1973 and then reversed sharply higher in 1974 were administered by Burns. However, when the Richmond Fed did a post-mortem on the monetary mistake, the findings mirrored the false narratives that are prevalent today. An excerpt read:

“Volcker still deserves credit for resisting political pressure to ease during the 1981–82 recession, which might have led to a continuation of the stop-go approach the Fed was seen as pursuing under Burns. What distinguishes Volcker from Burns in the minds of many is the fact that he followed through after initial disinflationary policy moves, a consistent approach that helped build and maintain the Fed’s credibility for keeping inflation in check.”

For context, a “stop-go approach” means the Fed cuts interest rates and then has to raise them once again. However, the mistakes of the past highlight how the Fed’s inflation gambit ends the same either way.

Please see below:

Source: Richmond Fed

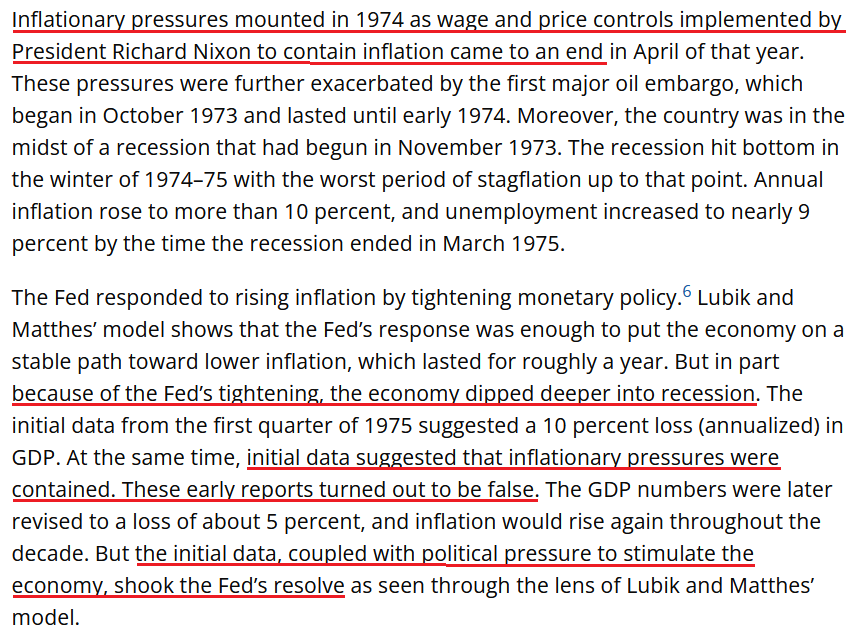

Thus, doesn’t that also sound familiar?

- We have politicians redefining the definition of a recession while investors clamor for a dovish pivot.

- The slightest drop in commodity prices, inflation expectations or the Consumer Price Index (CPI) is heralded as “peak inflation,” and therefore, the Fed can ease.

As such, Fed Chairman Jerome Powell can follow Volcker's path and raise the U.S. federal funds rate (FFR) to capsize inflation. Or, he can follow Burns' path and implement a "stop-go approach." However, history shows that both paths end with a much higher FFR.

Furthermore, don't you think that investors were calling for dovish pivots in the 1970s and 1980s? The Richmond Fed cited how "political pressure to stimulate the economy shook the Fed's resolve." As a result, it's naïve to assume that politicians and investors didn't argue about why the Fed needed to pivot back then.

However, the common denominator is that inflation didn't (and doesn't) magically disappear. In reality, the economic pain is needed to reduce the pricing pressures. Thus, while I've stated it several times, if Powell chooses Burns' path, the culminating recession will be much worse than if he chooses Volcker's path.

Fade the Squeeze

With gold, silver, and mining stocks rallying on Aug. 8, you may be a little unsettled by the recent price action. However, it’s important to understand the drivers of the move, and why the optimism is unlikely to last. To explain, I wrote on Aug. 5:

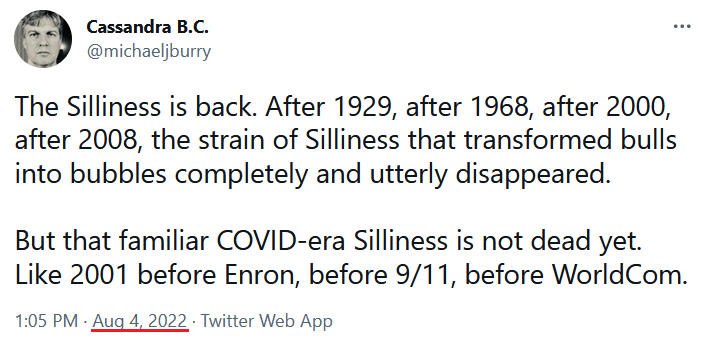

While the financial markets have turned back the clock to the summer of 2020, the fundamental environment couldn’t be more different. Moreover, with gold, silver, and mining stocks benefiting from speculative fervor, fighting inflation should prove more challenging than investors realize (…). Michael Burry – who is famous for shorting the housing market in 2008 – highlighted retail investors’ renewed “Silliness” on Aug. 4.

Please see below:

Therefore, with the “Silliness” continuing on Aug. 8, the rising tide helped uplift the PMs.

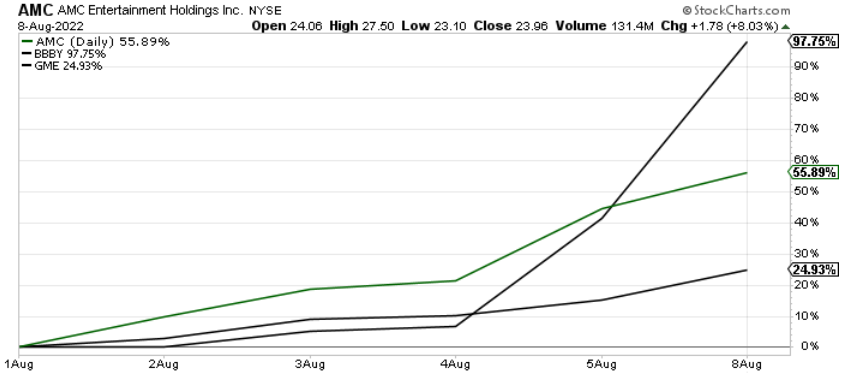

Please see below:

To explain, the green and black lines above track the one-week performances of meme stocks like GameStop. AMC and Bed Bath & Beyond. As you can see, the latter has soared by nearly 100% as the bubble buyers reasserted themselves.

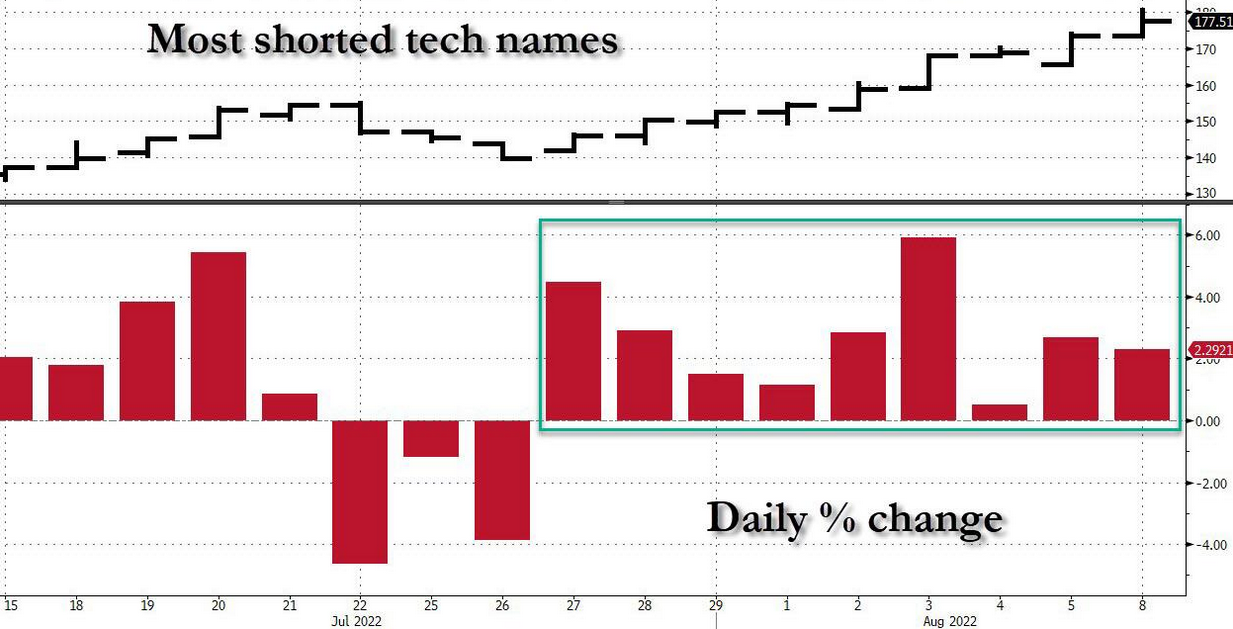

Likewise, Goldman Sachs’ basket of the most-shorted stocks has risen for nine straight days, matching the longest winning streak on record.

Please see below:

Source: Bloomberg/ZeroHedge

To explain, the red bars on the right side of the chart above highlight how the short squeeze has intensified as the most speculative U.S. stocks make a comeback.

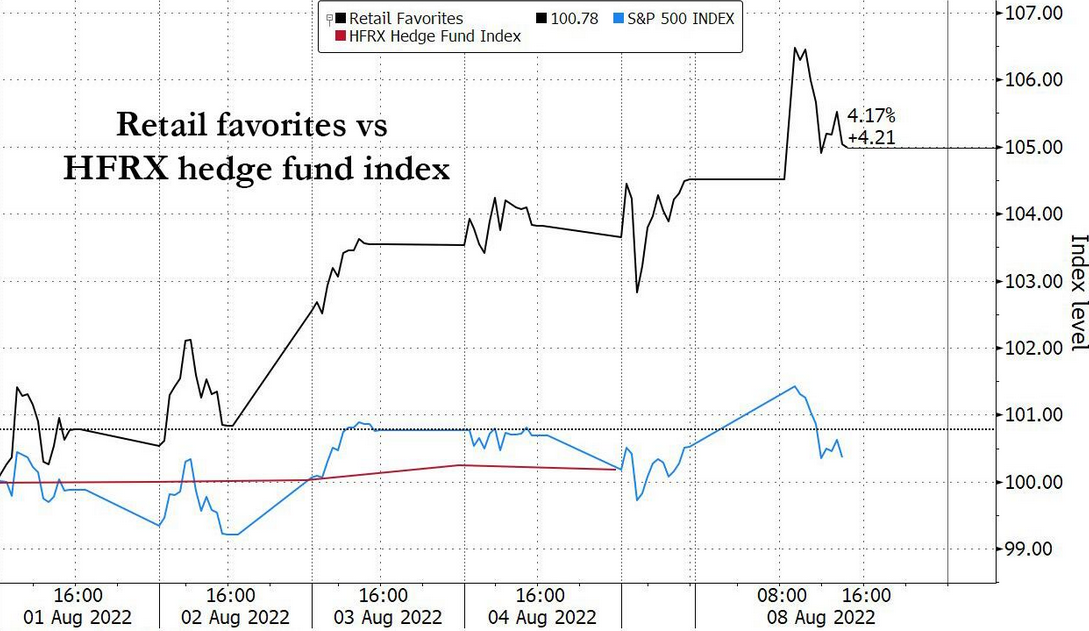

Furthermore, retail’s gain has been hedge funds’ pain.

Source: Bloomberg/ZeroHedge

To explain, the black line above tracks an index of retail investors’ favorite stocks, while the blue line above tracks the HFRX hedge fund index. If you analyze the relationship, you can see that the spiking retail basket has led to mixed performance as hedge funds scramble to unwind their short positions.

As a result, the above developments are the main drivers of the PMs’ recent strength. However, as 2021 showed, gravity is undefeated, and the gains are unlikely to hold.

The Bottom Line

Investors live on a faulty foundation of “this time is different.” First, inflation was a supply-side phenomenon. Then, it was broadening but still “transitory.” Now, we’ve reached neutrality and rate cuts can commence in 2023. However, the prospect is ridiculous, and while history highlights the catastrophic pitfalls of dismissing inflation, the consensus doesn’t learn from their mistakes. Moreover, with a meme stock like Bed Bath & Beyond nearly doubling in a week, does it seem like we’re anywhere near neutral?

In conclusion, the PMs rallied on Aug. 8, as the speculative frenzy continued. However, short squeezes were part of the PMs’ journeys to lower lows in 2021 and 2022, and this time should be no different. Therefore, it’s prudent to focus on the big picture and ignore the day-to-day noise.

More By This Author:

The Booming U.S. Economy Forces The Fed To Hit The Hawkish GasIs Gold Resting Before The Next Phase Of Major Decline?

Don’t Be Misled By Gold’s Recent Upswing

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more