Dominic Nash is the head of European utility research at Barclays, and is often bullish on the stocks of utility companies in the UK market.

United Utilities (GB:UU) and Drax Group (GB:DRX) are two stocks on which he has an 100% success rate.

Prior to joining Barclays in 2018, Nash led Macquarie’s utilities, renewables, infrastructure, and transportation research for five years.

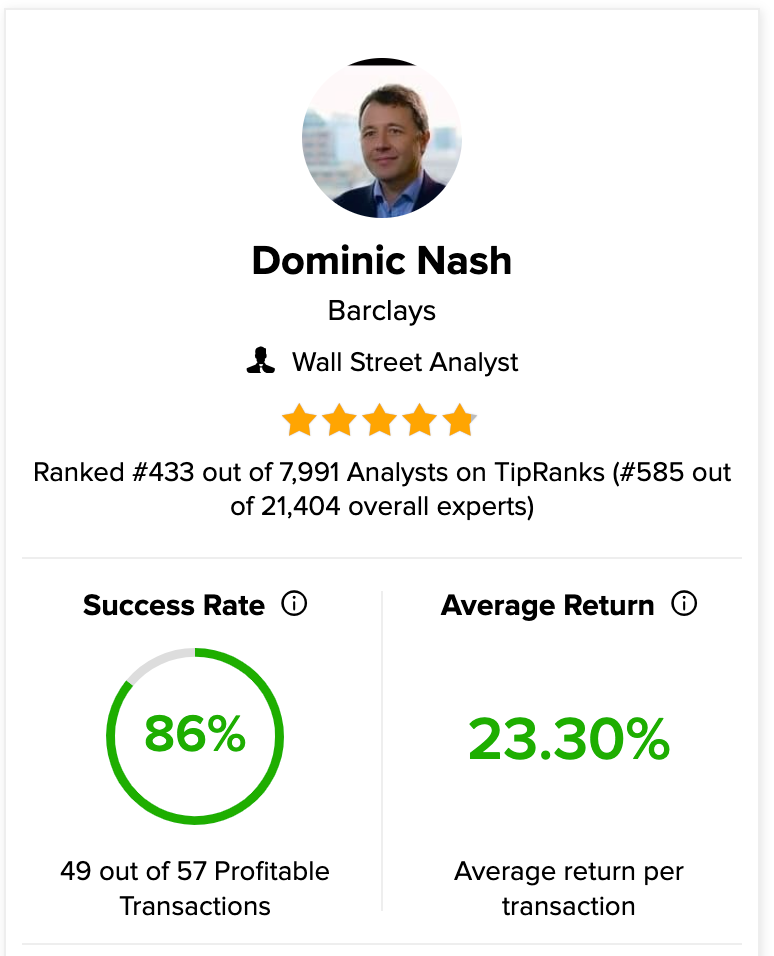

As per the TipRanks star rating system, he is a five-star rated analyst with a success rate of 86%. He is ranked 433 out of 7,991 analysts on TipRanks and 585 out of a total of 21,404 experts on the site.

The TipRanks Expert Centre rates the analysts on their success rates, average returns, and statistical significance. Investors can trust the analysts’ ratings and make better choices for their investments.

He has an average return of 23.3% per transaction.

Let’s discuss the two stocks in detail.

United Utilities – Hit by higher inflation costs

United Utilities offers water and wastewater services in the northwest of England.

The company posted a 3% increase in its revenues to £1.86 billion for the year ended March 31, 2022. Revenues were supported by higher demand from businesses as they opened up after the pandemic.

Underlying operating profit was up by 1.3% to £610 million. The profits were hit by higher operating costs from power and labour affected by higher inflation.

The company is not immune to the rising costs in the market, and it will impact profits in the near term. For the next financial year of 2022/23, operating costs are expected to increase by £100 million and finance expenses are expected to increase by £150 million year-over-year.

Even though inflation has hit costs hard, it has also improved the financial performance of the company. Considering this, it has invested an additional £765 million , which will generate higher growth over the next few years.

View from the city

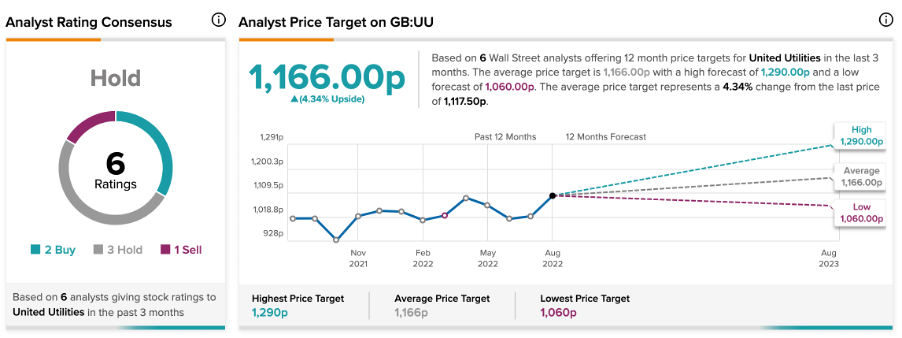

According to TipRanks’ analyst rating consensus, United Utilities stock is a Hold. The company has six ratings, including two Buy, three Hold, and one Sell.

The average price target is1,166p, which shows a change of 4.4% on the current price level of 1,117.

The price has a high forecast of 1,290p and a low forecast of 1,060p.

Drax Group – Riding high on more power

Drax Group is a renewable energy generation company in the UK. It owns renewable biomass and hydro assets to generate electricity.

The company’s recent half-yearly results saw its profit before tax increase to £200 million, up from £52 million last year. Adjusted EBITDA was up by 21% to £186 million. The company’s performance was mainly driven by solid power generation across its portfolio and better profits in the residential business.

Will Gardiner, chief executive at Drax Group, said, “We are accelerating our investment in renewable generation, having recently submitted planning applications for the development of BECCS at Drax Power Station and for the expansion of Cruachan Pumped Storage Power Station.”

“In the UK and the U.S. we have plans to invest £3bn in renewables that would create thousands of green jobs in communities that need them, underlining our position as a growing, international business at the heart of green energy transition.”

The company’s dividends are also sustainable, even though the yield of 2.45% is lower than the sector average of 3.09%. It announced an interim dividend of 8.4p per share in its recent results.

View from the City

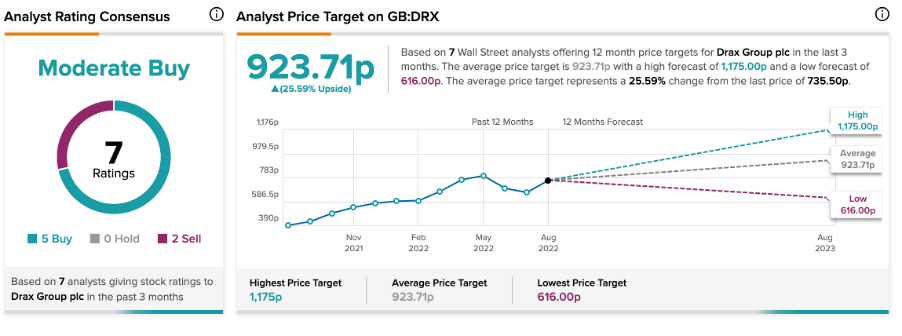

According to TipRanks’ analyst rating consensus, Drax Group stock has a Moderate Buy rating based on seven ratings. It includes five buy and two sell ratings.

The average price target is 923.7p, which is 25.6% higher than the current price level of 735p. The price has a high forecast of 1,175p and a low forecast of 616p.

Nash has generated a 68% average return per rating on this stock. His target price is 1,170p.

Conclusion

The stock of United Utilities has generated a 66% return for its shareholders in the last three years. The company’s profits are up for a hit in the near term due to inflationary costs, but overall the stock remains bullish.

Drax Group is optimising its production levels to meet the higher demands during winter. The mid-cap stock is not that widely known, but the outlook is encouraging and a further fall could make it more attractive for investors.