Join Our Telegram channel to stay up to date on breaking news coverage

Ethereum Classic (ETC) Price Prediction – August 11

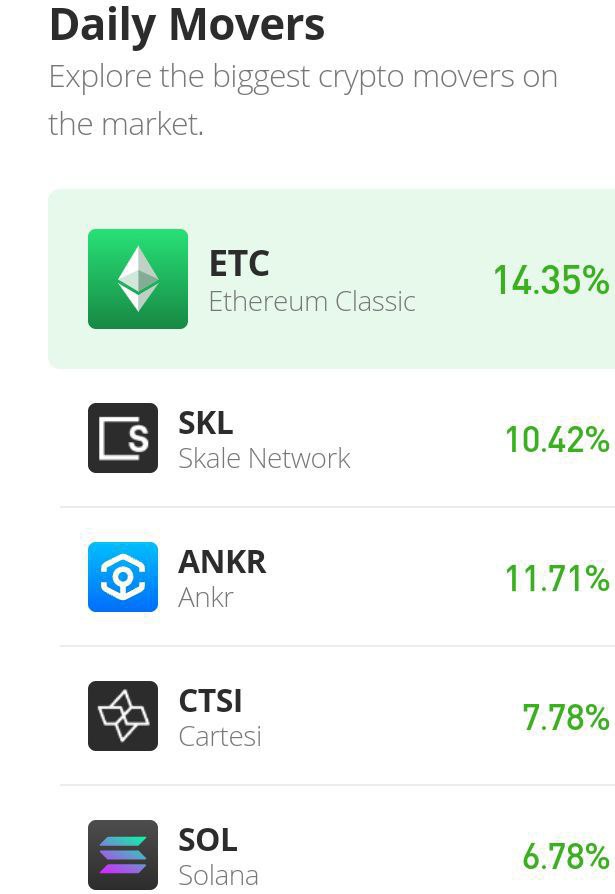

Over a couple of sessions, the Ethereum Classic market has a firm stance to trend higher against the valuation of the US fiat coin. The last six years of operation witnessed an all-time low of $0.4524 and an all-time high of $176.16 a year ago. As of the time of writing, the crypto’s price is around $43.06 at an average percentage rate of 10.85 positive.

Ethereum Classic Price Statistics:

ETC price now – $43.06

ETC market cap – 5.9 billion

ETC circulating supply – 136.3 million

ETC total supply – 210.7 million

Coinmarketcap ranking – #19

ETC /USD Market

Key Levels:

Resistance levels: $50, $60, $70

Support levels: $30, $25, $20

The daily chart showcases the Ethereum Classic trade operation may trend higher against the worth of the US currency in the following sessions. There has an interception of the 50-day SMA trend line at $26.4717 by the 14-day SMA trend line to position at $32.5656 at a point closer to the bottom trading spot of the current price. The horizontal line drawn at the $13 baseline support level shows the area where the market has been able to spring upward. The Stochastic Oscillators have moved southbound to the range of 20. And they are now trying to cross northbound from the range point.

Your capital is at risk.

Will the ETC/USD market continue to dominate the trading space in the long run?

The ETC/USD may trend higher through some resistance in the following operations that the crypto market will play a domineering object at the expense of the US Dollar weaknesses. At the moment, long-position placers may have to use the value of the 14-day SMA at $32.5656 as part of their yardstick to determine the critical point that the price may push back down to cause a deadlier-trading condition to invalidate the getting of sustainable ups.

On the downside of the technical, the ETC/USD market bears, going by the reading of the Stochastic Oscillators around the range of 20, lack the capacity strength to drive price aggressively in the direction of a downtrend to some extent. However, if the current bullish candlestick over the trend line of the smaller SMA eventually reverses for a correction, the indicator may experience lower lows in the aftermath.

ETC/BTC Price Analysis

Ethereum Classic trade has been on an increase-moving mode against the trending worth of Bitcoin over time. As it is, the cryptocurrency pair market may trend higher through other resistances in the subsequent operations. The bullish trend line drew slightly over the trend line of the 14-day SMA above the trend line of the 50-day SMA trend line. The Stochastic Oscillators have dipped into the oversold region, seemingly trying to cross the lines northbound to suggest the base crypto tends to push for more ups against its counter crypto in the near time.

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage