Investors are bracing for billions of dollars in losses due to lawsuits filed over the heartburn drug Zantac. The three U.K.-based drugmakers shed tens of billions of dollars from their market caps amid the potential for litigation in the U.S.

Although the issues and resulting lawsuits associated with Zantac have been widely known for years, the first legal proceeding in the case is scheduled for Aug. 22, which brought those concerns to the forefront of investors’ minds.

What Happened To Cause The Zantac Lawsuits?

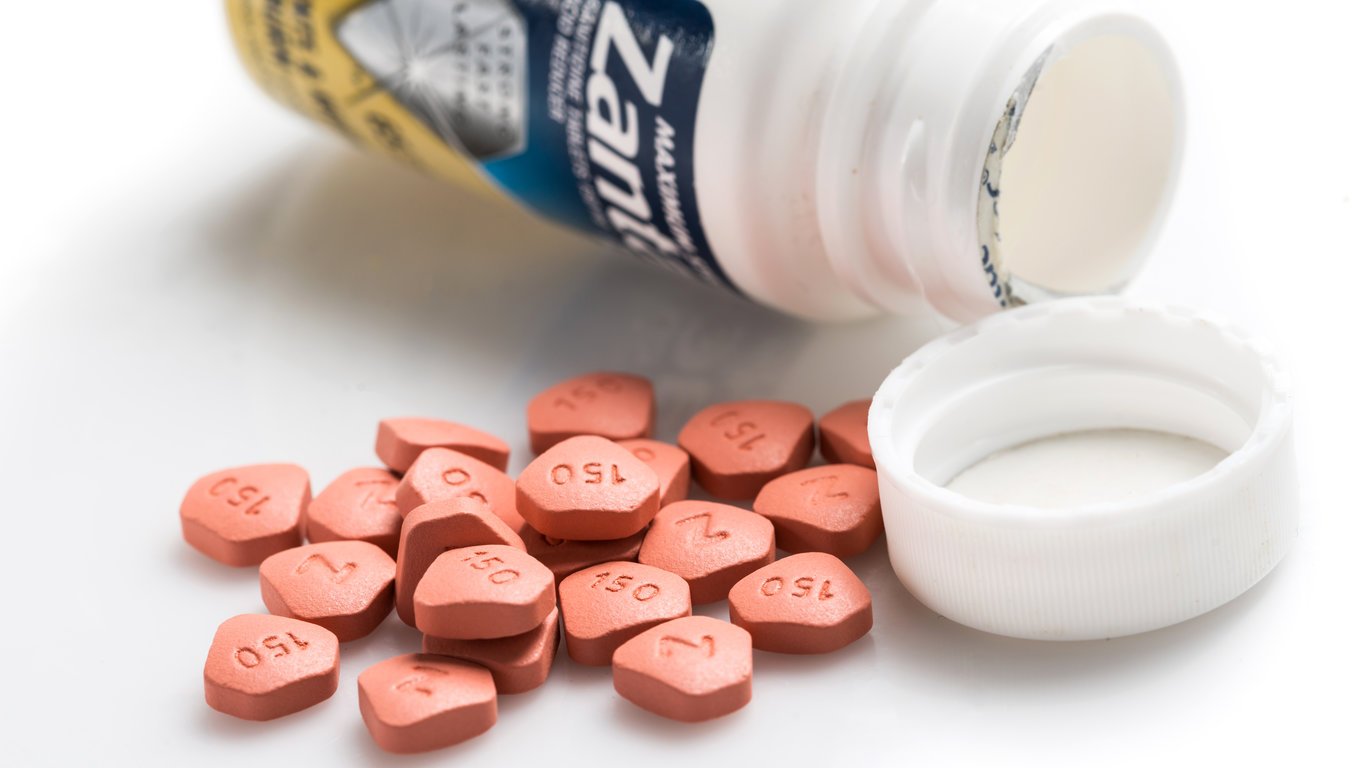

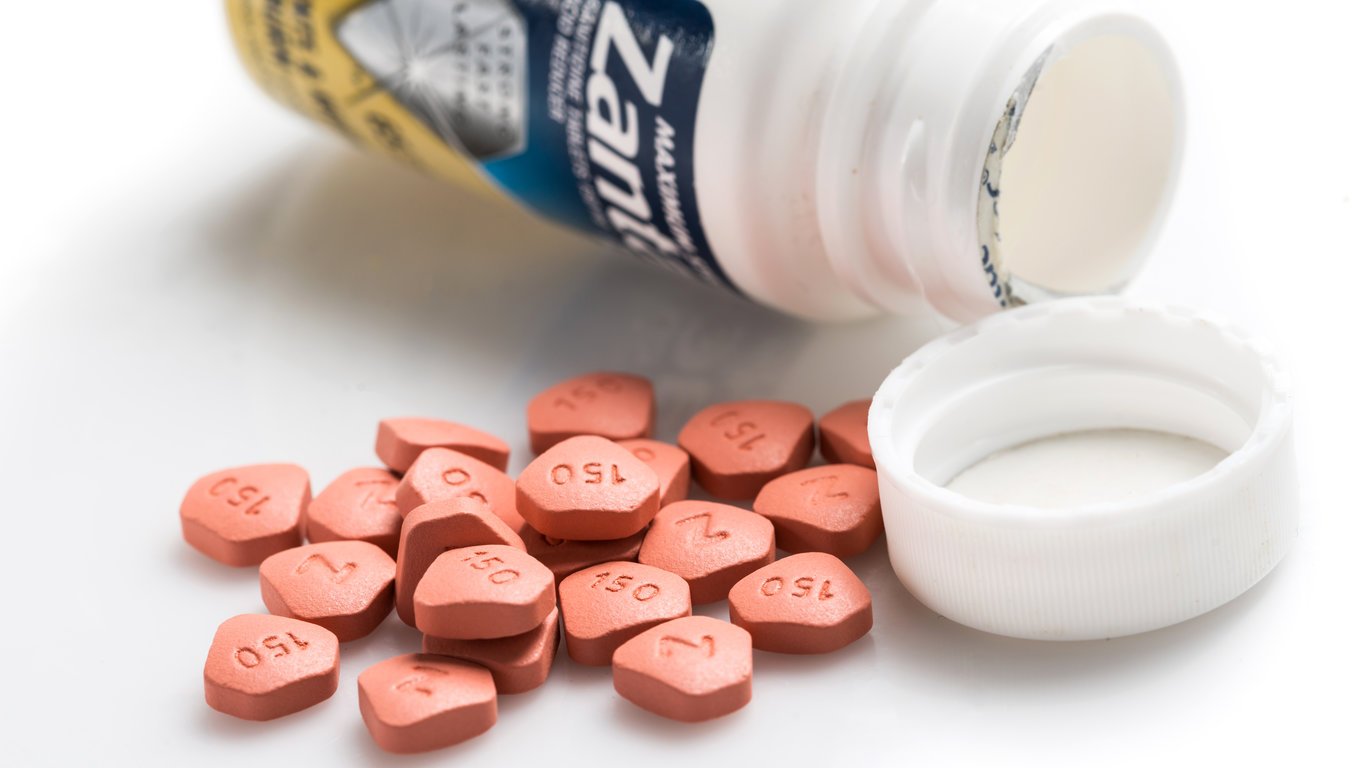

The drug ranitidine is used to ease heartburn and sold under the brand name Zantac. GlaxoSmithKline originally developed the drug and sold it by prescription only in the 1980s. Eventually, it was shifted to become an over-the-counter medication.

Regulators began to scrutinize the heartburn drug’s safety in 2019 as concerns that it contains NDMA, a likely carcinogen, caused manufacturers to remove it from shelves at retailers. By the following year, the U.S. Food and Drug Administration and the European Medicines Agency ordered that all Zantac boxes and all the drug’s generic formulations be pulled from the market.

Since the drug’s removal from the market, over 2,000 lawsuits have been filed in the U.S. by plaintiffs who say that taking Zantac can generate NMDA. Court proceedings in the first case start on Aug. 22 ahead of the trials against key pharmaceutical bellwethers next year.

Complex Cases Due To OTC Sales

According to CNBC, the lawsuits are especially complex because so many drugmakers have been selling the heartburn medication. GSK plc (NYSE:GSK)’s patent on Zantac expired in 1997, so numerus pharmaceutical companies have picked up the drug and been selling generic formulations of it.

The lawsuits name numerous distributors, manufacturers and retailers of ranitidine as defendants. Many drugmakers have owned the over-the-counter rights in the U.S. since 1998, the year after the patent expired. Among the pharmaceutical companies that have owned the OTC rights in the U.S. are GSK, Pfizer, Sanofi and Boehringer Ingelheim.

Haleon PLC (NYSE:HLN) claims it isn’t primarily liable in the ranitidine lawsuits, although it might face some peripheral involvement in the case. GSK spun off Haleon, its consumer health business, and merged it with Pfizer’s consumer health business in July 2019.

Drugmakers Defend Themselves In The Zantac Lawsuits

Shares of GSK have tumbled 11% over the last five trading sessions, while Sanofi SA (NASDAQ:SNY) stock is down by about 12%, and Haleon shares are off by 14%. However, in premarket trading on Friday, Haleon was up more than 4%, while GSK was flat, and Sanofi had gained more than 1%. All three drugmakers issued statements in defense of their involvement in the ranitidine litigation.

A spokesperson for GlaxoSmithKline said there is “overwhelming” scientific evidence that “supports the conclusion that there is no increased cancer risk associated with the use [of] ranitidine.” They added that opposing suggestions are “inconsistent with the science, and GSK will vigorously defend itself against all meritless claims.”

A spokesperson for Sanofi made similar comments, stating that there is no “reliable evidence that Zantac causes any of the alleged injuries under real-world conditions.” The drugmaker added that it hasn’t established any contingencies due to the “strength” of its case.

Haleon claims it isn’t a party in any of the claims about Zantac, adding that it “never marketed Zantac in any form in the U.S.” and is “not primarily liable for any OTC or prescription claims.” However, CNBC noted that comments in a prospectus issued on June 1 stated that the company “may be required to indemnify GSK and/ or Pfizer” under certain conditions if they are held liable in the Zantac claims.

This article originally appeared on ValueWalk

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.