The Magical & Mystical 200 Day Moving Average

On Monday I wrote China Stinky and said that we need to see how markets react to the news rather than accept the news at face value. And wouldn’t you know it, U.S. stocks surged higher after opening lower in the face of all that bad news. Let me get my shocked face, said me with full sarcasm. Can we rewind all those bearish pundit interviews before 10 am on Monday? Of course, the media won’t hold anyone accountable.

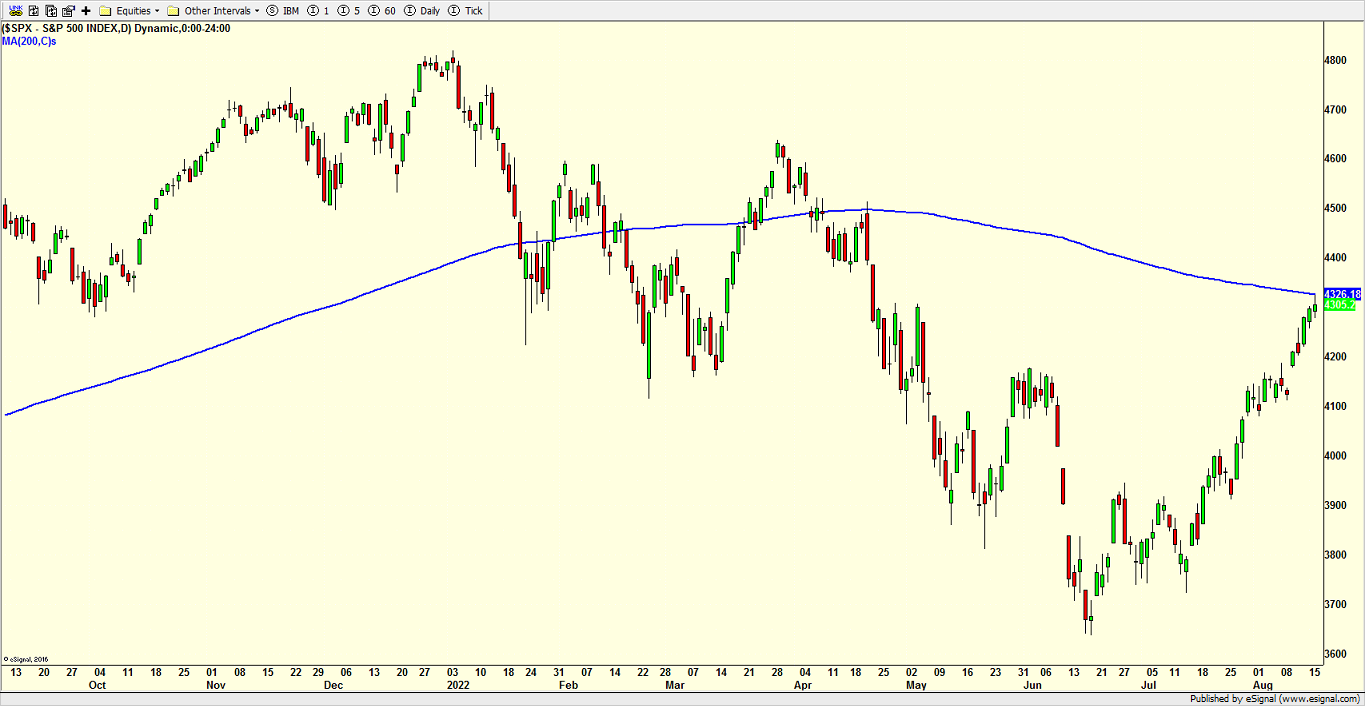

On Tuesday the S&P 500 finally hit its average price of the last 200 days, aka the 200 day moving average. It certainly seems like the masses are quoting it a lot these days as if it holds some magical or mystical powers. One pundit even opined that “billions of dollars could come flooding into the stock market once the 200 day moving average is exceeded.”

That is total and utter nonsense from a clown. I challenge anyone to find reputable firms that move massive amounts of capital because some arbitrary number is hit on an index. It is something I pay attention to because others pay attention to and there is often an opportunity there, like selling into those levels.

(Click on image to enlarge)

Look, the stock market has been on a torrid run since the June 17th bottom. No one on earth can deny that, recession or not. And I have been all over this rally. While the easiest money has long been made, that doesn’t mean more money can’t be made in the days and weeks ahead. I posted the semis chart the other day and they still look appealing.

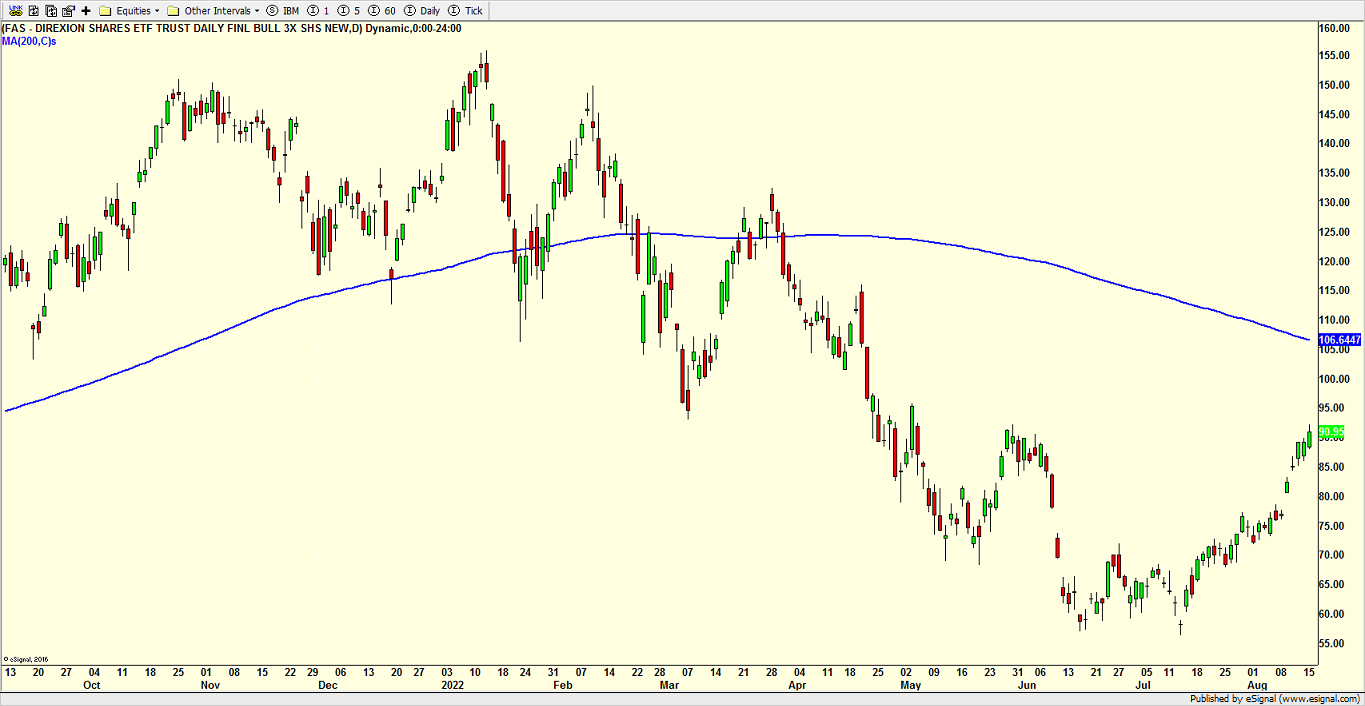

A few weeks ago we bought FAS in the financial space and that’s an example of a beaten-down sector that has played catch up. Financials bottomed in July after the stock market. It’s now time to put together a plan in case they reverse lower.

(Click on image to enlarge)

I started doing some work on what happens when a bear market regains half of what it lost. I think you will like the results. I hope to share that on Friday.

On Monday we bought SPYD, BIB, and BIIB. We sold some levered NDX. On Tuesday we bought GSK, AVUV, and levered inverse S&P 500. We sold EMB and some levered NDX.

More By This Author:

Face Ripping RallyIf I Am Wrong The Rally Has Ended

Heading To The Hamptons – No Recession There

Please see HC's full disclosure here.