cGlobal hotel brand InterContinental Hotels (GB:IHG) and hotel and restaurant company Whitbread (GB:WTB) are two hotel stocks recommended as ‘Buy’ by highly rated analyst Vicki Stern.

She has a bullish take on the industry as 51.8% of the stocks in her list have Buy ratings.

The hotel industry was hit hard by COVID-19, but hotel brands are recovering in the wake of the pandemic.

Stern is a managing director at Barclays Capital and a part of the leisure research team. Before joining Barclays in 2009, she had worked with Lehman Brothers and UBS Investment Bank.

As per the TipRanks rating system, Stern is ranked 1,749 out of 7,973 analysts. TipRanks rates analysts on three main factors: success rate, average return, and statistical significance.

Stern has a success rate of 64%, with 58 out of 90 ratings being successful. She has an average return of 6.7% per rating.

Let’s discuss the stocks in detail.

InterContinental Hotels

InterContinental Hotels Group is a hospitality company with around 18 hotel brands under its umbrella spread across the world. The company recently celebrated a milestone by opening its 6,000th hotel. It has more than 1800 hotels in the pipeline.

The company reported an encouraging set of interim results for 2022 in August. Group revenue grew by 52% to $1,794 million, and the operating profit increased by 162% to $361 million.

Global revenue per available room (RevPAR), a metric used widely in the hospitality industry, jumped by 51% in the first half as compared to the 2019 levels.

Considering such growth, IHG resumed its dividends and announced an interim dividend of 43.9 cents per share, a 10% increase on 2019 dividends.

The company is witnessing increased travel in most of its markets, also crossing the pre-COVID levels in a few of them. This, combined with significant debt reduction, a $500 million buyback scheme, a dividend comeback, and a strong cash flow, ticks all the boxes for share price growth.

IHG share price prediction

Post-results, Barclays reiterated its Buy rating on the stock. Stern has a target price of 5,400p on the stock, which is around 17% higher than the current level.

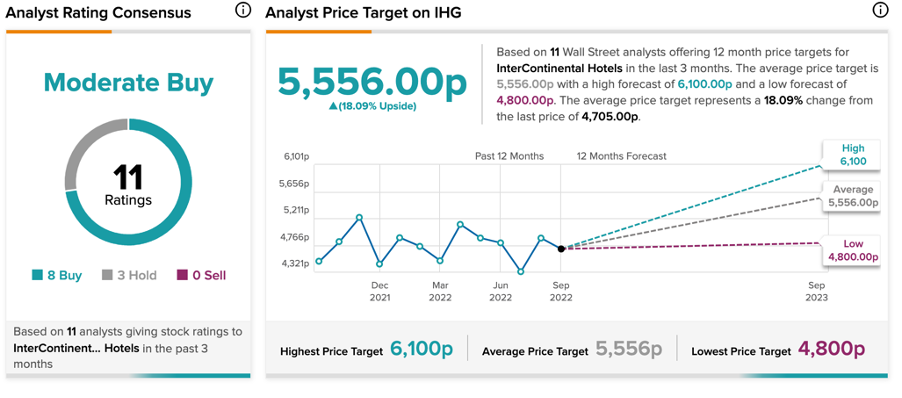

Overall, the analysts have a Moderate Buy rating on the stock, based on eight Buy and three Hold recommendations.

The IHG target price is 5,556.0p, which has an upside potential of 18.1%.

Whitbread

Whitbread is a hospitality business operating the leading hotel chain, Premier Inn, and other restaurant brands in the UK. The company expanded its Premier Inn chain in Germany across 31 locations.

The company posted solid growth in its trading numbers in the first quarter update for 2023, ahead of expectations. Total UK accommodation sales are 235.6% higher than in the fiscal year 2022. This clearly shows the strength of its brand, Premier Inn, and the recovery in the UK market.

Whitbread remains worried about rising labour and food costs. The company is expecting additional costs of £20 to £30 million in 2023 as it invests in IT, refurbishments, and maintenance. It is, however, also confident about offsetting the increased costs with high occupancy levels and sales.

Is Whitbread a good share to buy?

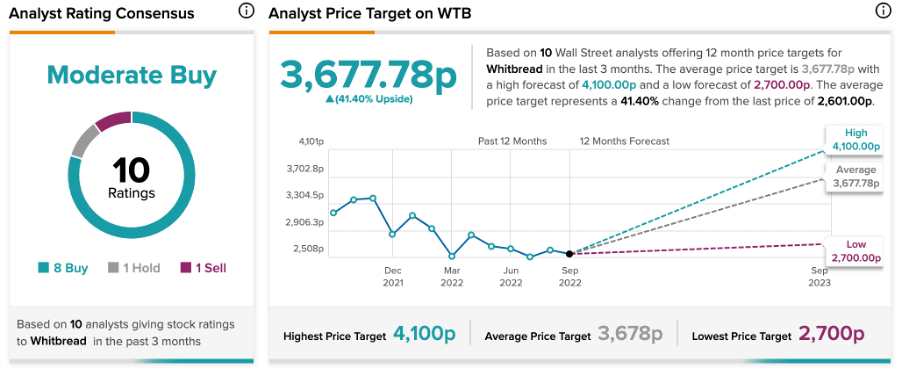

According to TipRanks’ analyst rating consensus, Whitbread stock has a Moderate Buy rating. This is based on the ratings of 10 analysts, including eight Buy, one Hold, and one Sell recommendations.

The WTB target price is 3,677.7p, which implies a 41.4% of upside potential at the current price level.

Conclusion

These businesses emerged from the pandemic after having their hotels and restaurants closed for months. Rising inflation still puts pressure on the operations; however, their strong brand value and recovery in demand are driving the revenues. Considering Stern’s knowledge of the sector, investors can see these stocks as great choices.