We've "Crossed The Rubicon": Bear Traps Warns "Risk Of A Crash Is Rising"

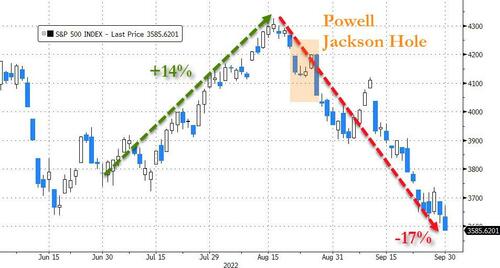

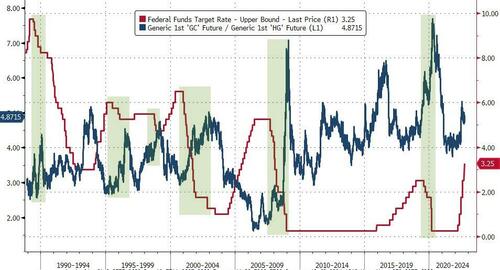

Since Fed Chair Powell unleashed his short-and-sweet uber-hawkish comments in late August at Jackson Hole, market expectations for The Fed's terminal rate (cycle high before pause or cuts resume) has surged hawkishly (adding 100bps of hikes).

However, as the chart below shows, the last week - as UK chaos erupted and spread to US equity and bond markets - there has been a dovish shift in market expectations for just how hawkish The Fed will be able to get before everything goes pear-shaped...

Powell's speech also triggered a total puke in equity markets as all that 'hope' for a 'Fed Pivot' was dashed (prompting the greatest quarterly loss after a 10% rise since 1938)...

All of which brings us to the latest Bear Traps note by Larry McDonald, who has argued for months that Powell cannot get Fed Funds to 350bps and that belief that The Fed can achieve $1T of QT balance sheet reduction in 12 months is a childish fantasy.

We stand by this view.

The Fed is done hiking or very close to that address.

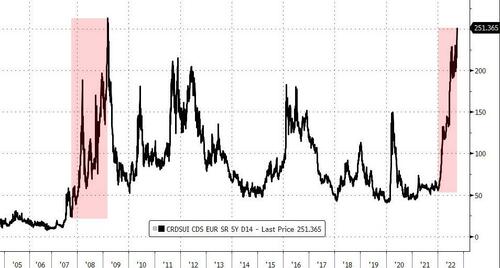

This week, the pension blow-up in the U.K. was excess leverage - under the surface - an eye opener.

It´s everywhere, there is NEVER one cockroach.

[ZH: another cockroach?]

We have “crossed the Rubicon” – academics are waking up to the fact that financial stability risks are trumping inflation risks in a meaningful fashion.

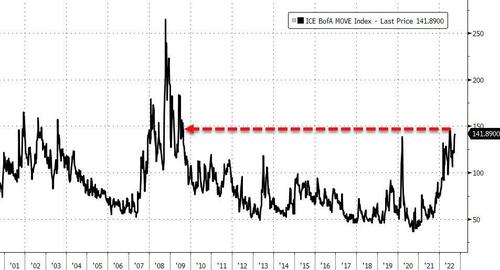

[ZH: Bond Volatility is at it highest since the Great Financial Crisis...]

One last dot to connect – we carefully monitor Sell Side Street research.

We must keep an eye on those sheep, you know.

Over the last 10 days, banks have gone from pounding the table on 450-500bps Fed funds to FAR more focus on U.S. dollar financial stability risks.

Reaching for the cell phone, senior executives at the banks have been calling their economic research analysts and saying, “what are you smoking?”

Brainard´s speech Friday talked up financial stability concerns but was NOT dovish.

The risk of a crash is rising, our 21 Lehman systemic risk indicators are the highest since the depths of the Covid panic.

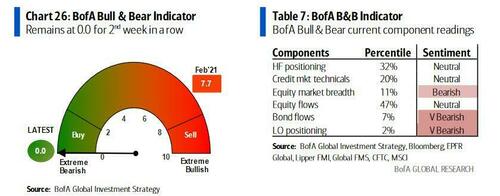

[ZH: This matches BofA's Bull-Bear Indicator at 'Max Bearish' levels...]

The beast inside the market will continue to put more and more pressure on the Fed.

[ZH: Powell has already seen the biggest wealth effect loss of any Fed Chief... US debt and equity markets are down almost $17 trillion since their peak in Nov '21]

In the coming 2-4 weeks, we expect a meaningful walk-back from Powell with a focus on financial stability.

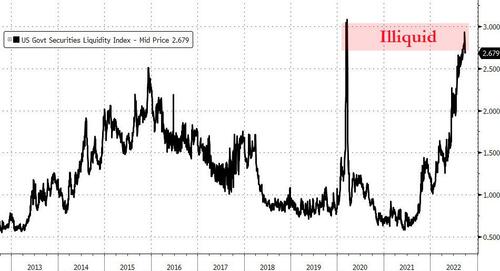

[ZH: Will the collapse in US Treasury liquidity be trigger for Powell's flip-flop?]

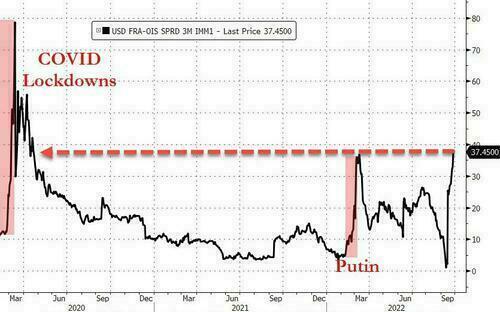

[ZH: The even more important FRA-OIS indicator of interbank funding stress sharply higher suggesting a sharp collapse in interbank liquidity...]

Central bank independence is dead, and the political levers are being pulled as week speak.

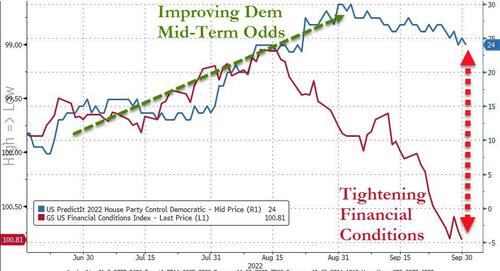

[ZH: Will drastically tighter financial conditions be the anchor around the neck of the Democratic Party's hopes of holding the House?]

At 1337, the Bloomberg Dollar index is close to 2% off its high, its 200-day moving average is light years away at 1236. Gold Miners like Barrick are 12% off the lows.

The main release valve will be - higher hard asset - prices, a weaker USD, and a LARGE tailwind for gold miners and emerging market equities.

So, Fed actions have created an unsustainable situation for the markets which will likely prompt The Fed to flip-flop back to easing... but only after crashing further from here.

Larry's comments echo those of Bank of America's Michael Hartnett who puts a timeline on it - arguing that traders can remain short until Halloween, then brace-brace-brace

"Markets stop panicking when Central Banks start panicking" and while we have had an appetizer of what is coming, the big central bank entree still awaits, to wit: "BoJ buys yen, BoE flips from QT to QE = panic, but neither credible (BoE QE + tax cuts = inflation, BoJ YCC), nor coordinated, so impotent."

What is needed for a credible pivot?

Well as the word itself suggests "Fed/Treasury panic requires US credit event."

Additionally, Morgan Stanley's Mike Wilson expects The Fed to fold sooner than many expect:

In our view, such [dollar supply] tightness is unsustainable because it will lead to intolerable economic and financial stress, and the problem can be fixed by the Fed, if it so chooses.

As one portfolio manager told McDonald:

"The securitized market selling is pre-Lehman like, pension funds are getting margin calls, real money is exiting, and the BoE was forced back into QE... Tepper must be lurking, this is gold bullish."

Accordingly, McDonald note that at the end of the hiking cycle - gold starts to outperform copper.

We have re-positioned our high conviction portfolio to show of the highest weighting in gold and silver miners in years.

More By This Author:

The Growing Global Reliance On Antidepressants

Visualizing The Global Wealth Pyramid

U.S. Hits Chinese Firms With New Sanctions Over Iranian Oil

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more