Gold’s Rally - A Whole Lot Of Nothing

The momentary role swap of the USDX and gold could raise some hopes for the bullish prospects of the yellow metal. Would they be justified?

The precious metals sector moved higher last week, and even though gold moved only a bit higher on Friday, miners’ daily upswing was more noticeable. Are miners showing strength here? If so, is this the start of a new, powerful uptrend?

As you have probably realized based on the title of today’s analysis, that’s not the case.

Let’s take a look at the charts and see what really changed.

Same Old

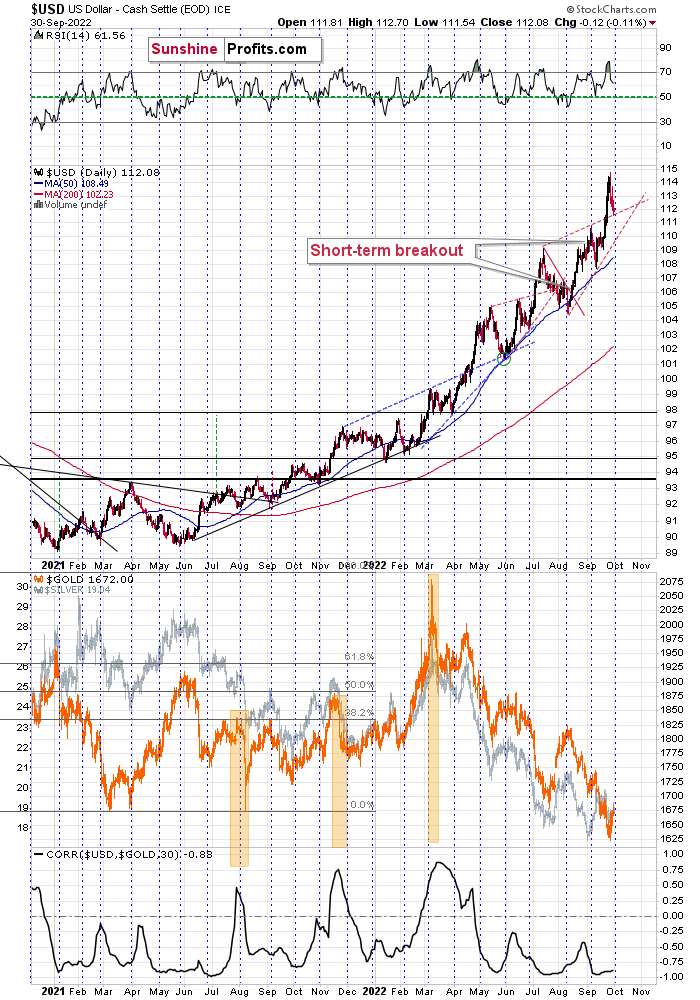

Nothing changed in the USD Index – it just verified the breakout above its rising support/resistance line. It declined close to the turn of the month, which is when it tends to reverse its course.

As the breakout held, the outlook for the U.S. dollar remains bullish, and given the above-mentioned monthly seasonality for the dollar, it seems that the rally is likely to resume any day now.

Given the strongly negative correlation between gold and the USD, the above is likely to translate into lower precious metals values.

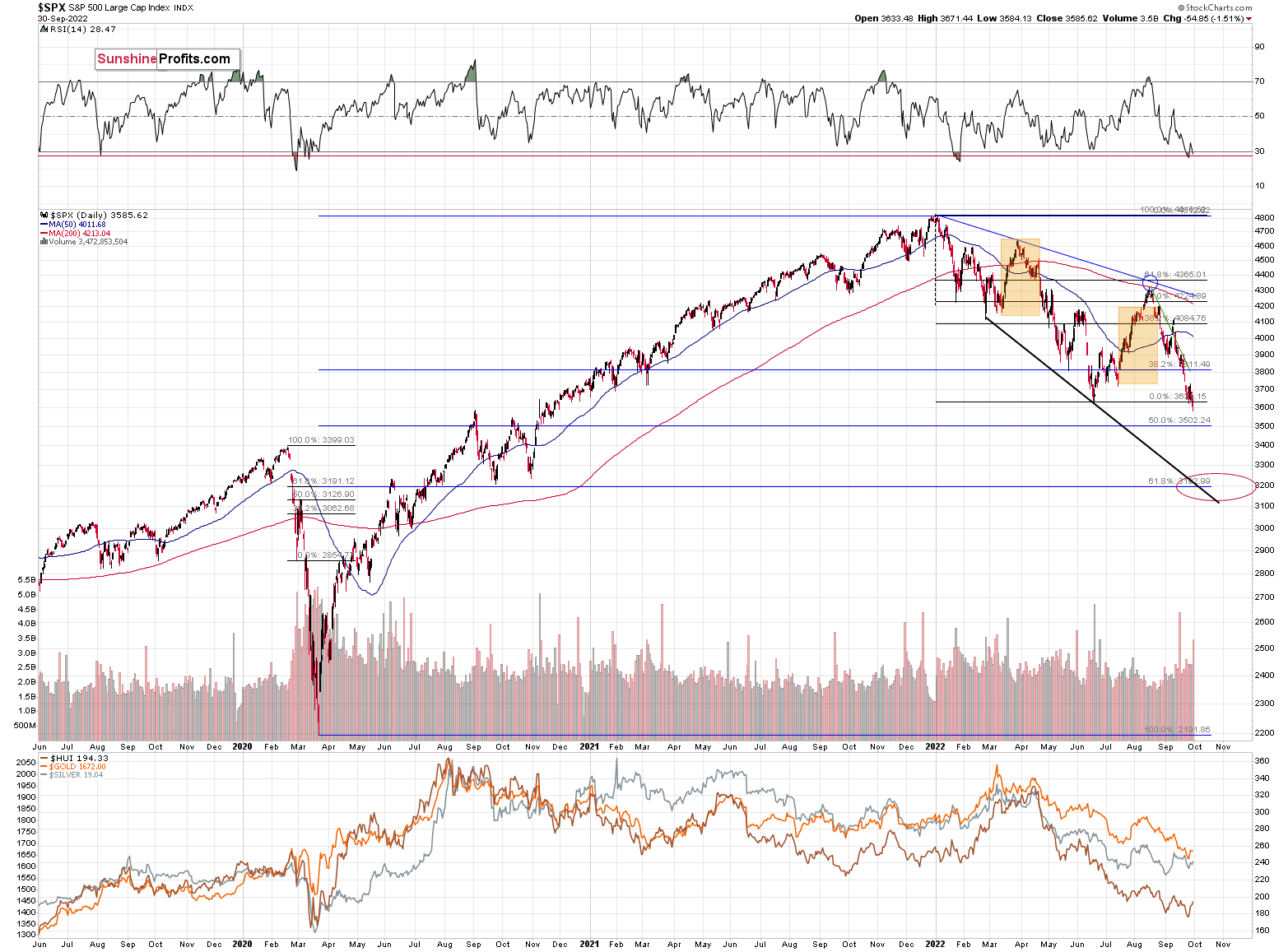

The general stock market just closed the day and the week at new yearly lows. This breakdown took place on strong volume, and the S&P 500 futures were lower in Monday’s pre-market trading.

This is a very bearish combination of factors for stocks. It’s also bearish for the parts of the precious metals market that are most aligned with stocks: silver and mining stocks. And, in particular, for junior mining stocks.

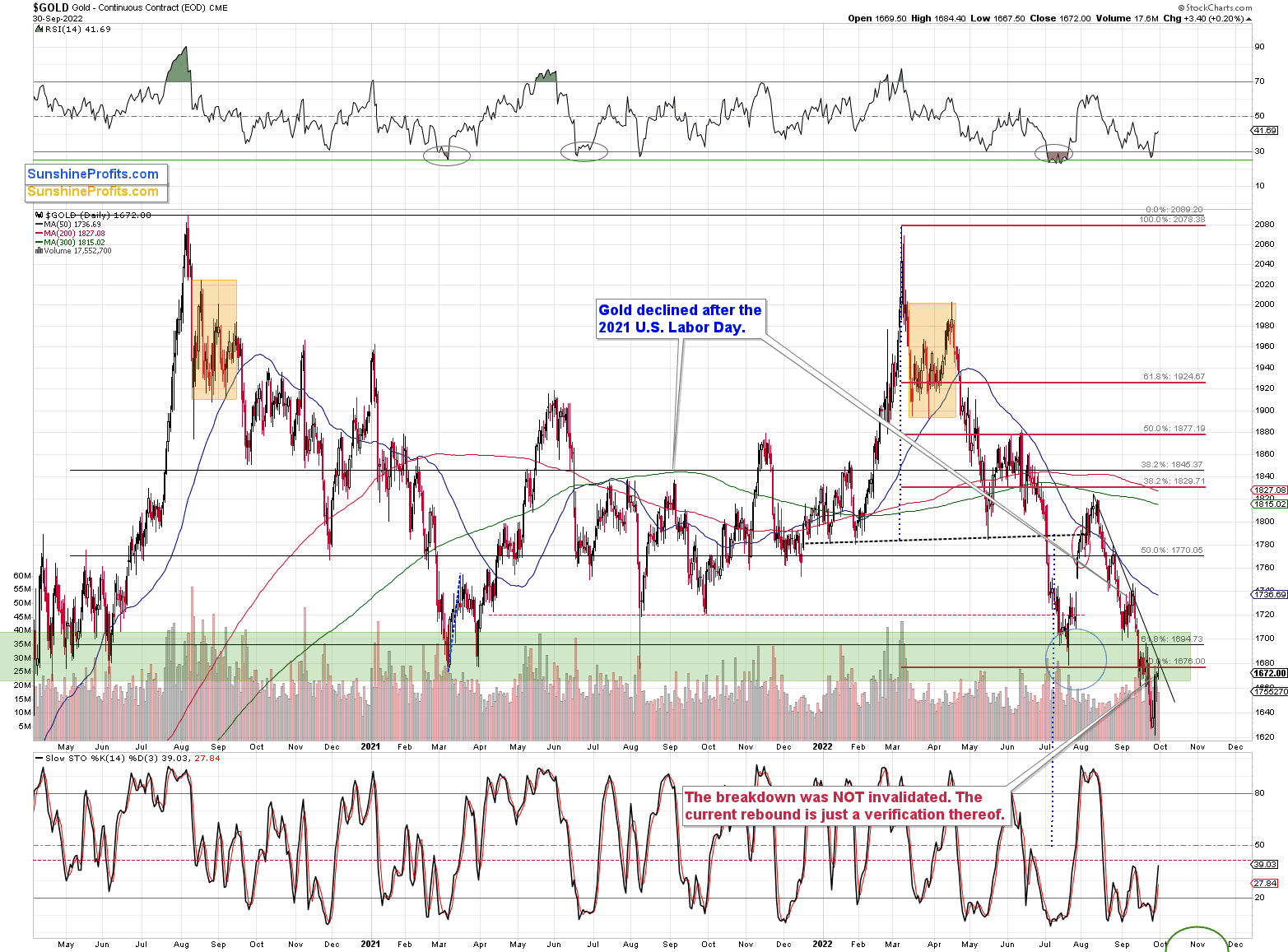

During Friday’s session, gold moved higher at first, but then reversed and ended the day only $3.40 higher. In other words, it formed a daily reversal.

Interestingly, the intraday high was very close to the declining, short-term resistance line. Do you remember what happened to the price of gold when it previously moved to this resistance line?

It happened in early September, and gold then declined by more than $100 in a rather sharp manner. I can’t promise any kind of performance, but the history tends to rhyme, right?

Actually, the situation is more bearish this time, as this time gold verified the breakdown below the green resistance zone, which opens the door wide open for really big declines – 2013 style.

Is It Strength?

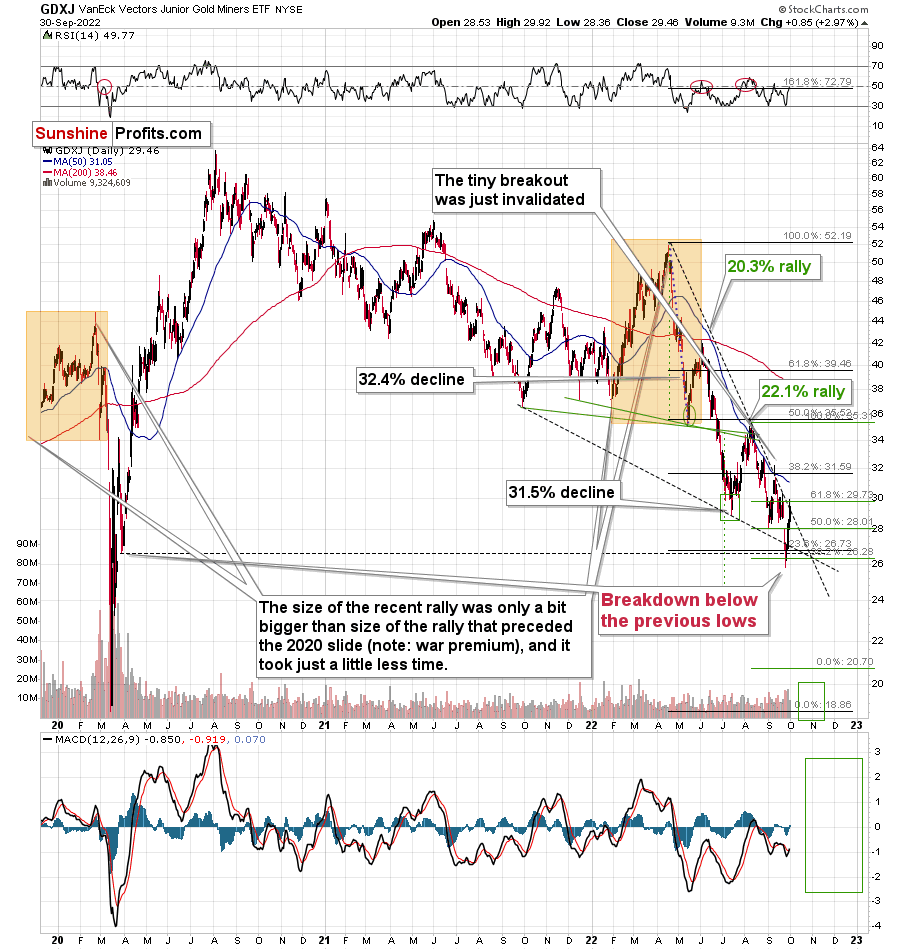

Junior mining stocks moved higher on Friday in a more visible manner, despite only a tiny rally in gold and an important decline in the general stock market.

What gives? Are they really starting to soar here?

No. Junior miners were recently a ridiculously weak market, and there’s a tendency for the weakest parts of the market to perform relatively well right before declines. Gamestop’s share price didn’t move to a new 2022 low on Friday, by the way.

Why would this be the case? Because those who have very little idea about the trends tend to buy exactly at the wrong times, and it seems that it was the case on Friday as well.

Technically, just like gold, junior miners just moved to their declining resistance line without breaking it.

Therefore, not that much changed, despite the quick rally. The downtrend remains intact.

In my previous analyses, I wrote that the GDXJ was unlikely to break back above $30, and it didn’t. Friday’s intraday high was $29.92, and it declined a bit before the end of the day.

Given gold’s and stocks’ technical situations, it’s highly likely that junior miners will reverse their course and get back to their previous downtrend shortly (thus increasing profits on our short positions in this sector).

More By This Author:

Gold Rallies In The Face Of The BoE’s Quantitative EasingThe U.S. 10-Year Real Yield Hits Its Highest In Over A Decade

Since the Momentary GDXJ Bounce Wasn’t Bullish, What Awaits Gold Stocks?

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more